Profiting From Forex Scalping How to scalp fundamentally

Post on: 26 Апрель, 2015 No Comment

2011 m. gruodžio 2 d. penktadienis

How to scalp fundamentally

Popular wisdom in the market states that traders who want to trade fundamentally should choose a longer time frame involving daily, or even weekly, charts. Those traders who want to trade more short term (hourly charts, for example) should focus strictly on technical setups. As with so much conventional wisdom in FX, this bit of advice couldn’t be more wrong. For the purposes of this article, we define scalping in FX as using short-term time frames (usually hourly charts or smaller) to make trades with targets and stops approximately 20-30 points in length. Not only is it possible to scalp FX fundamentally, but retail traders actually have a significant advantage over larger market players when it comes to executing their trades.

Macroeconomic News Moves the Market One of the great aspects of the currency market is that it trades off of macroeconomic news that is transparent, impossible to fabricate and readily available to all market participants at the same time. (To learn more, see our complete Forex Walkthrough Economics Section .) The key news that drives the FX market is governmental economic data such as the latest employment statistics, GDP growth rates, trade balance reports, inflation readings and interest rate announcements. These reports are typically released every month and can been previewed on economic calendars.

Not only is the release of this data planned well in advance, but it is also reported instantaneously through a variety of news outlets including Bloomberg, Reuters, Dow Jones and CNBC, making it universally accessible. There’s no need for traders to know about a secret contract that Intel (Nasdaq:INTC) may have negotiated, or the super-cool new product that a company like Apple (Nasdaq:AAPL) just prototyped at its labs in Cupertino, California. In FX, headline economic data really does move markets, and currency traders can take advantage of that fact. More importantly, individual traders often have a decided advantage in reacting to the news faster than the larger corporate and hedge fund players.

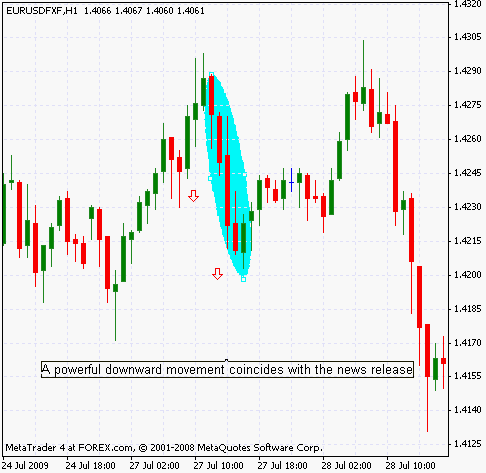

Retail Traders Can React Quickly As the most liquid financial market in the world, forex trades almost US$2 trillion each day in volume (in April 2004, the Bank for International Settlements (BIS) reported that the forex market traded US$1.9 trillion a day). Most retail brokers will provide liquidity up to $20 million, meaning that they will allow any trader to buy up to $20 million worth of a currency pair at the current ask or to sell the same amount at the present bid. This trade size can accommodate 99% of all retail orders, making it easy for traders to open a position quickly without affecting the market. However, larger players that are looking to place trades worth hundreds of millions or even billions of dollars at a time will move markets. Therefore, by reacting quickly, retail traders in FX have a chance to front-run the big players and benefit from any momentum generated by that order flow. Economic news, whether favorable or unfavorable, can take up to several hours to fully filter through the market as traders adjust to the new information. This type of time frame offers astute retail traders a great opportunity to take advantage of the situation and scalp short-term profits as the pressure from the big players moves prices in the direction of the news.

How the Best Fundamental Scalps Occur If event-driven scalping were as easy as buying good news and selling bad news, every FX trader would be inordinately rich. Of course, success is not that simple. First and foremost, good or bad economic results in and of themselves are usually meaningless to the market. FX markets trade on expectations and perception. Therefore, relative comparisons matter much more than absolute ones. For example, suppose the United States reported quarterly GDP growth of 5%, while the eurozone reported GDP results of only 1.5%. At first glance, it would appear that EUR/USD should decline because the U.S. results clearly show superior growth. However, if the market expected 7% GDP numbers from the U.S. and only 0.5% readings from the eurozone, the exact opposite might occur because eurozone news would have exceeded expectations, while U.S. results would have come up short.

However, playing the expectations game alone is not enough to create profitable trades. This is where technicals become integral to a successful fundamental setup. The best, most profitable fundamental scalps occur under technically extreme conditions. These highest-probability setups are created when a favorable fundamental surprise takes place under technically oversold conditions and vice versa. At that moment, the currency can bounce like a rubber ball off pavement, as every market participant who is short scrambles to cover his or her position. The same dynamic occurs in reverse. If prices are extremely overbought and fundamental news shocks to the downside, most market players will rush for the exits, creating a stampede of sell orders that generates a strong momentum-driven move that can be profitably traded to the downside.