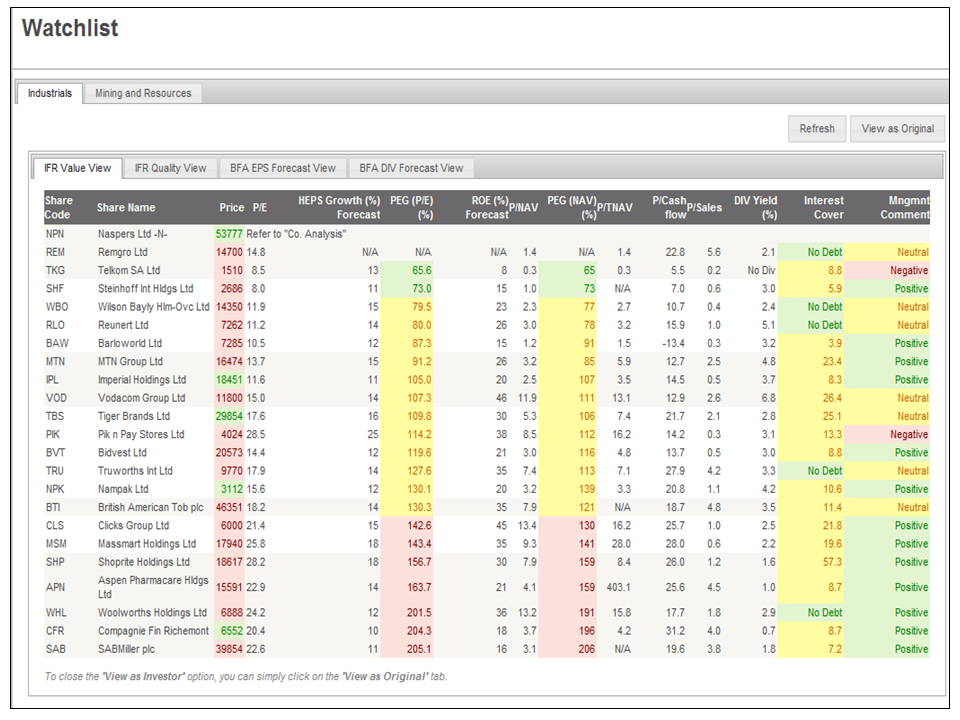

Select Financial Ratio Information

Post on: 16 Март, 2015 No Comment

With respect to financial ratios, you should look at three items.

1. Is the industry uniformly competitive or uniformly monopolistic? Compare the profit margin across firms and the industry.

2. Does a high debt/equity ratio indicate a high return on equity? In the above data, Coke is so profitable that a low debt/equity ratio does not mean a low return on equity.

3. Do low profit-margin firms have high P/E ratios? If a low margin is simply temporary bad luck, the P/E ratio will be high for low-margin firms. I think the relatively low P/E ratio on Coke indicates that the market believes that Coke profits will come somewhat back toward the industry average.

One thing that you need to remember is that financial ratios contain a lot of random (or unidentified) variation. You can discuss what you find, but you don’t want to present it as absolute fact.

The naive interpretation of the Price/Earnings ratio is as a measure of whether a stock is over-valued or under-valued. Remember that a share of stock is a claim against a portion of earnings. If the price of the stock is large, relative to the company’s earnings, a naive person will claim the stock is over-valued.

But of course, stock prices are followed by thousands of analysts each day. If Coca Cola was a bad buy (with a high P/E ratio), wouldn’t mutual fund managers sell it in droves? Wouldn’t the P/E then come down?

On March 22, 1998, the P/E ratios for Coca Cola and the industry exceed the average P/E high over the previous five years. This could be evidence that stock prices IN GENERAL were a little too high in early 1998 (and fund managers did not overestimated the value of equities) ; or it could mean that the expectations for the industry are for increasing earnings.

The (net) profit margin is ( R — C)/R. Divide through by quantity and you get (AR-AC)/AR. It should be clear to you that one minus the PM is the cost margin. The soft drink industry is somewhat competitive, profit margins are greater than 5 percent but below 10 percent. To find Coca Cola with such an unusual profit margin would indicate that the difference (between Coke and the industry) must lie in retail prices, economies of scale or the fundamental cost structure. I do not know the answer, but I know there are plenty of articles about Coca-Cola that put forth an answer.

Be careful with Return on Equity and Return on Assets. These ratios capture the relationship of earnings to two measures of company size. Remember that equity is smaller when a firm has relied on debt financing in the past. Remember that assets are smaller when an industry is in the service sector or somehow knowledge based (e.g. Microsoft’s greatest assets are the brain power of the employees). Knowledge based assets do not appear on the balance sheet.

Revenue/Assets is a broader measure of the firm’s asset productivity. With this ratio, we simply compare how different firms are able to generate revenue based on the level of assets. Again, we would expect this ratio to be higher in the service sector because accounting assets are relatively small.

In the past, Coca-Cola had to decide whether to raise capital with debt or new stock issues (equity). The decision largely determined the company’s Debt/Equity Ratio. telling you the relative size of each group and whether the firm expects relatively large interest payments. As mentioned above, a higher debt/equity can ratchet up the ROE … but only if the firm can generate a rate of return above the interest rate on debt.

Current ratio is (Current Assets) / (Current Liabilities). The largest current assets are typically accounts receivable and inventory. This ratio is most useful for internal control, it can tell the manager how much liquidity the firm has to work with.

Finally, when you write the paper, remember two things. First, that I already know the basics on financial ratios (don’t regurgitate definitions). Second, analyze the health of the industrratios and do not describe the numbers in the Table.