Pros and Cons of Using Stochastic Indicator in Forex Trading

Post on: 13 Июль, 2015 No Comment

I am writing this article because I see that indicators is one of the first things novice traders try to choose to start trading. They think in order to become able to trade, they have to choose some good indicators first. If you look around the web, you will see that many of them frequently ask what the best indicators are for forex trading. Among all indicators, Stochastic Oscillator is so popular and well-known. It is the indicator that many forex traders, specially those who have shifted from stock to forex trading, use a lot because they are used to it. Of course MACD. RSI and Bollinger Bands are also very popular.

In this article, I am trying to explain how Stochastic works and whether it really works the way some traders think or not.

Day to day forex trading is deeply dependent on a wide platter of technical tools and the deduction that you derive from them. Given the huge daily turnover in forex market, nearly $4 trillion change hands on a day to day basis, it is but natural that the pace of trading is quite hectic and need to make quick decisions is absolutely important.

Keeping this very fact in mind various kinds of indicators based on moving averages. volatility and momentum. Different parameters work in unison to highlight the market dynamics and determine the swing and market direction on any given trading day.

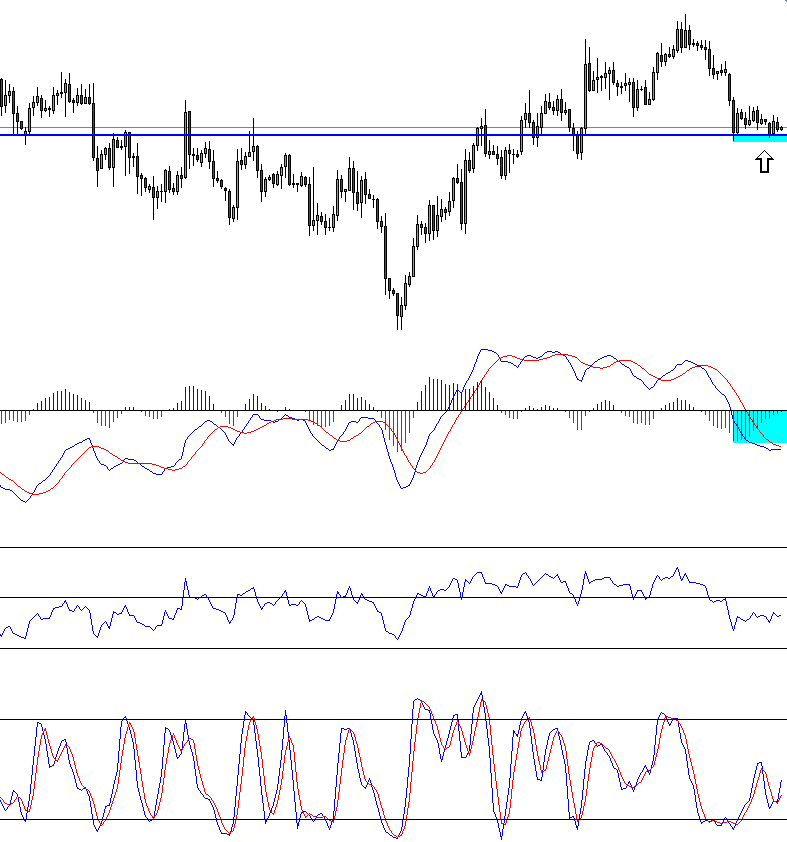

One such commonly used momentum indicator is the Stochastic Indicator. Essentially a means to calibrate if the trend that might be currently ending in the market, the Stochastic Indicator helps you identify overbought or oversold conditions in the market.

History Of Stochastic Indicator

The Stochastic Indicator was devised by George Lane. He was a trader, educator, speaker, technical analyst and author. A member of the future’s trader group in Chicago, he developed the Stochastic Indicator, an immensely popular tool among technical traders in today’s world.

Based on the support and resistance zone, it helps you gauge the current price movement relative to the entire time period. Its founder Dr George Lane was of the view that this oscillator should be used in tandem with Elliot Wave Theory and the Fibonacci retracements for timing it right. The divergence and convergence of trendlines drawn on the stochastic chart form the basis of the trading inferences and trend identification done on the basis of these charts.

