OptionsXpress IRA Review 2015 ROTH

Post on: 15 Июнь, 2015 No Comment

OptionsXpress Roth IRA Fees, Traditional IRA, Rollover IRA, SEP IRA, SIMPLE IRA (individual retirement accounts) review, promotion offer, rating, fees and commissions. Is OptionsXpress IRA good and safe way to invest?

OptionsXpress IRA Commissions

- Stocks and ETFs: $8.95

- Options: $14.95 for up to 10 contracts, $1.50 per contract for over 10 contracts

- Options Active Traders: $12.95 for up to 10 contracts, $1.25/contract for over 10 contracts

- Mutual funds: $9.95

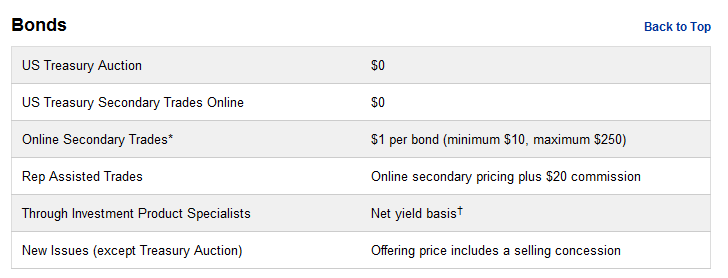

- Bonds: $5 per bond, $9.95 minimum

- Spreads, Straddles & Combos: $14.95 for up to 10 contracts, $1.50 per contract for over 10 contracts

OptionsXpress IRA Account Types Offered

- Individual Retirement Accounts:

- Traditional IRA

- Rollover IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- Minor:

- Custodial

- Coverdell (educational IRA)

- Minor Roth

- MinorTraditional

OptionsXpress ROTH/Traditional/IRA Rollover/SEP/401(k) IRA Accounts Fees

- IRA setup fee: $0

- Annual IRA fee: $0

- IRA termination fee: $50

- Outbound Full Account Transfer: $60

- Outbound Partial Account Transfer: $60

OptionsXpress IRA Review

There are many online brokerages available where to invest your hard-earned savings. Each offers unique features. It is prudent to research the company before committing your money — you don’t want to get short changed on your online broker. There are several features to be aware of, including fees, market access, account limits, research amenities and trading tools. Rarely do you find everything you need in one place. That is especially important today, since savvy investors can use options, bonds, forex and commodities to generate income and to lower the risk.

One of the online brokerages that offers an impressive suite of trading and research tools is OptionsXpress. The firm was one of the top rated discount brokers in the industry, and big brokerage houses took a notice. In 2011 OptionsXpress was bought by Charles Shcwab, and it is now a part of one of the largest online investing firms in the U.S.

OptionsXpress is a public broker and anyone legally able can open an account. Trade levels, what you are allowed to trade, are set based on individual risk tolerance and the type of account you are trading. Multiple forms of accounts are available including business, personal and IRA. A standard cash account would have a rating of 3 which would enable stock, bond and option trading including long positions and covered calls. OptionsXpress, unlike so many others, allows options trading in retirement accounts. This means that you can enhance your retirement savings returns using covered calls and other cash producing options strategies. Commissions are not the cheapest in the industry but fair when compared to what you get, usually $12.95 up to 10 contracts; active traders, businesses and institutions can get discounted pricing. Any portion of funds in your account not invested is swept into a money market which adds a small amount of interest to your bottom line.

OptionsXpress charges $8.95 flat commission for stock and ETF trades, and $9.95 for mutual fund transactions. The firm does not have IRA fees, aside from $50 IRA termination fee. There are also no account inactivity and maintenance fees.

OptionsXpress offers a wide range of IRA account types, with very good selection of retirement accounts for minors. OptionsXpress is not cheap if investing in equities, but with only $10 for mutual fund purchase/sale transactions, it’s one of the cheapest online brokers for investing in mutual funds!

OptionsXpress provides its customers with amazing selection of free services: DRIPs (dividend reinvestment), paper trading (trading with virtual money), broker-assisted trades, online classes, streaming quotes and access to professional trading platform.

Any IRA, mutual fund or trading account can be transferred to OptionsXpress for free. Their customer support network is top notch and is available for assistance anytime through phone calls, emails or live chat.

The Good

- Best customer service

- Excellent trading tools

- No hidden fees

- Great research

- Free real-time streaming quotes

- Free virtual trading

- $0 to open cash account

- Free broker-assisted trading

- DRIPs

The Bad

- High commissions on stocks and ETFs

Conclusion

It is without a doubt that OptionsXpress is a platform for savvy traders, but it is not just for the savvy. While its members are investing in the market, OptionsXpress is investing in its members through support and educational services. The website comes with a full education center and includes a demo trading account with no cash or trading limits. The education center also has articles on all types of trading and is supported by a forum, free webinars, trading workshops and even a mentoring program. The mentoring is a ten week program, at extra charge, where members are guided by seasoned professionals through the process of analyzing and choosing trades.

The bottom line is that OptionsXpress is one of, if not the, best platform for trading options on the market. And the best thing is it’s free. This isn’t some dashboard, trade station or downloadable platform that you have to purchase, this is an on-line broker providing full service trading tools as an added feature to its clients. They are not in the business of selling you services, they are in the business of providing you services. The basic service, brokering trades, is by far the least of what OX has to offer. All you have to do to gain access to all of these services is to open an account, you only have to fund it if you want to trade or invest real money.