Moving Averages in Forex Tradin MTF strategy

Post on: 24 Июнь, 2015 No Comment

The Moving Averages (MAs) in Forex trading is the most simple, yet effective trading strategy. And if you will use it on Multi Time Frame (MTF), you will always have the highest probability setup.

But what is a Moving Average?

The Moving Average is a trend pointing indicator. because is based on the past prices. Considering a certain period of time for the MA, means that after each close, the MA position and value, will change. This is the reason why the MA is considered a lagging indicator (repainting).

Simple Moving Average (SMA) vs. Exponential Moving Average (EMA)

There are many Moving Averages types, but these two, are the most popular ones:

1. The Simple Moving Average (SMA). represent the mathematical average price of a certain historical period of time. Usually this is applied to the close prices, but there are many other options (open, high, low, etc).

2. The Exponential Moving Average (EMA) formula reduce a bit the lag, by giving more weight to the recent prices. Specially if you are using a big value for your EMA. I.e 200 EMA on Daily recent Daily prices are giving more weight in the Moving Average formula, than the oldest prices.

Since, the prices on a chart are painted from left to right, we basically have 2 potential directions and 1 for the range market:

1. 1-2 oclock = bullish trend

2. 3 oclock = range or a flat MA

In trading we count of the highest probability setups. Nobody cant predict the next prices value. But if you will consider the Higher Time Frame (HTF) direction and place your entry on the Lower Time Frame (LTF), in the same direction, you will have more mathematical chances to be right. Why? Because like any lagging indicator, the MA, will lag less on the HTF.

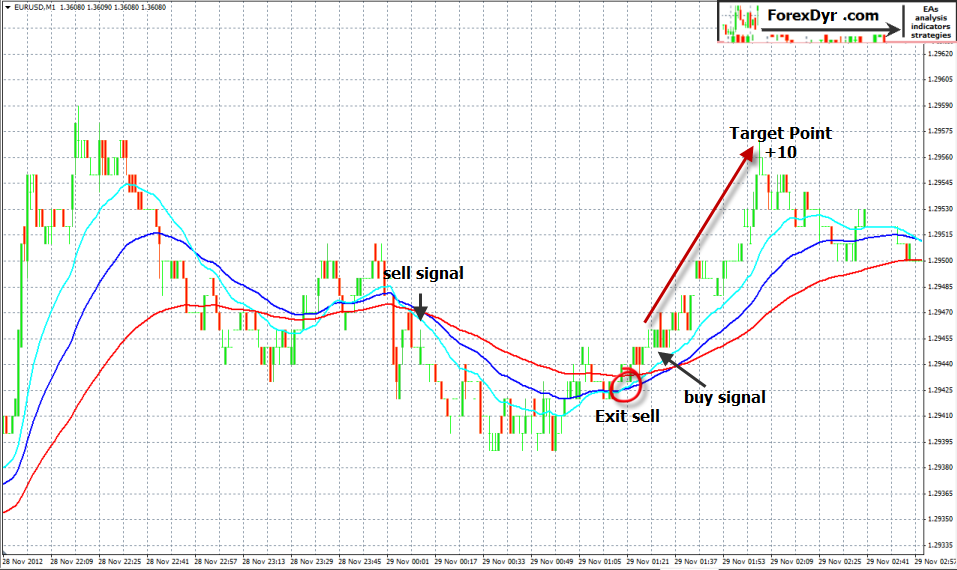

How to place trades using the EMA?

Well, depends on which type of trade you are. Most of the traders prefer to trade the Breakouts (BO), so they place Buy/Sell Stop Pending Orders. While others wait for the Support/Resistance (S/R) retest, so they place Limit Pending Orders. By placing trades like this, the Stop Loss (SL) is usually at the next S/R level. Or just below Support for long trades (or above Resistance for short trades).

I personally use the Fibonacci Retracement 50% and/or 61.8% levels, for placing my Pending Orders, in the direction the the BO. And I use as Stop Loss (SL), the 100% level. Of course, by measuring the swing that confirmed the EMAs BO.

