Parabolic SAR_2

Post on: 31 Май, 2015 No Comment

Parabolic SAR

Developed by Welles Wilder, creator of RSI and DMI, the Parabolic SAR sets trailing price stops for long or short positions. Also referred to as the stop-and-reversal indicator (SAR stands for stop and reversal), Parabolic SAR is more popular for setting stops than for establishing direction or trend.

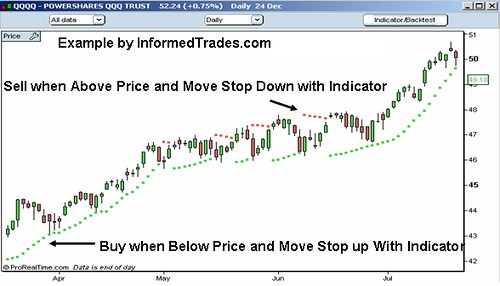

Wilder recommended establishing the trend first, and then trading with Parabolic SAR in the direction of the trend. If the trend is up, buy when the indicator moves below the price. If the trend is down, sell when the indicator moves above the price.

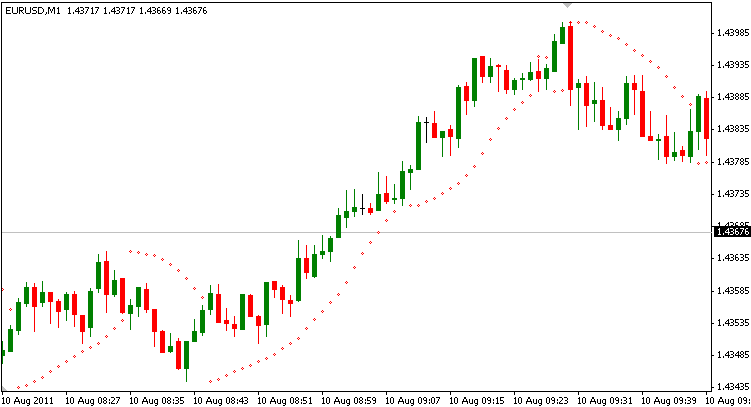

The formula is quite complex and beyond the scope of this definition, but interpretation is relatively straightforward. The dotted lines below the price establish the trailing stop for a long position and the lines above establish the trailing stop for a short position. At the beginning of the move, the Parabolic SAR will provide a greater cushion between the price and the trailing stop. As the move gets underway, the distance between the price and the indicator will shrink, thus making for a tighter stop-loss as the price moves in a favorable direction.

There are two variables: the step and the maximum step. The higher the step is set, the more sensitive the indicator will be to price changes. If the step is set too high, the indicator will fluctuate above and below the price too often, making interpretation difficult. The maximum step controls the adjustment of the SAR as the price moves. The lower the maximum step is set, the further the trailing stop will be from the price. Wilder recommends setting the step at .02 and the maximum step at .20.

The chart for Microsoft (MSFT) shows how the Parabolic SAR can catch most trends and allow the trader to profit from the buy/sell signals. The default settings that Wilder recommends diminishes distracting fluctuations, but does not make the indicator immune to whipsaws (black arrow). A proper interpretation of this indicator would suggest that a trader should close long positions when the price falls below the SAR (red arrow) and close short positions when the price rises above the SAR (green arrow).

The Parabolic SAR works best during strong trending periods, which Wilder himself estimates occur roughly 30% of the time. Therefore, the user may first want to determine if the market is trending by using other indicators such as Wilder’s ADX line.

How to trade with Parabolic SAR indicator

However, trading with Parabolic SAR is not that simple; not all Parabolic SAR reversal signals can be traded profitably.

Let’s turn to advice given by the developer of Parabolic SAR indicator — J. Welles Wilder. He suggests using Parabolic SAR, first of all, for trailing stops and finding the best exits.

The way Forex traders use Parabolic SAR is by simply setting a Stop loss order at the level of the most recent SAR dot appearing on the chart. Stop is then trailed along with each new Sar dot till trend remains intact. Once Parabolic SAR indicator changes its position — SAR dots appear on the opposite side of the price — the trade is closed.

Welles Wilder doesn’t recommend using Parabolic SAR as a stand alone indicator. The main reason for that is: Parabolic SAR can easily create whip-saws (false signals) during periods of market consolidation. The Parabolic SAR works best during strong trending periods, which Wilder himself estimates occur roughly 30% of the time. Thus Forex traders will need other Forex indicators to identify those strong trending periods.

For himself, Welles Wilder developed ADX indicator — another trend indicator — which tells what kind of trend is dominant and how strong the trend is. Upon knowing the trend and its health Forex traders can pick appropriate signals from Parabolic SAR and disregard the rest.

How do you determine the trend if you don’t want to use ADX. Try 50 EMA. Price readings above it would suggest an uptrend, below — downtrend.

Parabolic SAR settings

So, Parabolic SAR is developed to keep stop loss level moving adjusting to new prices and thus locking profits on its way.

The formula of Parabolic SAR includes an acceleration factor, which allows to react to market changes fast as the trend starts to accelerate. At the beginning, new Parabolic SAR dots are placed close together and then accelerate as the trend advances.

Parabolic SAR has two variables: a step and max step. Settings recommended by W.Wilder are: a step of 0.02 and the max step of 0.2.

The step sets sensitivity of Parabolic SAR indicator. If the Step is too high, Parabolic SAR becomes more sensitive and will flip back and forth more often, with lower step Parabolic SAR will become smoother. Maximum step sets a cushion between price and Parabolic SAR. The higher the max step the closer the trailing stop will be to the price.

Parabolic SAR — useful tips:

Tip 1:

When space between Parabolic SAR dots increases significantly, it indicates that acceleration formula for SAR is already working. Thus, if you have missed out on an entry, it might be better to avoid late entries at all and rather wait for an opportunity to re-enter the trade with a help of, for example, Stochastic indicator.

Tip 2:

Parabolic SAR is only a mathematical interpretation of the price. Even though it helps to identify initial place for a Stop, it may not be the final or best one sometimes. Forex traders who also look at support/resistance levels, round numbers, trend line etc may find even better place for Stops to be set.