Price Action Candlesticks and the Story They Tell

Post on: 16 Март, 2015 No Comment

Join Date May 2012 Posts 586

Price Action, Candlesticks, and the Story They Tell

Hey everyone, my name is Graham and I’ve never really gotten deeply involved in forums or web-based discussion. Thought it was time to give back to the trading community by sharing some of my experience with the markets, and also share my thoughts on what’s going on with current charts.

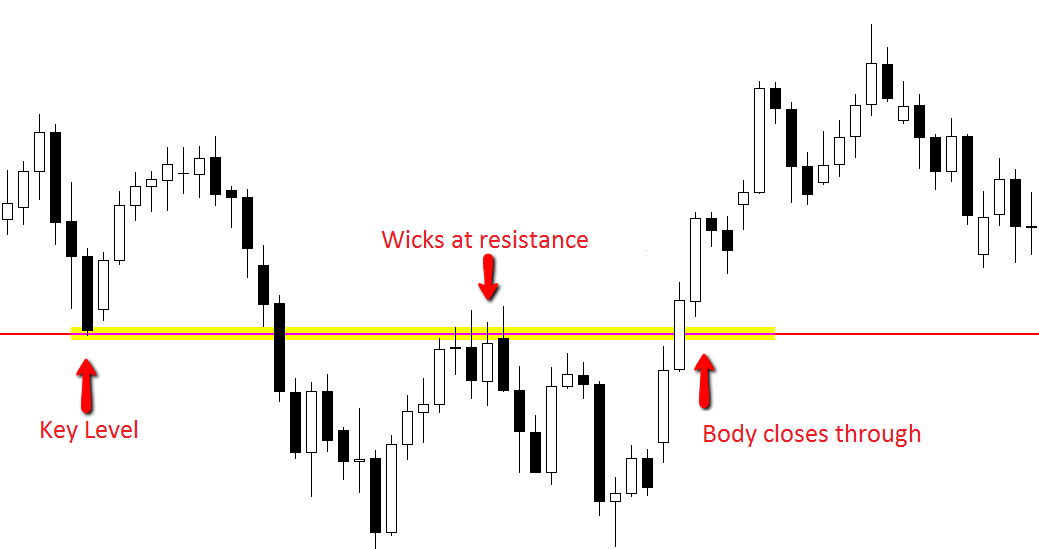

I trade exclusively with price action, I’ve been a passionate price action trader every since I got involved with Forex 6 years ago. I am not interested in RSI, Stochasic, ADX, MACD’s, exotic fib retracements, pivot lines or any other mathematical derived variables. I do however use 2 moving averages to map out the mean value on my charts, that’s as far as I go with adding on any ‘extras’ to my charts. I try to keep my price charts as clean, simple, logical, as easy to read and work with as possible.

I also don’t focus on the market news. The fundamental side of trading can be interesting at times, but I try to keep it away from my decision making process as I don’t think there is an edge trading news or economic data releases. Generally the output of the news is reflected on the charts via the price action anyway.

Although price action trading can be applied can be applied to the lower time frames easily, we know from experience nothing ever good comes out of it, so we like to stick to the higher time frames where price charts have more clarity, are less ‘choppy’, and just all round paints a better, clearer picture to what the market is doing.

The daily chart is our number one trading tool, and some of you might think that higher time frames like this might be boring but they aren’t. It’s actually less stressful, you place one trade let it evolve and by using proper risk/reward ratios in your money management, you can easily get a return of 6%+ on a higher time frame trade. A lot of scalpers and day traders are out there flogging the charts with market orders trying to achieve the same results — how stressful. I generally like to stick with using end of day trading strategies because of the many advantages it brings into your trading, and your life.

We’ve noticed there are several other price action discussions going on around Baby Pips, and we just wanted to get our own price action based discussion going, and get some of you aspiring price action traders out there salivating on this stuff, and get some nice, clean, profitable trades happening.

I don’t want this thread to be viewed as some sort of ‘signal service’. It’s just raw price action discussion, educational information if anything. Although I may post up a few charts and talk about a lot of charts, I try to only have one trade open at a time and generally last anywhere from a week to a month or two. So to be fully transparent I am talking about a lof ot stuff but I am not trading every single thing I post.

Last edited by DnB Price Action; 12-31-2013 at 10:17 PM.