Pin Bar Trading Price Action Forex Trading with Pin Bars

Post on: 11 Август, 2015 No Comment

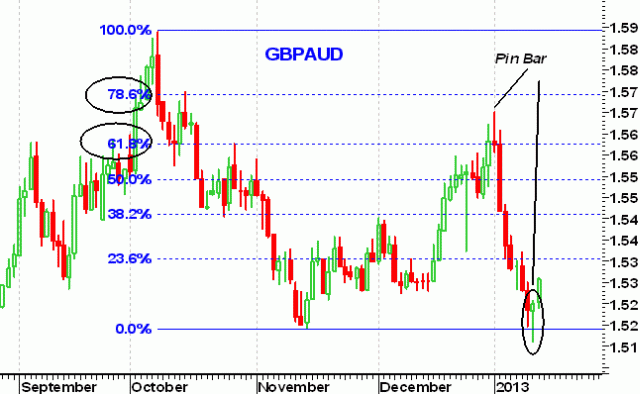

Today I am going to discuss trading the price action pattern called a Pin bar which is a fantastic technique for catching reversals, entering traps, and getting into trends. In this article, I will specifically talk about how you can use it for finding short term tops and bottoms, what it is communicating from a price action and order flow perspective, and one method for trading them.

The term was originally penned by Martin Pring calling it the Pin bar . which stood for pinocchio bar or a bar that is telling a lie.

Why?

Martin had noticed that these types of bars come up in strong trending moves, but what they do is initially create a break of the highs or lows for the move, but then break back into the range of the prior candle. This break of the highs or lows is the telling a lie part of it, trying to get short term traders in on the break. When the candle breaks back into the range, they are then trapped and if the price action continues to break in the opposite direction of the trend, then those traders who are trapped have to exit their longs/shorts, thus helping fuel the reversal. But lets take a look at a general pin bar in the image below.

Looking at the image above, the blue bar at the bottom is a pin bar, which generally should open inside the body (and/or wick) of the prior bar. The pin bar itself should form a new low in a downtrend, or a new high in an uptrend. This is what creates the trap for the traders that entered short on the break below the lows. With the bar closing up, the new shorts are now trapped and if price climbs enough, they will have to exit for a loss which will help fuel a price rise and the reversal.

Now lets take a look out a little further at this pinbar in the context of the price action around it with the chart below.

Now that we see the larger picture here, price was selling and then formed a SL at .8100. Price then bounced to .8275 where it ran into resistance and created a pullback from the SL. Price then sold off for 8 candles (32hrs) only to run into a pin bar a prior support level, giving us a really good price action trigger to go long and reverse this move. Lets see how it played out in the following chart.

After selling off for 8 candles and 32hrs straight, price action then formed a pin bar, which was the low in this move reversing 90 of the 130pip sell off (over 61.8% of the move). We actually blogged about this setup ahead of time and many of our price action traders got long on this one for a nice 3:1 reward-risk setup.

We placed our entry on a small pullback into the pin bar, and targeted .8225. Price went about 10pip past our entry and then encountered a new wave of selling. But as you can see, the pin bar itself was the key price action trigger in setting up this reversal.

Lets take a look at another pin bar to give you another example, then we will talk about finding a good entry for the pin bar along with time frames.

Here is the EURUSD on the 1hr time frame. Price has been climbing for over a day from 1.3140 1.3290 and then forms a pin bar at the top of the uptrend. Notice how in forming this pin bar, price had already been struggling around 1.3270/80 to make any new significant highs. Lets take a look at how price action responds to this pin bar formation.

Looking at the chart above, notice how after forming the pin bar, price then formed an inside bar right after the pin bar, telling us there was definitely a pause from the pin bar rejection which is interesting since a) price was already struggling around 1.3270/80 and b) the bulls had been in control for so long. Where did they go all of a sudden? This should have been a clue the market was about to reverse and the pin bar was the trigger.

Price then traded sideways for a few hours, but then sold off heavily shedding +180pips from the pin bar highs giving a highly profitable trade with very low risk so hopefully this gives you an idea of the pin bar formation as a whole.

Pin Bar Entries

In terms of finding a good entry, one method is to take a pullback into the pin bar itself. If the bulls/bears are in control at the time of the pin bar, there is a good chance they will attempt to break the highs/lows of the pin bar so a pullback gives a nice option to get in the market. There are actually many pin bar entries, and they should depend upon the context of the price action around and leading up to the pin bar itself. Depending upon how the price action is leading up to it and around it will determine and communicate what is the best entry, but the pullback is one solid option you can use for now.

In my forex price action course. I actually discuss how to quantitatively break down a pin bar as we have tested over 10yrs worth of data on pin bars over 15 pairs, totaling over 100,000+ pin bars. From this information, we were able to come up with a very precise definition of a pinbar, along with giving you exact entry parameters for each type of pin bar, and how to find optimal targets.

One methodology suggested has been to find a 2:1 reward to risk target, or next key support/resistance level. But testing has shown this not to be an optimal method for trading this, as many times price can way under/overshoot the target, either leaving you stopped out before your target, or missing out on a lot of potential profits.

In terms of time frames for trading pinbars, they really can be traded on all time frames from the 1min, to the weekly chart. However, testing has shown them to be a lot less accurate on anything lower than a 1hr time frame, so we suggest using them on the 1hr, 4hr and daily time frames.

It is not that they cannot be used on the lower time frames, but in isolation, they will be a lot less effective, so you will need to add additional optimizers and parameters to enhance the strength of them. Also consider on the 1hr, 4hr and daily time frames, more traders will be watching them, and thus get into the trade likely strengthening the reversal.

Along those lines, think about it this way. If price action forms a pin bar on a 5min chart, we are talking about a rejection that lasted 5mins. Think of how many orders or transactions occurred during that time.

Now compare that to 1hr of price rejecting, 4hrs of price rejecting (half a trading session), or a daily pin bar showing price had rejected for an entire day across three different sessions with three different sets of investors all weighing in saying this price rejection was a significant one. If you consider that, then it makes more sense the 1hr, 4hr and daily ones will have greater strength to them.

Thus as we can see, the pin bar formation is a strong price action pattern communicating a rejection of sorts in finding tops and bottoms, telling us a counter-trend move is likely to begin. Obviously this is an over-simplification of it, but we can see how it works and understand it from an order flow perspective.

There are many other variables and types of pin bars, which will enhance or weaken the pin bar, such as body size, close-type, prior price action, was it a trap, was it hitting off key levels, etc. but this should give you a good introduction on what a pin bar is, what it means from an order flow perspective, how it works from an order flow perspective, and one way you can trade it.

There are various other methods to use this so should you want to learn more about then, then feel free to check out my Price Action Course whereby I teach quantitative methods for trading pin bars and discuss live setups all the time.

Other Related Articles: