Price Action Made Simple

Post on: 4 Апрель, 2015 No Comment

#1 Forex Education Mentoring Program

What is price action? How do you trade using price action? Price actionyeah right!!

These are things than any trader hears constantly. The reality is most trades are based on price action in some form or another. Naturally, those that choose to trade purely by indicators are trading a graphical interpretation of price action from X periods ago. However, true price action trading is based on what you see happening right in front of you on your price chart.

When looking at price action one can look for various different things. These are the 3 common ones which are worth considering.

Impulses

Impulse moves are very easy to spot. If the price is accelerating quicker in one direction over another compared to recent price moves it would be considered an impulse or impulsive price action. These moves should be easy to spot otherwise you can probably consider you are having to look to hard.

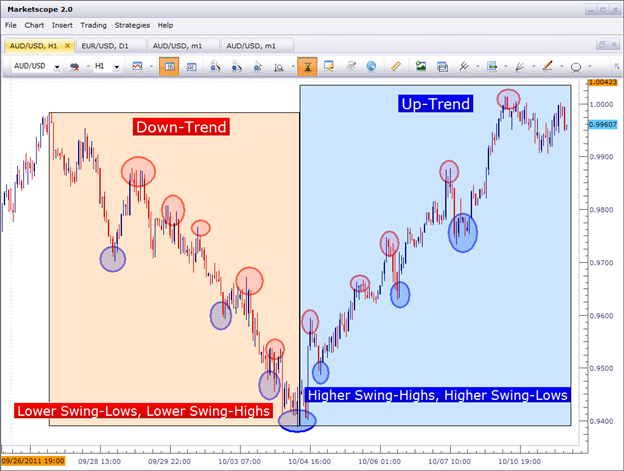

Higher Highs-Lower Lows

This is nothing new and if you have been looking into trading even as a newbie you will have come across this. Simply put, you can work on the assumption that if price has made a new high above a previous high then it will continue to make new highs and obviously visa versa. Whilst an incredibly simple concept it really is a great starting point. Ignoring potential new high followed by new low followed by new high type expanding triangle, breaking higher highs etc will keep you on the right side of trend and ultimately you will only be wrong once in a move (i.e the top or bottom when a reversal occurs).

Reversal Bars

These bars can be called various names and are also inbuilt in many indicators. It is probably the most simple price action trading system known to traders. It is still used by a lot of stock swing traders and can be used on any trading instrument than you can view as a bar or candlestick chart.

Quite simply you wait for a new high bar or low bar to be completely formed and then wait to see whether the bar after it fails to break that low or high. Then you will take a trade when it breaks the high or low of the confirmation bar. This concept used the idea of making a higher low (or lower high) when forming the confirmation bar and then making a new high (or low) when breaking the confirmation bar. These are such strong principles in price action trading you will find them in most trading methods somewhere or other.

Price action need not be limited to these three concepts that have been touched upon briefly above. Price action can be used in devising mechanical trading systems. A price move above or below a measured moving average would be considered price actions. So would breaking a horizontal resistance/support line. Chart patterns to some extent are price action based patterns and the Elliott Wave Theory method of wave counting could also be considered price action (at points).

The benefit of using price action in your trading systems is that you make your decisions based on what is happening at this point in time. This means you can be more reactive to further price moves. The delays that you get with some/most indicators is not apparent with price action and can help your trading become more profitable if you are struggling with indicator trading.