Should You Use Multiple Time Frames When Trading Forex

Post on: 1 Май, 2015 No Comment

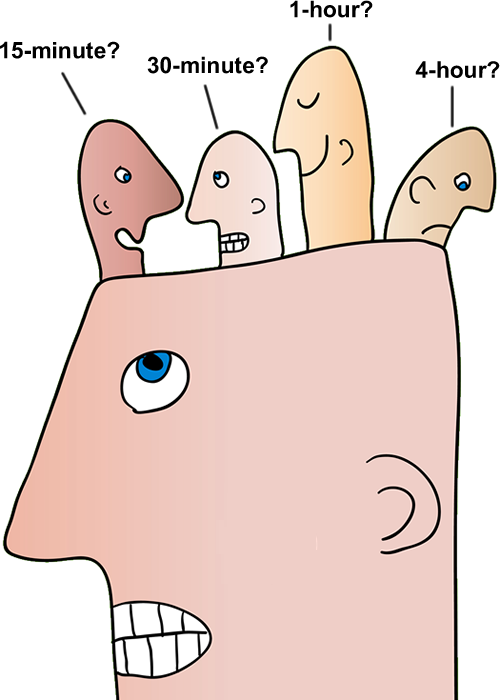

In today's article I want to talk about the merits of using multiple time frames to trade the various different forex pairs. If you go to some of the forex forums and check out the different strategies that people use, you will find that some prefer to use just one time frame, whilst others prefer to use two, three or four different time frames. So how many time frames should you use?

Well the short answer is that you can potentially make money from forex trading using however many time frames you want. There is no right or wrong approach in my opinion.

You may automatically assume that you are more likely to make winning trades using multiple time frames because you can find pairs that are trending in the same direction on each of these time frames, and then pinpoint your entry point on the shortest of those time frames. For example you could look for currency pairs that are trending upwards on the 1 hour, 15 minute and 5 minute charts, and then look to go long at the most opportune moment on the 1 minute chart.

This kind of strategy definitely has it's merits because you are always trading in the same direction as the longer term trend, and therefore you always have probability on your side. However if you use too many time frames you can over-complicate things and you ultimately end up getting a lot of conflicting signals and fewer and fewer opportunities to actually trade the markets.

That's why when I trade my main 4 hour trading system (see right for more details), I only use two time frames. I use the daily chart to highlight the current trend, and the 4 hour chart to find opportunities to go long/short in the same direction as this trend.

The actual system I use only produces a few really good trading opportunities every week (and sometimes none at all) across the major currency pairs. So if I were to use the weekly and monthly charts for additional confirmation of the long term trend, then my trading system would barely produce any trades at all.

I also think it's important to point out that whilst it's a good thing to always be trading in the same direction as the long term trend, you don't always need to use multiple time frames when trading forex. For instance the Forex Morning Trade system. which has made me a lot of money since I first started trading it last September, only ever uses the 15 minute charts.

Similarly when I trade early morning breakouts using my own breakout trading system, I only ever use the 5 minute charts to enter and exit positions. I don't even look at the 15 minute or 1 hour chart, for instance, to look at the longer term trend. All I am interested in is finding a profitable breakout opportunity on the 5 minute chart using simple price action and a couple of technical indicators.

So the point is that you can indeed use multiple time frames to trade forex. I myself use two different time frames when trading my main 4 hour trading system. However as you start to use more and more time frames, you will start to get a lot of conflicting signals and you will also get a lot fewer trading opportunities. Furthermore it is sometimes just as easy to make profits trading just one single time frame, as I have hopefully demonstrated using the two examples above.

The fact is that everyone has their own trading strategies, and it doesn't really matter how many time frames you use because you can still generate profits regardless of how many you use.