Price & Time The Gann New Year

Post on: 13 Июль, 2015 No Comment

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use o f various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresp onding movements can be achieved.

Foreign Exchange Price & Time at a Glance:

GBP/USD:

Charts Created using Marketscope Prepared by Kristian Kerr

- Cable has stalled its recovery over the past few days from the key 1.4815/45 Gann/Fibonacci support zone

- Our immediate focus is still higher in the pair with a move over the 1.5195 3 rd square root progression from last weeks low needed to setup a deeper upside retracement

- Shorter-term cyclical studies are negative over the next couple of days, but these may be overshadowed by a bigger picture Gann turn window in effect over the second half of the week

- The 10 th square root progression from the year-to-date high near 1.5070 is immediate support

- However, only weakness below the 50% retracement of last weeks range at 1.4995 turns us negative on the pair and warns of a broader downside resumption

Strategy: We are still long half a unit from 1.4940. Took off the other half last week at 1.5070. Raising stop to just under 1.4995.

USD/CHF.

Charts Created using Marketscope Prepared by Kristian Kerr

- USD/CHF tested the 2×1 Gann angle line from last years high last week before coming under steady pressure over the past few days

- Our bias is now lower in the pair with immediate focus on a cluster of Gann, Fibonacci and Andrews levels between .9360/84

-A clear break under this zone is really needed to signal the start of a more important decline

- Very short-term focused time cycles are negative for another day or so, but a broader Gann seasonal turn window commences Wednesday

- A convergence of various retracements near .9500 is resistance and strength above this level needed to turn our attention higher

Strategy: Cyclical picture is not the clearest but risk/reward is good here on the short side. Looking to sell USD/CHF at .9480 with a stop just over .9507.

NZD/USD.

Charts Created using Marketscope Prepared by Kristian Kerr

- NZD/USD remains in a strong position since reversing last week from a key Gann/Fibonacci confluence in the .8150/60 area

- Our bias is still higher in the Bird with focus on a convergence of several retracements and the 1×1 Gann line from the year-to-date high in the .8285 to .8300 area

- Above this resistance opens the way for a much stronger advance

- Near-term focused time cycle analysis is still positive, but the latter half of the week is a key Gann turn window and caution is required

- The 88.6% retracement of the December to February advance near .8200 is immediate support but only weakness below .8150 turns us negative on the pair

Strategy: The market finally came to us and we got long at .8200. Looking to take profit on half around .8280. Moving stop to cost.

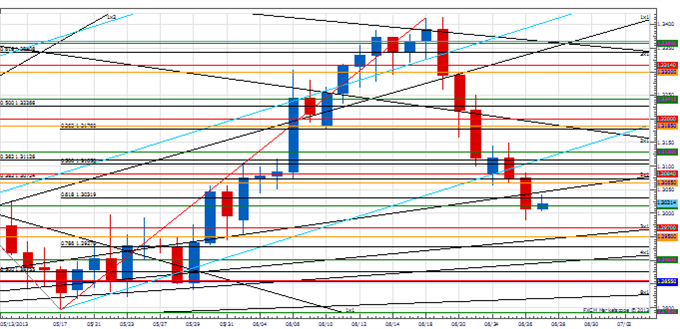

Focus Chart of the Day. EUR/USD

Gann placed heavy timing emphasis on the Vernal Equinox (this year it is March 20 th ) and believed it was one of the most important times of the year. In the Square of Nine it is denoted with 0 degrees and is the beginning of the year from a Gann/geometric perspective. He theorized changes in trend occur more often around this date and if one looks through market history it is indeed littered with important turns in late March. Is it happenstance? Perhaps, but the fact so many important reversals have been spawned around this time period suggests to us that there is a natural cyclicality here — if only due to the interrelationship of these past significant highs and lows. In our experience it is foolish to ignore this potential window and we will be closely watching markets in extended trends over the next week or so and specifically the euro as it is making new multi-month lows into it.

— Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter at @KKerrFX.

Are you looking for other ways to pinpoint support and resistance levels? Take our free tutorial on using Fibonacci retracements.

To receive other reports from this author via e-mail, sign up to Kristians e-mail distribution list via this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.