Scalping Forex A HowTo Guide

Post on: 26 Апрель, 2015 No Comment

Scalping forex is a trading technique that involves the quick opening and liquidation of position in the market ; most scalpers only hold their positions for a maximum of three to five minutes. Because of the short time that the trades are open, most scalping is done as part of a forex day trading strategy. While it can be slightly lower risk than other trading strategies. it requires much more diligent attention to each and every trade and thus isn’t for every type of trader. However, if you have the mind for it and the right broker, it is a way that you can make some large, albeit hard earned, gains in the market.

Is Forex Scalping for Me?

How to Scalp Forex

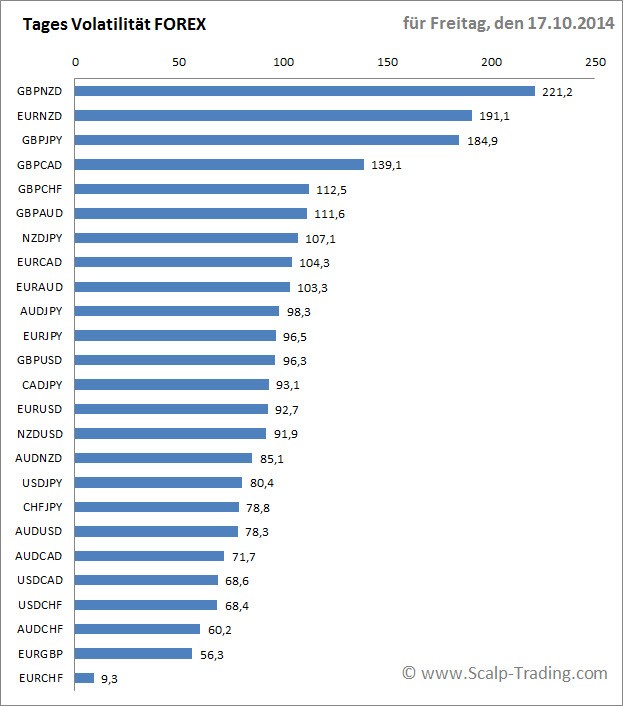

As a rule, scalping forex strategies focus on exploiting sharp price movements. So, it works well in especially volatile and rapidly moving markets. Temporary shortages of liquidity can offer scalpers some ways to profit, but by far the most widely used scalping strategy is using news breakouts. By staying calm while the market reacts emotionally to news, the sharp brief swings in the aftermath of a press release can give a scalper lots of potential profit opportunities.

Japanese Yen

While you can write a treatise on scalping around news releases, in general important press releases involving GDP, employment, and other economic indicators will almost always produce a huge rise in volatility along with a strong market movement in one direction accompanied by several aftershocks. A successful forex scalper will usually stay away from the market during the period just period the news release and in the immediate aftermath, however with the use of time stops and tight stop losses, they can take advantage of the emotional reactions of the market that the aftershocks create.

The Problem with Forex Scalping

The main problem with forex scalping is finding a broker that will give you the tools and spreads you needs as well as allow you to practice your trade. You always want to find a broker with low pip spreads, but if you’re scalping and taking out thousands of trades a day, low spreads are even more important. Timely execution and correct quotes are as always a must, and you will need top of the line technical tools at your fingertips. There’s no need for fundamental analysis if you’re scalping.

However, since you are opening and closing your positions so rapidly, some forex brokers won’t be able to execute the trades to stay up with you. If this is the case, they could end up losing every time that you win. For this reason, many brokers outlaw scalping. Make sure you check with yours before you invest a lot of time figuring out their system.

Scalping forex is one of the many strategies that you can use to make money in the foreign exchange market. However, it is not easy and not for everyone. You need to be able to stay calm and patient in the face of an emotional market and concentrate for long periods of time. If you think you’re ready for this or any other type of trading strategy, try out Zecco Forex. our top-rated broker. Find out more by clicking the banner below.

Trading FOREX is a risky endeavor and can involve substantial losses as well as gains. Make sure you know all the risks before investing. The information on this site is for general purposes only and should not be construed as a solicitation to buy any of the products or services offered