Risk Management in Forex Trading_1

Post on: 14 Сентябрь, 2015 No Comment

An effective capital management strategy is an essential attribute of the financial markets. Without high-quality money management it is impossible to stay on the market of forex trading. For successful forex online trading, the player must be able to identify risks in each transaction. This will not only save money, but also multiply it.

The rules of money management include the following principles:

1. Investing no more than a half of total capital.

The figure of 50% is the Murphy figure. Financial experts recommend a lower percentage: 5-30%. That means more than half of the players own funds should be left for use in unusual situations and to continue effective work.

2. Investing less than 10 — 15% of total capital in one position.

This allows you to insure against the devastation caused by investing all the funds in one transaction.

3. Risk rate in each transaction must be less than 5% of the total funds.

Observance of this principle will keep the losses of a trader in a transaction below 5% of its total capital. Some analysts recommend reducing this figure to 1.5-2%.

4. The amount of down payment should be less than 20 — 25% of the capital for every open position in a group of instruments.

The prices of instruments in one group usually move similarly. Opening a large position in one group is impractical as far as diversification is concerned. You should always follow the important rule of optimal investment: all funds must be diversified. Allocate your capital so that it withstands, if one of the big deals is unprofitable. With proper diversification, loss-making trades are always offset by profitable ones.

5. The level of portfolio diversification.

Diversification is a reliable way to protect from losing money, but it must also be moderated. It is necessary to maintain a reasonable balance between diversification and concentration. For diversification to be reliable, it is enough to open a position on 4 — 6 different groups of instruments. Diversification vary inversely with correlation between groups of trading tools. If the correlation is negative, the diversification of the investment is strong.

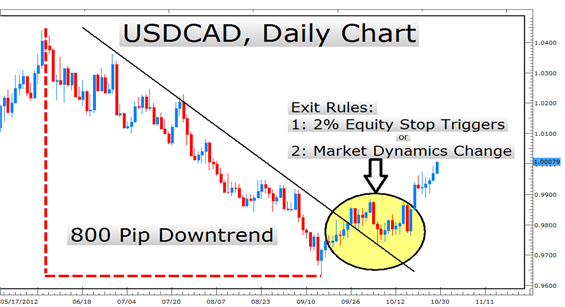

6. Placing stop orders (stop-losses).

A Stop-loss order is set by the trader to prevent large losses. The stop-loss order is a fixed price at which a trader closes the position in the event of adverse price fluctuations in the market. The level of stop-loss is determined by the traders readiness for losses in the current transaction and analysis of market situation.

Example: A trader has a deposit of $2,000. Having assessed the market situation, the trader opens a long position on EURUSD, i.e. buys euros for dollars. The trader is ready to invest 10% of his deposit in the transaction, with the risk level of 3% of traders deposit.

Given the level of 1 to 100, the trader buys 0.15 lot EURUSD at the price of 1.2930. In this case, the trader makes a down payment of $200 (10% of the deposit).

Next, the trader sets a stop-loss order. 3% of $2000 is $60. This means the trader will continue losing until the losses amount to $60. Once the loss exceeds $60, the trader closes the position at the market price (fixes the losses).

When the EURUSD reaches the level of 1.2890, the financial result of the 0.15 lot EURUSD position is -$60. The trader closes the position at 1.2890.

Thus, the trader has made a loss of 3% of the deposit, but has avoided the loss of the whole deposit, if the EURUSD exchange rate dropped much lower.

Before setting a stop-loss order a trader should properly assess the combination of technical factors reflected in the price chart and remember to protect his funds. The stronger the market changes are, the further from the current price level the stop-orders should be set. The trader is always interested in setting a stop-loss order as close to the price as possible to minimize losses from failed transactions. However, stop-orders set too close to the price can prevent from benefiting from numerous profitable positions because of the short-term price fluctuations. Vise versa, stop-orders set too far from the price can greatly increase the number of unprofitable trades.

7. Determination of the profit rate.

For each potential transaction, there should be a determined ratio of profit and losses. They must be balanced with each other if online currency trading market moves in an undesirable direction. Usually the ratio is 3 to 1. Otherwise, the transaction should be rejected. For example, if a trader is risking $200, then the potential profit of the transaction must be $600.

Since a significant profit can only be reached in a very small number of transactions, every effort must be made to maximize the profit. To do so, it is necessary to maintain profitable positions as long as possible. But minimizing losses of unprofitable transactions should not be forgotten.

8. Opening several positions.

By opening a few positions in one instrument, the trader identifies trade and trend position. The purpose of the trade positions is a short-term trade. They are limited by close stop-orders, which are executed when the price reaches the stop-level. The trend positions have more distant stop-orders and allow positions to be maintained under the minor fluctuations in market prices. With these positions, a trader can achieve the largest profit.