OptionsHouse Review 5 Pros Cons Of OptionsHouse

Post on: 15 Июнь, 2015 No Comment

Today in our online broker review series, youll learn about a haven for option buffs: OptionsHouse .

Lets get into it.

According to Barron’s. OptionsHouse is one of, if not the best brokerage out there for options traders. Clearly, they have built up a solid reputation for themselves since the company was founded by PEAK6 in 2005. Their mobile trading platform is currently rated the best in the industry (rated 4.5 stars by Barron’s), and the low fee and commission structure is nearly unrivaled by their close competitors. OptionsHouse has some shortcomings, but in regards to cost—just $4.95 per trade—its tough to beat. Read on to determine whether OptionsHouse is right for you.

Brief Overview

Best For: On-the-go traders who can take advantage of OptionsHouse’s extensive mobile platform, traders who want access to very in-depth option analysis tools, or traders who prefer cost savings over a wide variety of investment options (you wont get access to foreign investments or futures with OptionsHouse).

Mobile Platforms: Browser, Apple, Android, Kindle Fire.

Investment Offerings: stocks, mutual funds, options.

Newsworthy Mentions: “Best for Options Traders” in the 2013 Barron’s Review of Online Brokers, “#1 for Options Trading” by StockBrokers.com.

Minimum Deposit to Open an Account: $1,000 (or $2,000 if you want to open a margin account).

Trading Tools

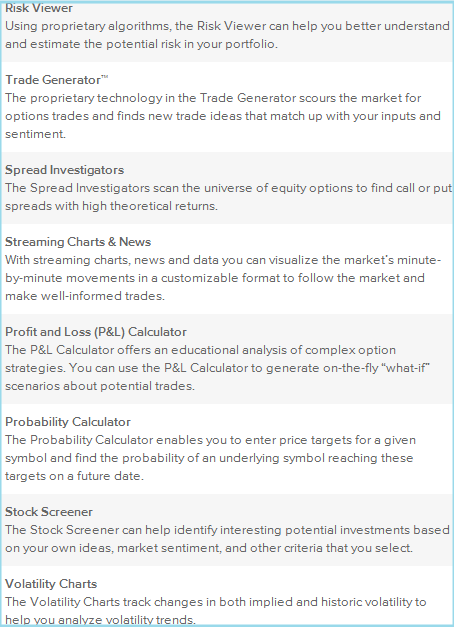

In addition to their collection of helpful webinars that benefit newer traders, OptionsHouse has several advanced trading tools at your disposal:

Risk Viewer — This tool helps you assess the risk factor in your portfolio. The Risk Viewer utilizes proprietary algorithms to determine risk and present information on profit/loss analyses and market risk (based on potential market fluctuations).

Stock Screener — For a truly personalized portfolio, OptionsHouse’s Stock Screener tool is perfect for investors searching for company stocks based on their own preferences. Information such as industry, market capitalization, price to earnings ratio (P/E), percentage change over a specific period, volume, etc. can be used to determine the right investments for your portfolio.

Spread Investigator — This tool scans all equity options to find call or put spreads with the highest possible returns.

Streaming Charts & News - The extensive chart analysis provided free-of-charge to OptionsHouse customers not only helps you stay up-to-date with current market movements, but it is also customizable to suit your unique market-watching needs.

Calculators — OptionsHouse has two main calculators: profit/loss (P&L) and probability. The P&L Calculator creates a graph based on hypothetical information you provide—stock, days until expiration, volatility changes, interest rates—and helps you analyze potential trading scenarios based on the outcomes. Their Probability Calculator allows you to enter price targets for a given stock and determine whether the target would be met in the future.

Pricing Structure

OptionsHouse commissions fall among the lowest in the industry:

Stocks: $4.95

Options: $5.00 for 5 contracts + $1.00 for each contract thereafter OR $8.50 base fee + $0.15 per contract (Note: for traders who are very active in the options side of the investment industry, you likely won’t be able to find prices as low as $8.50 + $0.15 elsewhere—this is a major advantage to choosing OptionsHouse)

Mutual Funds: $9.95 + load

Margin Rates: Base + 3.75% — Base + 1.25%

OptionsHouse also has an interesting comparison tool (to see how much other discount brokerages charge for varying numbers of contracts), which is available here .

Opening an Account

It’s worth mentioning again that for futures, forex, and foreign investment traders, OptionsHouse is not worth your while due to their limited service offerings. There are also other brokerages that dont require a minimum deposit to open an account, whereas OptionsHouse requires a minimum $1,000 upfront.

Drawbacks aside, OptionsHouse does offer basic accounts, such as individual/joint investment, no-fee IRAs, and a virtual trading account (for traders who want to explore OptionsHouse’s trading tools prior to investing real money).

Customer Service

Services Offered: email, phone, live chat.

OptionsHouse would do well to offer 24/7 customer support, but in the meantime, their customer service hours are Monday through Friday, from 7am to 7pm (Central Time).