Presidential Elections and Stock Market Cycles Graziadio Business Review

Post on: 16 Март, 2015 No Comment

Presidential Elections and Stock Market Cycles

Can you profit from the relationship?

For the past several decades, individuals in all walks of life have observed the cyclical nature of the stock market. Pundits have attempted to correlate these cycles with everything from referencing the position of the moon and stars to using highly sophisticated econometric models. This article, however, attempts to address the timely relationship between politics and stock market behavior.

During the first half of the twentieth century, economic theory was limited primarily to the micro study of supply and demand theory. Minimal concern was given to the macro economic environment. However, after World War II, the work of John Maynard Keynes, an English economist, began to dominate Western economic thinking with a broad macro view of economics. First presented in 1936 by Keynes, this approach was the beginning of macro economic theory. It called for governments to prescribe specific macro economic policies in an effort to ameliorate business cycles. By the late 1950s, Keynesian theory was widely accepted in academic circles and was being taught at most major U.S. universities. [1] The federal government began to embrace Keynesian economics by the early 1960s, and from that time forward, Washington has played an active role in influencing the direction of the economy.

Its the Economy, Stupid

It wasnt long before politicians recognized the relationship between voter approval and the state of the economy. The Federal Reserve has responsibility for monetary policy such as interest rates and alterations in the money supply, and the executive branch has limited ability to influence that part of the economy. However, the executive branch of government can influence fiscal policy—changes in taxation and spending patterns. Administrations have often yielded to the temptation to exercise fiscal policy in a manner designed to pump up the economy just prior to a presidential election and thus garner voter approval for the incumbent party. These pre-election actions and campaign promises often have created some euphoria among voters and investors alike.

On the other hand, post-election periods seem to have suffered from an opposite effect that has resulted in less investor optimism. In The Stock Traders Almanac, 2004, Yale Hirsch notes that based on his studies, Presidential elections every four years have a profound impact on the economy and the stock market. Wars, recessions and bear markets tend to start or occur in the first half of the term and bull markets, in the latter half. [2]

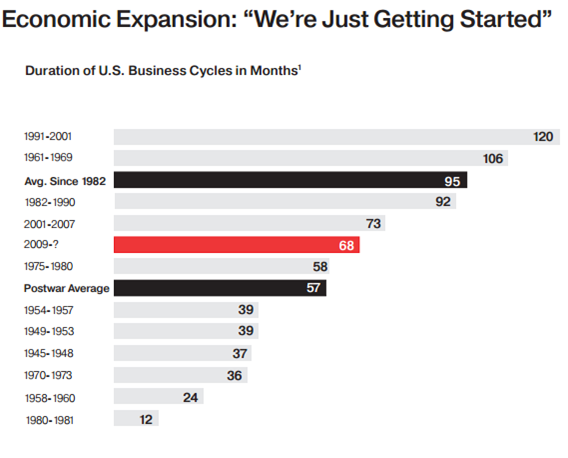

Because of the consistency and predictability of administrative actions and campaign rhetoric and their anticipated influences on the economy, investors have come to assume better times for business conditions, corporate bottom lines, and stock prices in the period prior to a presidential election and a less robust period following those periods. Thus, a four-year stock market cycle seems to have become a part of the investment landscape since the mid-twentieth century. From April, 1942 to October, 2002, 15 stock market cycles have occurred, each averaging approximately four years duration.

Major market cycles usually have abrupt V-shaped bottoms with declines in excess of 10 percent. The following stock market recoveries are often created (as suggested earlier) by strong economic stimulus invoked by government officials in an effort to counter potentially unpopular economic recessions. Strong doses of fiscal and/or monetary policy stimuli unfortunately often result in creating inflation, which then must be addressed, thereby perpetuating the business and stock market cycles. Given the foregoing scenario, it is not at all surprising to find that the stock market often has made major bottoms about two years before presidential elections and has risen through the end of election years.

To illustrate this pattern, consider the historical performance of the commonly used Standard & Poors 500 Index (S&P 500). This Index consists of 500 top U.S. companies, and it is used by Wall Street as a benchmark for tracking the overall stock market. Table 1 below shows the historical stock market cycles from 1942 – 2002.

Table 1

Historical Stock Market Cycles for the S&P 500 Index