For the Take Profit level (TP), most of the traders use the opposite signal on the entry TF (PA crossing back the 200 EMA), or the next S/R level. But this doesnt give you a min 1:3 as R:R Ratio. Using the HTFs 200 EMA crosing/retest might do the job.

I use the fibonacci retracement added on the last counter trend. So my TP can be @ 127.4%, 161.8% and/or 261.8%, looking for a min 1:3 as my R:R ratio (Risk/Reward Ratio). If my TP is not at least 3xSL, I lower my entry TF to H1 and trade the next swing, there. In this way I will have a smoother entry, with a smaller SL, while keeping my HTFs TP. So my smaller TF entry will be an attempt. And I can afford to lose many entries like this to equalize the H4s SL. This will give me later on, a R:R usually more than 1:5 or 1:8 or higher.

If you are a Position Trader, you can use in this way, the HTFs counter trend fibonacci retracement. But for this idea, I recommend you to shift your initial SL at least one time, in profit (to lock your profit). And then, you can let your profitable position to run, until the HTFs TP is triggered.

How to avoid false Breakouts?

Every time a tool is broken, that initial high/low must be broken too, in order to confirm the Breakout (BO). Otherwise, we have to consider that initial BO a false BO at the MAs retest. And that high/low will later become a Ross Hook (Rh) or Fractal. Which based on these theories, must be broken too, in order to consider the change of the trend.

On HTFs the MAs retest with a false BO, wont usually change the MA pointing. On LTFs, the MAs BO might be confirmed initially, by creating a new high/low, which later on might be invalidated. And after that, the Price Action (PA), might continue the HTFs direction. Even if the LTFs BO will be confirmed, initially.

Case studies. Setup examples for EMA on MTF.

Just to understand this simple, yet effective trading strategy based on the Exponential Moving Averages on Multi Time Frame, I will give you few setups (scenarios):

This is the AUDJPY pair, on the Weekly, Daily and the H4 charts. Based on the 200 EMA pointing bullish, on all 3 charts, we will take long positions, only.

Weekly = long

Daily = long (even at 200 EMA retest, the EMA was still pointing bullish)

H4 = long (even at 200 EMA retest, with a false Breakout, the EMA was still pointing bullish)

This is the AUDUSD pair, on the Weekly, Daily and the H4 charts. On the Weekly chart, we have the Price Action (PA), under the 200 EMA, so the long term trend is still bearish. But on the H4 and Daily charts, the PA is above the 200 EMA. So we can either, wait, on the H4, for the PA to go below the 200 EMA (bucking the Weekly trend) and trade short. In this case, after crossing, the 200 EMA have to point us bearish, on the H4, too.

Or we can wait for the Weekly chart to confirm the same long direction, later on. We went above the 200 EMA on H4, then on the Daily. So we can assume, the PA will go above the 200 EMA on the Weekly, as well.

Weekly = short

Daily = long (even at 200 EMA retest, the EMA was still pointing bullish)

H4 = long

This is the EURUSD pair, on the Weekly, Daily and the H4 charts. Based on the 200 EMA pointing bullish, on all 3 charts, we will take long positions, only. If on the H4 the PA will go below the 200 EMA, we will stop trading this pair. If later on, the PA will go below the 200 EMA on the Daily, too, we will wait on the H4 for the PA to run below 200 EMA, as well, in order to take short positions, expecting at least a Weekly 200 EMA retest (what we see on the H4, should be seen on the Daily, later on and after that, on the Weekly, too).

Weekly = long

Daily = long (after having a flat 200 EMA, the PA broken it and created a new high = bucking the Weekly trend)

H4 = long (even at 200 EMA retest, with a false Breakout of the Support, the EMA was still pointing bullish)

The Moving Averages trading on Multi Time Frame, can be a very profitable strategy, because you will always trade the highest probability setups, in the direction of the Higher Time Frames. By using it with a good Money Management system and a R:R Ratio of at least 1:3, you should always be on the profitable side.

And of course, as a disclaimer, I recommend you to test this strategy on a DEMO account, for few months in a row, just to see if this is working for you. However, if you decide later on, to use this idea on your real money account, you should understand that all the risk involved it will be yours.