RSI Indicator v Action Forex Trading Strategies Systems Reviews

Post on: 4 Апрель, 2015 No Comment

RSI is yet another popular indicator that many traders think will somehow “magically” give them some sort of insight that is not available elsewhere. This is simply an erroneous idea and we will dispel the “myth” of the RSI indicator by taking a real-time look at the daily chart of the EURUSD. Read on to see how the RSI fairs as an analysis tool vs. what is arguably the best forex system ; price action.

First off let’s discuss exactly how the RSI indicator works:

The RSI is a technical momentum indicator that contrasts the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of a Forex currency pair. The RSI ranges from 0 to 100, an asset is deemed to be overbought once the RSI approaches the 70 level, meaning that it may be getting overvalued and is a good candidate for a pullback. Similarly, if the RSI approaches 30, it is an indication that the asset may be getting oversold and therefore likely to become undervalued.

• The main problem with RSI

Now, the RSI is an oscillating indicator, meaning it oscillates between an A and a B point in an attempt to “predict” market reversals. The obvious and very real problem with such oscillating indicators is that they will produce on-going sell signals if a market is a trending strongly to the upside, and on-going buy signals if a market is trending strongly to the downside. Now, anyone who has been around the markets for a while knows that the most lucrative time to trade is when a market is trending strongly, thus the last thing you want to do is confuse yourself into trying to pick the top or bottom of a strong trend by looking at some indicator like RSI.

• A clear example of RSI vs. Price Action

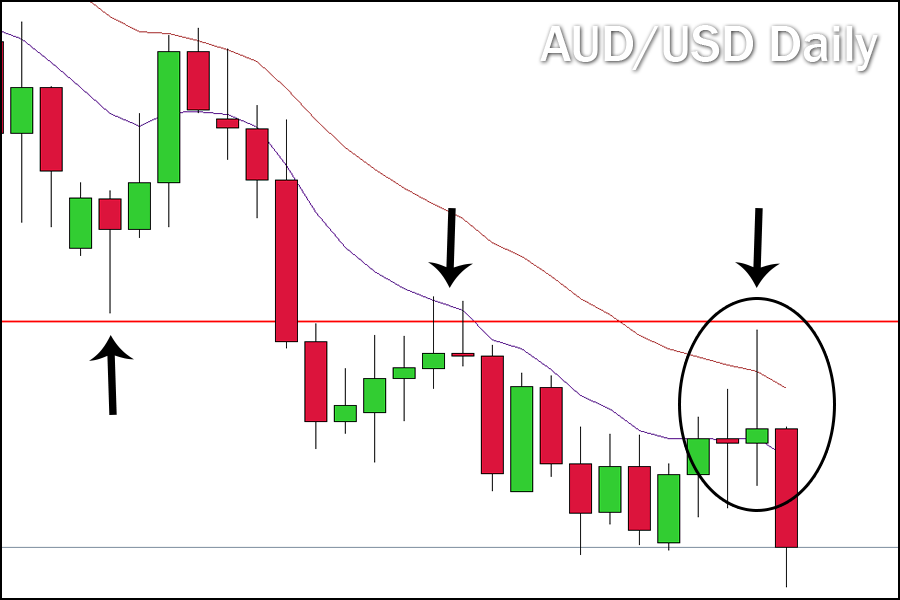

Let’s take a look at the current daily chart of the EURUSD as of April 1st 2011. We have a standard RSI indicator applied to this chart. There a couple things to discuss here that clearly point to price action being the obvious winner in the battle of RSI vs. Price action .

First off, the market is clearly in an uptrend since early January of this year. Since we want to take chunks out of the trend, because that is the most efficient and effective way to make money in the markets, we should only be considering long trades during an up trending market. Now, if you are a real believer in the RSI, you would be watching as it approached the 70 level, which indicates an “overbought” market, implying you should sell. The problem with the whole notion of “overbought” and “oversold”, is that a market can stay overbought or oversold for a very long time, so you see it’s all relative. Trying to pick tops and bottoms is a loser’s game, and the best way to identify major market turning points is with simple price action setups anyways.

Next, we can see there have been at least two high-quality price action setups that could have gotten you into this trending market over the last few months. If you were aware of what to look for based on simple price dynamics, you would have no desire to confuse yourself with “oscillating” indicators like RSI, Stochastics, or any of the rest of them.