Spotting Market Reversals

Post on: 25 Июнь, 2015 No Comment

The Anatomy of Market Reversals

When we study a price chart. on any market, what we are seeing is a visual representation of the battle between the Buyers (Bulls) and the Sellers (Bears.) When the price is moving up the Buyers are in control and when the price moves down the Sellers have seized control. The price movement reflects times of exuberant buying. panic selling and times of indecision .

Its like a Tug of War. Whenever the direction of pull changes there is a Market Reversal. Whether the Reversal will be a temporary correction or the start of a new Trend is determined by many factors.

The following can be helpful in identifying Market Reversals .They are brief summaries and more study is needed to fully understand them.

Leading versus Lagging Indicators

It is well-recognized that Moving Averages and Oscillators are Lagging Indicators. In other words, they tell us what has already happened in the market. I think you will discover that the Indicators, Reversal Patterns, Reversal Candlesticks, Divergence, and Strategies summarized below could be considered Leading Indicators because they suggest market moves that have not yet happened.

Elliott Waves

At first glance the FOREX market appears to be full of random chaotic movements with no apparent rhyme or reason. After studying several years of Stock Market price charts R.N. Elliott determined that the apparent chaos consisted of patterns . He called the patterns Waves. The following is segment of Elliotts basic wave sequence.

If a trader can determine where the market is in the Elliott Wave sequence there will be a reasonable expectation of where it will go next. Software, like MotiveWave can help to identify the wave counts and where the market is in the Wave pattern. Traders, like Jody Samuels . have gone to great lengths to simplify Elliott Waves for us.

Vegas Tunnel

Several years ago “The Tunnel Method” was released by someone who goes by the name of Vegas. I summarized it in the post titled, The Vegas Tunnel and its Elliott Wave Connection. The basic premise of the Vegas Tunnel Method is that large Market Reversals are often associated with the price crossing the Tunnel. The chart below also points out the Elliott Wave Connection.

Left click on image to enlarge. Then click on back button to return to this page.

Wavy Tunnel

Jody Samuels took the Vegas Tunne l to the next level by combining it with the Raghee Waves . Jody calls her new trading strategy The Wavy Tunnel . She went far beyond the Vegas Tunnel trade, which she calls a Breakout-1 Trend Following Trade. She has identified three Trend following Breakout trades and two End of Trend trades. The Wavy Tunnel has a definite connection with Elliott Waves. In fact, the Strategy makes it easier for those who are not Elliott Wave experts to count the waves.

Left click on image to enlarge. Then, click on back button to return to this page.

Reversal Candlestick Patterns

Ancient Oriental rice traders developed and used a technique that involves analyzing the candlesticks and candlestick patterns on price charts. Steve Nison was the first to reveal Candlestick Patterns to the Western world. I personally have enjoyed his DVDs. Candlestick Patterns are used by many traders to help determine when Market Reversals are near.

This ancient method has been correlated with modern technical indicators. For example, when a Candlestick Reversal Pattern occurs when an oscillator is in the OverBought condition it more reliably warns of a possible Market Reversal to the down side. And, when a reversal candlestick pattern is found while the oscillator is in an OverSold condition it often suggests a Market Reversal to the upside. The screen shot below illustrates how the oscillator helps to confirm Reversal Candle Signals .

The 1-2-3 Reversal Pattern

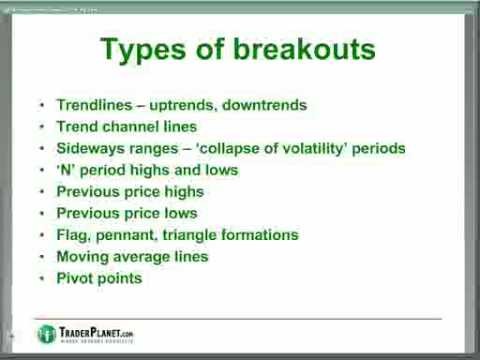

The 1-2-3 Pattern is a Reversal Pattern that often suggests a Market Reversal. When price exceeds its previous high it is considered a Breakout. I went into greater depth in my post titled The 1-2-3 Pattern and its Elliott Wave Connection.

Reversal Chart Patterns

Several chart patterns have been identified. Some suggest a continuation of the trend while others suggest a Market Reversal. One such reversal chart pattern is called the Rising or Falling Wedge in traditional terminology. In Elliott Wave Terms its called an Ending Diagonal. The ending diagonal occurs in Elliott Wave-5 or in the C-Wave of the corrective sequence. (See Elliott Waves- Patterns in Chaos for more detail.) When the pattern meets its requirements it is said to have a 90% accuracy in forecasting a Market Reversal. The price generally moves the start of the pattern or beyond. My first experience with this pattern is summarized below. Although I combined it with a 1-2-3 entry a much earlier entry would have been at the break of the chart patterns trendline.

Divergence

Divergence is a phenomenon that often precedes a Market Reversal. It reflects a decreasing momentum of the trend-setter. The price chart is used with one of several indicators or oscillators. A few include, MACD, Stochastics, RSI and the Awesome Oscillator.

In an uptrend divergence is demonstrated when price makes higher highs while the oscillator does not match the higher highs but instead displays lower highs. In this case, the Buyers, or Bulls, are losing momentum. In a downtrend. the price makes lower lows but the oscillator shows higher lows. Here, the Sellers, or Bears are losing momentum. The following chart states this visually.

Left click on image to enlarge. Then, click on back button to return to this page.

Please notice on the above image:

- Several Candlesticks of Indecision (Dojis) were present at the time of Divergence.

- Stochastics oscillator was in OverBought condition at the time of Divergence.

- A Reversal Candlestick Pattern (Bearish Engulfing Pattern) appeared just before the Market Reversal

- The Downward direction of the arrow on the oscillator peaks suggested a downward Reversal in the market.