Essentially divergence and convergence in the trend lines act as momentum indicators in the forex market. They also help you understand times when the market gains might be waning and when the market might be prepping for a reversal in trend. It is on the basis of this relative price action that a forecast of the market trend is predicated on. If the upswing continues after a price break, it gives the trader the cue that he or she should continue increasing position in the market. Just the contrary cue to liquidate holds true if the direction of trend lines opposes the price action .

Definition Of Stochastic Indicator

At the very behest let’s deal with the definition bit. So what exactly is a Stochastic Indicator? Technically speaking, it is a momentum indicator which compares the closing price of a currency pair ’s closing rate to the overall price range. The indicator’s sensitivity to the swings in the market can be changed by making adjustments in the time duration on which it is calculated.

The driving theory that forms the foundation stone for this Indicator’s analysis is that prices tend to end near their highs in an upward trending market. Contrary t this, in a market that is heading down, prices are generally seen closing around the lowest levels in trade. The %K and the %D are main protagonists in this kind of chart mapping where D stands for a specific time period for which the graph is being plotted and analyzed further.

One of the easiest and most common usages of the Stochastic Indicator is in its ‘slow stochastic’ avatar and is generally employed by day traders to reap maximum benefits and reduce committing a trade on the basis of false or incorrect signals. The slow Stochastic gives you the measure of the relative positioning of the closing price in comparison to the highs and lows that the particular chart might have hit over the course of 14 days. As mentioned earlier, the basic premise that this signal is based on is that prices trade near their lows during a downmove and highs at the time of market uprisings.

How To Use Stochastic Indicator

So, now the question is how you can use this and what is the formula that drives the calculation based on which you can predicate your trend predictions?

The formula is calculated on the basis of the last closing rate; the low price is referred to as Low_N and the high as High_N. In both cases, N stands for the time period on which the entire calculation is based on. In a typical 3-line Stochastic chart, you will get anticipatory signal in the %K line; the %D line gives you a trend confirmation. N the time period is normally seen as recording 5, 9, or 14-day period. Normally the indicator is smoothened over three time periods for more accurate analysis.

Number 14 has an immensely interesting connotation. The time model uses the magic number 14 as the time model for calculation of this momentum oscillator and deriving near perfect deductions. Depending on the chartist’s goal it could represent the number of days, weeks, months taken in consideration for the purpose of charting the trading momentum and the deductions that one can achieve through them. For example, a 14-month chart will give a user about the entire year’s range and the long-term trend patterns that might be underway.

Almost immediately, it gives you an idea of how trade is panning out and in what direction must you work your investments in. As I had mentioned earlier, essentially the Stochastic Oscillator helps you mark out the overbought and the oversold zones in the market on a scale of 0-100. If you have a reading where this line trades above 80, then this indicates that the market is in overbought zone. Similarly, when the line is below 20, it is a cue for the traders that the market is in oversold and perhaps buying procedure could be initiated depending on the trend results. The basic strategy in this kind of a situation is you buy when the market is in an oversold zone, and you sell in times of overbought trade.

So what happens when the market is in the overbought zone? Normally the price drops after it hits this zone. A reversal is what you are witnessing after an extended period. Traders use this chart to constantly identify new developing patterns as well as ride on momentum that they could pretty well capitalize on and gain from.

What a trader must always remember is that the fastest line on the charts is the K line, and the D line is relatively slower. What we generally notice is that this D line along with the prices tends to move in either oversold or overbought zones. When the upmove is accompanies with strong volume trends. the trader gets the cue to act as per the positioning of the line in a scale of 0-100.

Meanwhile, we reach the crossover situation when the K line goes ahead and actually intersects the D line. As the price action trends up, you get a buy signal. However, if this same K line crosses under this D line, you get your sell signal or exit points.

Divergence is another interesting signal that you can identify with the help of these charts. Divergence forms when price goes up and indicator goes down at the same time. The increase in divergence signals reversal in the price action .

