OptionsHouse vs TradeKin TradeKing vs OptionsHouse IRA Fees Cost

Post on: 15 Июнь, 2015 No Comment

OptionsHouse vs TradeKing 2015: Account Pricing, Commissions, Fees

OptionsHouse

- Stocks and ETFs: $4.95

- Options: $4.95 + $0.65 per contract

- Short options valued at 5 cents or less, can be bought to close these positions for no charge (commission free)

- Mutual funds: $9.95

- Bonds: $1 per bond with $10 minimum, $250 maximum

- Treasuries: commission-free

- Certificates of Deposit (CDs): $24.95

- Investments: stocks, options, mutual funds, bonds, CDs, forex, treasuries, ETFs

- TradeKing minimum deposit to open account: $0 for cash account, $2,000 for margin account

- All TradeKing fees

OptionsHouse

- Additional $0.01 per share on the entire order for stocks priced at less than $2

- $50 annual inactivity fee if BOTH apply to an account(s):

- Combined account value of the household account(s) is less than $2,500

- No commission-charged trades have been executed in the account(s) during the last 12 months

- For stocks priced $2 or less that are not options eligible, add $0.005 per share for the entire order

OptionsHouse vs TradeKing: Comparison Summary

Optionshouse (Optionshouse Review ) and TradeKing (TradeKing Review ) are identically priced companies for stock and ETF trades: $4.95 per trade. Mutual fund transactions, however, are $9.95 at TradeKing and $20 at Optionshouse. While Optionshouse does not offer NTF (no-transaction fee or commission-free) mutual funds, TradeKing provides NTF load funds to its customers.

TradeKing charges additional $0.01 per share on stocks priced under $2.00. Optionshouse adds $0.005 per share more on stocks priced under $2.00 that are not options eligible. Both firms do not have additional commission on large orders and extended hours trading.

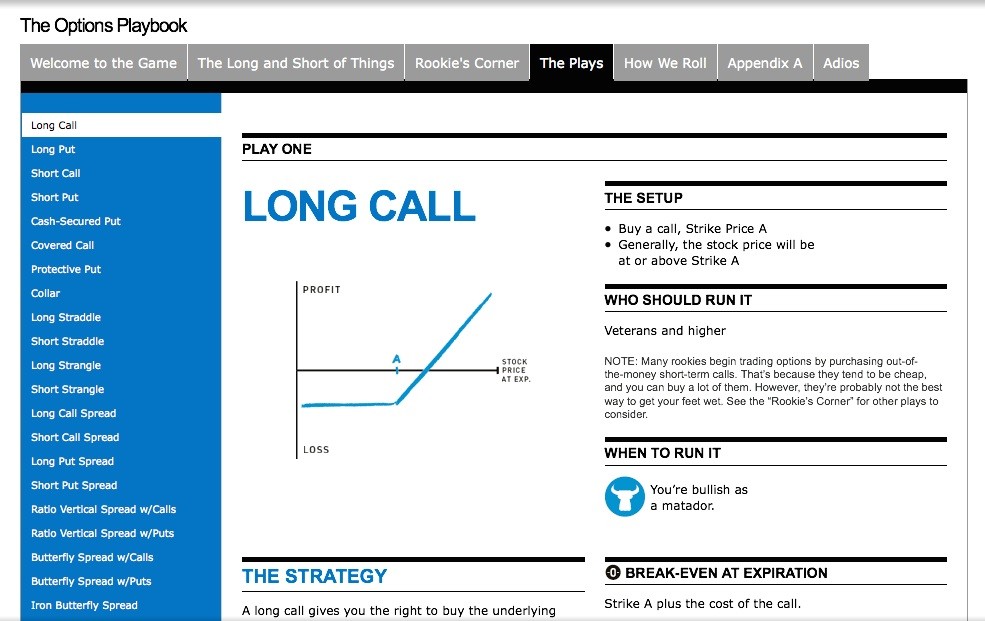

OptionsHouse and TradeKing offer fantastic pricing on options trades. In fact, thanks to low pricing and great suit of options trading tools, these are some of the most popular companies among options traders, and we included them in our list of the Top Brokers for Options Trading.

TradeKing is one of the Best brokers for beginner investors. it offers lots of learning materials, and helpful online investor community for clients to learn from each other and share investing ideas. Customers could also call a broker and place a trade with his/her help without a surcharge at both firms. For the four years in a row Smart Money magazine rated TradeKing’s customer service #1 in the industry.

TradeKing and OptionsHouse do not charge IRA setup and IRA maintenance fees (also called annual or custodial fees). Coupled with low mutual funds investing costs as well as free DRIPs (dividend reinvestment plans) on both stocks and mutual funds, it makes TradeKing a great choice for Traditional IRA, ROTH IRA, and self-employed IRA accounts.

Both of these companies are excellent, but TradeKing is rated higher by both us and all financial magazines. The firm works especially well for customers new to investing, as well as anyone looking for an IRA account, or wanting to take advantage of the online investor community.

OptionsHouse is our recommendation for options traders — there is a suit of great options tools and better options trading costs.

You can also open accounts with both firms in about 20 minutes with no obligation (non-IRA accounts don’t have account closing fee), and take advantage of their unique and valuable features free of charge.

TradeKing Promotion — refer a friend