Oil Price Collapse and Reaction Efforts

Post on: 16 Март, 2015 No Comment

World crude oil prices have declined by over 20% since June 2014 and prices could decline to much lower levels by year’s end. This may be good news, short term, for U.S. consumers. But the declining price of oil, if it continues longer term, jeopardizes both manufacturers of “green” energy technologies, such as xEV’s, and producers of domestic unconventional oil, two groups whose interests have not always aligned.

There are many explanations for why oil prices are falling. Slowing economies in Europe and Asia, discord within the OPEC Cartel, and growing U.S. domestic crude production (coming in large part from unconventional reserves) are all contributing factors. But it has also been suggested that certain large foreign oil producers may intentionally be manipulating prices in order to squeeze out competition to conventional crude oil and preserve their share in the petroleum market. A similar drop in oil prices in the 1980’s effectively shut down U.S. investment in alternative fuels and stalled efforts to improve automotive fuel economy for the better part of two decades.

Fool me once; shame on you. Fool me twice; shame on me. The oil price declines of the 1980’s and resulting loss of investment in alternative fuels left the U.S. woefully unprepared for the energy price spike of 2008, let alone for dealing with the long-term consequences of foreign oil dependence and GHG emissions. We must not repeat this historic mistake.

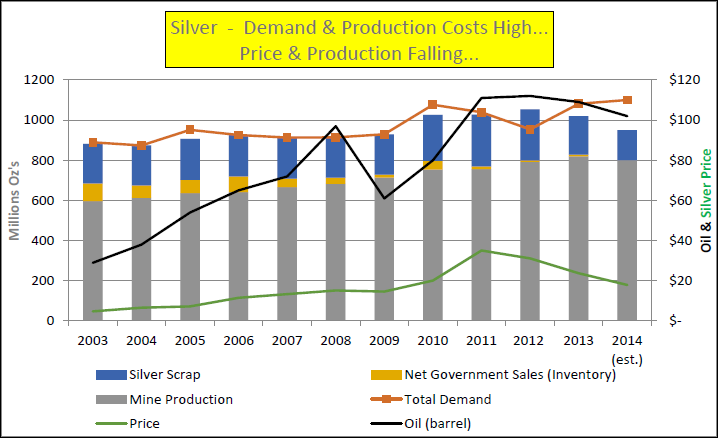

To the extent that falling oil prices are a consequence of market manipulation, the target of that manipulation is more likely producers of unconventional oil than promoters of green technologies. Unconventional oil, which accounts for about 70% of total crude oil reserves, poses a real threat to the market share of traditional oil producers. But the cost of producing a barrel of unconventional crude oil is generally substantially greater than producing a barrel of conventional petroleum. According to the International Energy Agency, production costs for oil produced through enhanced oil recovery (EOR) techniques (such as fracking) run from about $40 to $85 per barrel vs. production costs from conventional reserves, which run from about $10 to $30 per barrel. If the price of oil can be held low enough long enough, investment in EOR technology could be shut down just as effectively as was investment in alternative fuels in the 1980’s.

Companies with interests in “green” energy technologies and unconventional crude oil production therefore share a common interest and probably a common fate. Both sets of companies have a strong interest in ensuring that the dumping of conventional crude oil in the international market does not shut down investment in technologies that hold the promise of making the United States more energy secure and efficient.

It will be interesting to see if and how this new coincidence of interests between domestic producers of unconventional crude oil and manufacturers of “green” energy technologies plays out. Wouldn’t it be remarkable if the impetus for finally taking action to reflect the true, societal cost of imported oil in its price came, not from “green” energy technology advocates, but from within the oil industry itself?