Rising Wedge (Stock market) Definition Online Encyclopedia

Post on: 29 Июнь, 2015 No Comment

Weekly Rising Wage Pattern Screener.

Rising Wedge

The Rising Wedge pattern resembles the Ascending Triangle. both patterns are defined by two lines drawn through peaks and bottom s, the latter headed upward.

Rising wedge formations in downtrend s are very similar to other triangle patterns in that they are characterized by narrowing price range s and slowing volume. Unlike symmetrical and right angle triangles. rising wedge formations in downtrend s almost always result in large price declines.

Rising Wedge

A rising wedge is formed when price consolidate s between upward sloping support and resistance lines.

rising wedge

The Rising Wedge. The rising wedge pattern generally identifies a bearish pattern in Forex market s. The rising wedge pattern is formed mostly when the FX Market is making higher highs and even higher lows with a decreasing price movement range.

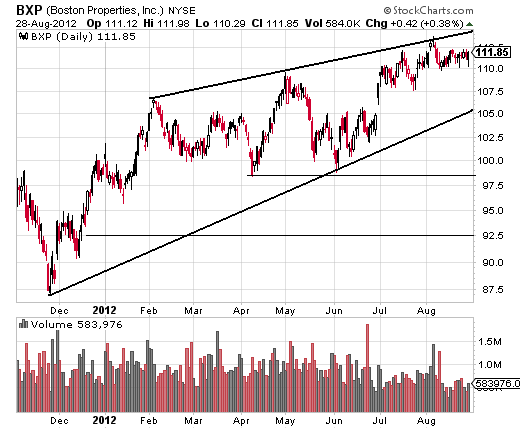

A rising wedge occurs when the highs and lows of the trading range are both rising, as seen in the chart below. Should a rising wedge form in an up trend. it will normally be a reversal pattern. however should it form in a down trend. it will be a continuation pattern.

A rising wedge resembles an ascending triangle with one vital difference. The main selling is not taking place at a precise level, but at gradually higher prices. This suggests that there are more participants selling and, most significantly, indicates a loss of upward momentum.

The rising wedge pattern we’ve been tracking is essentially complete. This final jump in the S&P 500 has been a bounce from the upper trendline. But by the look of things, this is likely the final push.

Bearish rising wedge s are a powerful yet often ignored indicator you should be familiar with. This pattern is easily confused with a bull market since the stock continues to rise; the critical differentiating factor is volume.

Example of a Rising wedge :

0 Comments

A rising wedge is a sign that the price of a stock is likely to fall and is identified by the gap between the support and resistance lines closing over time; a falling wedge indicates the opposite, or that a stock ‘s price could rise.

Rising Wedge — Represents a temporary interruption of a falling trend. It is a pattern that consists of two converging trendlines with both trendlines rising. Runaway Gap — This type of gap often occurs halfway between a previous breakout and the ultimate duration of the move.

As you see on the daily chart. after a breakdown below the very short-term rising support line. oil bears not only pushed the CFD under the upper line of the rising wedge. but also approached the lower border of this formation.

This completed a 3-3-5 Elliott wave pattern that I identified, and broke the rising wedge on cue. At 1130, the S&P 500 had retraced a Fibonacci 61% of the April highs to July 1st lows, and had completed that retracement over a Fibonacci 5 week window.

While the trend is clearly up I can’t help but notice the rising wedge which is a bearish pattern. During an uptrend we want to see bull flags and pennants. not a grind higher forming a narrowing range.

Tales From The Trenches: The Rising Wedge Breakdown

Click the charts to see them in full size .

Comments are turned off for this post.

As with the triangle. prices move into a narrower and narrower range as the pattern progresses, looking somewhat like a coil. In a rising wedge. the price highs do not advance as much as the price lows. When the uptrend line along the lows does give way, prices tend to spring out to the.

The falling wedge is a bullish reversal pattern in which the upper trendline slopes downwards at a greater angle of slope to converge towards the lower trend line. The rising wedge is a bearish reversal pattern in which the lower trendline slopes upwards at a greater angle of slope to converge.

But the emotional crowd also generates many undependable patterns as greed slowly evolves into mindless fear. Complex Rising Wedge s will defy a technician’s best effort at prediction while the odd Diamond pattern burns trading capital swing ing randomly back and forth.

A chart pattern composed of two converging lines connecting peaks and troughs. In the case of falling wedge s, the pattern indicates temporary interruptions of upward price rallies. In the case of rising wedge s, indicates interruptions of a falling price trend.

Monitoring the existence of significantly higher volume to confirm a valid breakout for Falling Wedge is more crucial than for Rising Wedge .

Without a significant surge in volume. the upward breakout above the resistance of Falling Wedge would lack conviction and be more vulnerable to failure.