Pay Off Mortgage Sooner Invest Or Save The Math Analysis

Post on: 16 Март, 2015 No Comment

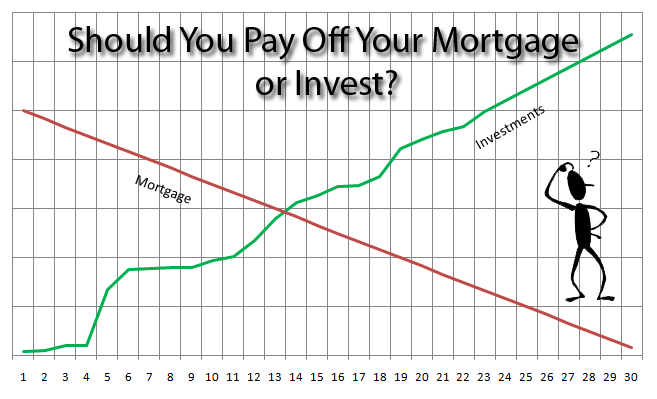

I’ve previously written about this topic – should you pay off the mortgage early or invest – but I realize that post was sorely lacking the math. Today, I want to take a deeper look at the discussion to give a more thorough answer to the question – should you pay off the mortgage or invest? Watch out! I’m about to unleash the geek inside and let him run some math with the calculator.

This post is the first in a series that deals with home ownership questions. The series will cover the following topics:

Pay Off Mortgage Or Invest – Points To Ponder

I was recently talking with someone who wants a home loan. He likes where the average home mortgage rates are and he thinks you’d be crazy not to have one. At the time of this article, the national average for a 30 year fixed rate is 5.13 and for a 15 year it is 4.38 – wow those are some great rates!

However, we should keep in mind that over the last 10 years, the Wilshire 5000 index has basically been flat. In other words, if the next 10 years are just like the last 10 years, you could have paid around 5% to invest the money and get 0% return.

Canada Vs. United States

Your country of residence also influences this decision. In the United States, interest paid on a mortgage is tax deductible, while in Canada you do not get this deduction. If you are a Canadian, your numbers and calculations will need to reflect the proper Canadian taxation. It is better to pay off your balance in Canada than in the States.

Occupation

Ministers are eligible to receive lodging from the church free of income tax. In addition, ministers can receive a tax deduction for interest payments. This means that if you are a minister, your full house payments are tax deductible (along with the cost to maintain a home – called a housing allowance). While the IRS does allow a minister to deduct fair rental value of the home, there does seem to be some discussion on how ministers are impacted if they pay off the home early. Consult your local tax professional for guidance.

Personal preference, personal comfort, and personal security

A home is not just a place where the heart is, but it is also the place you feel most safe and secure. When you completely own your home, you reduce the possibility that someone will come and take it from you.

The “I-just-feel-better-having-the-house-paid-off” feeling is certainly worth something.

What if we change the formula – pay off the mortgage or spend it?

For most people, it is extremely hard to continue to be financially focused when they are already doing very well. Compared to national averages, anyone who only owes on the house is in a good financial position. Thus, the question is if you had an extra $150 per month, would you really invest it or would you blow it? Sometimes we have great intentions, but we don’t follow through on our intention to invest the money.

Your debt definition

Some people think that if they pay off everything but the house they are debt free. Dave Ramsey set that standard. However, you are still in debt, all be it a good debt on the account of many. Some people want to be REALLY debt free, and if that is your personal goal, you will be better off paying off the mortgage and then get to your investing.

Mortgage Interest Rates

If you have any other debts, there is a good chance that your mortgage interest rate is the lowest. With the exception of student loans, you are probably not going to get a lower interest rate for borrowed money. In addition, those who have borrowed on the house make the assumption that their property will increase in value. This may or may not be true.

Upon purchasing a new home, it is smart to use a mortgage loan calculator to make sure your new investment is within your budget.

It your mortgage a fixed rate or variable? What is the length of your term?

Guaranteed return vs. possible return

Paying off the mortgage guarantees that you will save yourself the interest. Investing the money means you are assuming the investment will make a larger return than your borrowed money. Anyone who has been alive more than three years knows the investment market can be quite volatile.

Inflation

When the dollar becomes less valuable in terms of the value of your payments, they actually decrease over time. If, like many think we are, we are on the verge of seeing a time of inflation, then you will be getting more of tomorrow’s dollars, but will still be required to pay the same dollar amount in the future. In other words, there is not inflation increase on mortgages (assuming it is a fixed rate).

Asset allocation and risk

There is really only one way to increase your investing return potential. Increase your risk. When you say pay off the mortgage or invest, you need to compare paying it off to different levels of investing risk. The more conservative you are, the less likely you are to make any sort of significant gains over and above your mortgage. However, the more risk you take, the more likely you are to do much better or much worse.

Thus, you need to find a way to take enough risk to make the investment worth it, but not to take too much risk to be in a worse financial position.