Advantages Of Using The Stochastic Indicator

Like every technical indicator out there in the marketplace, the Stochastic charts too have a specific set of advantages as well as demerits. A look at the advantages of using this unique charting technique first and why many forex market veterans literally consider the Stochastic signals as the ultimate word while deciding on their trading strategy in the forex market:

1. Accuracy

Most users consider the Stochastic charts as accurate buy or sell indicators with minimum room for error. The premise driving the chart movement along with the adaptability of the time period provides this indicator a massive advantage compared to other momentum plays. The driving force which relates the closing price with the overall trend of the particular currency pair that you might be tracking gives it a distinct edge over many other Oscillators and market indicators. You can almost immediately see a pattern forming on the charts depending on the price action and the chosen time period.

2. Time Period

I think this is another factor that lends it uniqueness and helps it acquire a much higher degree of perfection on the basis of the adaptability on the time factor. Also, I believe that as most Stochastic charts are plotted on the 14-day parameter, the relatively current timeline reduces the scope of redundancy a lot more and makes it a lot stronger force to reckon with.

Also, this kind of a time frame can easily negate the misleading impact of a very short period where you might see a sudden spike up or nosedive in prices.

Another important factor that forms as the biggest advantage of using this indicator is that it helps you play the trend. Forex market trade is essentially about identifying the trend right and then entering/exiting it. The Stochastic chart when plotted and interpreted correctly lets you do exactly that. You can identify as a trend is unfolding and catch it at the appropriate moment to enable you to reap maximum benefit from your investment. It also gives you a fair idea of the exit and the entry points, so the chance of being trapped in the wrong trade reduces significantly.

4. Ease Of Use

The convenience of use and easy interpretation of these charts make it the first choice for many forex market traders. Not only seasoned traders but this is one chart even the relatively new comers in the market can use it to their benefit and make it the stepping stone for sustained forex market gains over an extended period of time. Charting on dreading these charts are both simple in comparison to many complex charts that forex traders use for their daily analysis. This works towards making these charts the tool of choice when making complicated forex market investments.

Disadvantages Of Using The Stochastic Indicator

However, there are some points to keep in mind and without them you could end up deducing wrong inferences:

Certain times if too many trades are plotted simultaneously, these charts fail to register the tiny pullbacks that might have taken place in the marketplace. Depending on the profit objective that you might have preset it is possible to get multiple investment options and create a state of confusion or chaos which makes it more difficult for you to take a strictly objective trading call. It also opens up the possibility of getting trapped in the wrong trade.

2. Drop Off Effect

This is another fallacy that you must be careful of while referring to the Stochastic charts for your market deductions. This is a situation where an abrupt change in the current value is noticed as soon as a previous value is suddenly deleted in the course of a fixed period series of calculations. This can even interfere with the overall oscillator’s value and give you false trading signals. This can even lead to a situation where you might end up booking unnecessary and extremely uncalled for losses.

Concluding

However, the overall rate of accuracy of this chart type is what adds to its pull among the trader community. Both new and seasoned investors are able to reap equal benefits from this kind of chart and identify almost accurate exit and entry points. Extended use of this oscillator across a wide cross section of market conditions and different time expanse works towards increasing the accuracy rate as well an improving your efficiency as a forex market trader to interpret them efficiently in a way that maximizes your returns from the currency market investment .

As a momentum oscillator, Stochastic charts also gives you the unique opportunity to glide through the market volatility, rise above the volumes anomalies and get you a fairly firm ground to book maximum possible profit from a specific currency pair given the direction and trend signals are favorable for the execution of the trade.

This, of course, brings me to the final point I want to make in this series. Technical indicators like Stochastic Indicators are extremely useful tools and can any day help you log in significant gains, but some key factors should be kept in mind. It is important to get as much possible clarity in your charts. Pay attention to layout, color scheme and ultimate charting to bring out the best possible results. Also do not try to pack in too many value parameters. Most cases you will end up being confused. Always remember information is power if used efficiently, and it can spell doom when not used judiciously.

Also, if you see there are much easier ways to trade without having to have these indicators on the chart, then youd better to go for them. This is what we do.

More about Stochastic from FxKeys:

Don’t Miss Our New Articles!

Be the first who receives our most recent articles:

Learn more: