Musings on Markets Earnings surprises price reaction and value

Post on: 16 Март, 2015 No Comment

Earnings surprises, price reaction and value

The earnings season is upon us and each companys earnings announcement is eagerly awaited, traded upon and talked about. For widely followed companies like Apple, the obsession with what the next earnings report will deliver overwhelms any sensible assessment of what it means for the company. But is this obsession merited? Do earnings announcements have significant effects on value? If so, why? More importantly, can you make money off earnings announcements?

The Announcement Process

To understand how and why earnings reports matter, we should start by looking at the process. Publicly traded companies are required to report on their performance at regular intervals. In the US, the reports have to come every quarter, with full financial statements filed with the SEC. The degree of disclosure varies across markets, both on timing (quarterly, semi-annual and annual) and on information (partial reports of performance in some regimes).

The reporting ritual is highly scripted, at least in the US, in terms of timing (companies report earnings on about the same date every year, give or take weekends, and in the same format to allow for year to year comparisons). The initial report provides the bare bone details (revenue growth, earnings per share and a breakdown of a few extraordinary items) and is followed a few weeks later by the full filing of the quarterly report (10Q) with the SEC.

Since earnings reports contain information that can affect prices, the SEC does regulate trading and disclosure around the reports. Insiders are restricted from trading before earnings announcements and Regulation FD bars firms from providing information about upcoming earnings reports to subsets of investors (analysts). In theory, at least, the information in an earnings report should be news to markets.

Companies may be restricted from providing information selectively to analysts following them, but this does not prevent analysts from forming and propagating their expectations about what the earnings report will contain to their clients and, by extension, the public. In fact, a substantial portion of a typical equity research analysts time is spent on the earnings forecasting exercise, and there are services that assess analyst quality by looking at how close the forecast comes to actual numbers. In the US, services such as Zacks and I/B/E/S that track and report analyst forecasts of earnings and you can find them in the public domain (Yahoo! Finance or similar sites)

The Expectation Game

When a company does report its earnings, markets will react to the news in the report but the way we measure the news has to be relative to expectations. Thus, a company that reports that its earnings went up by 30% may be seen as delivering bad news, if investors were expecting an increase of 40%, and a firm that announces an earnings decline of 30% may be providing positive information, if the expectation was that earnings would decline by 40%. Thus, it is not the magnitude of the earnings change that matter but the surprise in the earnings, measured as the earnings change relative to expectations.

But how do you measure expectations? One obvious answer is to use the analyst estimates of the earnings and news reports like this one generally compare the earnings change to the consensus estimate of earnings change to frame the report. A second is to use the past earnings growth for the company as a measure of expected earnings growth. With either measure, then, a positive (negative) earnings surprise then becomes an earnings report where the actual earnings per share exceeds (falls below) the expected value (using consensus earnings estimates or historical earnings growth).

While you can use analysts or history as the basis for estimating expected earnings, the market expectations process is a more nuanced one and more difficult to model. In the last two decades, firms have become more attuned to playing the earnings game, and have become increasingly adept at beating earnings expectations by playing both sides of the game. First, they work on analyst expectations, using selective leaks to bring expectations down, prior to earnings reports. Second, they work to mold the actual earnings, using both accounting choices (earnings management) and operating discretion (timing of R&D expenses, for instance) to deliver results that beat expectations. The problem with this game is that markets catch on and adjust expectations accordingly.

The Announcement Effect

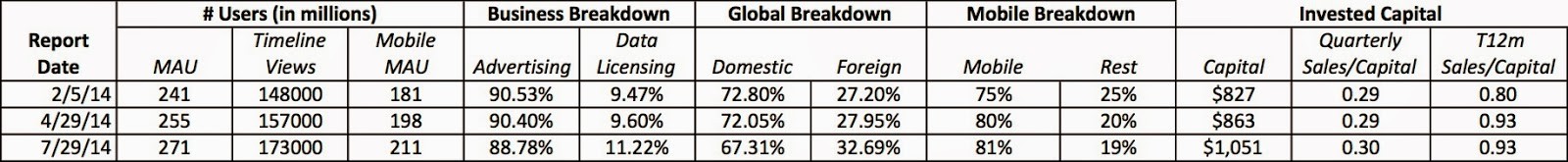

If you can measure earnings expectations, an earnings surprise should have an effect on stock prices, with positive (negative) surprises evoking positive (negative) responses. The earliest studies of earnings surprises used historical earnings to estimate expected earnings and found backing for this hypothesis. In more recent studies, consensus estimates of earnings have been used to measure expected earnings. The following graph captures the announcement effect of earnings surprises, categorized from most positive to most negative, with expectations measured as consensus estimate from analysts:

There are three interesting findings embedded in this graph.