So You Want to Trade Forex

Post on: 27 Апрель, 2015 No Comment

Created by EQUITIES Magazine

The current volatility and fluctuation in global currencies have attracted investors and traders to the foreign exchange market. The growing popularity of trading Forex, though, has also created the need for improved regulation to better protect beginners.

Thanks to the Commodities Futures Modernization Act of 2000, regulating bodies like the U.S. Commodity Futures Trading Commission and the National Futures Association have taken on larger roles in establishing proper procedures with the goal of improved oversight and stricter requirements.

The industry is continuously growing, says Larry Dyekman, director of communications and education for NFA. Growth with no regulation is ripe for fraud. Customers have lost hundreds of millions of dollars. The CFTC has taken much legal action and hopes that new requirements and regulation [will help] a lot of this fraudulent activity disappear.

As a self-regulating agency for the U.S. futures market, the NFA reports to the CFTC. The Commodities Futures Modernization Act requires that any firm acting as a counterparty to futures contract transactions must belong to some form of regulatory organization.

There are a lot of reasons Forex is a little more difficult to regulate, Dyekman says. It’s more global, and there’s no central clearinghouse. These dealers are acting as the counterparty to the trade, so it’s not as transparent as on-exchange futures contracts. So when you don’t have that kind of transparency and liquidity in a central location, it’s a little harder to regulate.

There are a few major differences when comparing Forex trading to trading stocks. Whether these features create an advantage or disadvantage depends on the investor’s preference. Retail Forex operators like FXCM, which boasts more than 100,000 live accounts, have made it easier than ever for beginning traders to enter the market.

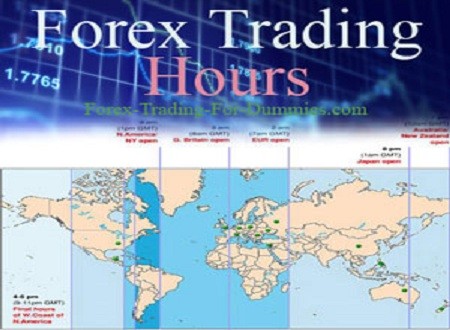

True 24-hour access is a major advantage that the Forex market has over equities and futures—it eliminates weekday overnight risk for traders, says Brendan Callan, managing director of sales and customer services for FXCM. They can trade as news breaks on the other side of the world, and transaction costs are substantially lower than in the equities and futures market. Leverage capabilities are another draw. In Forex, retail traders can leverage their accounts 100 to 200 times. We don’t suggest using that much leverage, but the ability to do so gives them a great deal of flexibility with their trading strategies.

Callan adds that FXCM shifted away from serving as a counterparty to trades, adopting a No Dealing Desk execution model three years ago. Forex brokers usually generate revenue by collecting bid-ask spreads, or pips. FXCM simply passes on the best prices from the many banks that we have clearing relationships with, Callan says. We don’t need them to lose in order to earn revenue, which is the case with many of our competitors, who trade against their own clients.

When selecting an appropriate Forex broker to use, Dyekman recommends that traders do their due diligence and investigate each firm. Before making any decisions about trading in Forex or any investment decisions, you need to know the product you’re going to trade and know who you’re trading with, he says.

On the flip side, increased regulation has put the onus on Forex operators to know their customers. The Patriot Act of 2001 requires that all financial institutions verify the identity of their customers as part of an anti-money laundering program. The NFA has put in place a program designed to mirror that of the federal government. In addition to identity verification, brokers are also required to evaluate customer information to provide the appropriate risk disclosures.

We have a rule that requires our members to obtain certain information from a potential customer before accepting them, Dyekman says. Things like their name, address, income, net worth, and their experience in trading the product they’re going to be trading. There are definite procedures that we ask the firm to follow when they open a new account for a customer.

However, for investors looking to capitalize on the ups and downs of the Forex market, the information gathering and verification process to open and fund an account could take longer, says Darren Rennick, director of transaction software developer M2 Global.

M2 has developed a patent-pending technology called card-integrated acquiring, which streamlines the verification process for Forex brokers and shortens the time it takes to transfer money in and out of trading accounts. For many brokers, the quickest way for customers to fund an account still takes at least one or two days.

Let’s say you open up a trading account, but then it takes five days to get your money into your account and start trading, Rennick says. You can imagine how frustrating an experience that is for somebody who wants to trade. It’s so volatile an industry that the opportunity that you’re looking to capitalize on might be gone after five days. The challenge is that it’s not particularly easy for people to fund their trading accounts. M2 has solutions to a lot of these problems.

Rennick says that the technology works similarly to how online retailers complete transactions. M2 provides the Forex broker with a merchant account, and through that account, the company’s proprietary technology will verify the customer’s identity, process the transaction, and fund the account.

Nobody’s come up with a solution until now, Rennick says. It’s patent pending, so we just need to educate people about how it works, why it conforms to NFA regulations—which it does—and then walk them through the technical implementation aspect of it. It’s a simple thing to do. The issue that we have right now is that it’s new.

After the account is opened, traders should also fully understand the strategies and the potential consequences that they expose their portfolio to. One major risk that beginning traders need to be aware of is the power of using leverage, which is a popular investment strategy that magnifies the impact of trades and market movements.

Leverage is the big one, Callan says. Clients that come to this market need to use leverage wisely. Relatively speaking, Forex moves very little. A 1% to 2% move in a day would be considered significant volatility. While 1% to 2% isn’t much, if you are leveraged 100 times, that becomes a 100% swing on your account in one trading day. As they say, leverage is a double-edged sword.

For investors that want to trade on the Forex market, Dyekman stresses that due diligence and information gathering is a must. [The NFA website] goes into a lot of details that you should know, he says. Please do your due diligence. It’s a volatile market place, and you have to have a certain temperament to deal with it.