Moving average to interpret trading signals explained with example

Post on: 16 Март, 2015 No Comment

What is Moving Average? It is the average price of a stock over a period of time.

Why are Moving Averages Used? Moving average helps us to understand the trends of the market. It also gives us buy or sell signal. Moving averages are commonly used to predict areas of support and resistance. The price movement is also smoothed out so that the traders can better understand the trends.

What are different kinds of Moving averages ?

a) Kinds of Moving averages are:

b) Simple Moving Average(SMA)

c) Exponential Moving Average(EMA)

d) Weighted Moving Average(WMA)

e) Cumulative Moving Average(CMA)

Though there are dozens of moving averages but the most common moving averages used by technical analysts is simple moving average and exponential moving average. Therefore we will limit the scope of this tutorial to simple moving average and exponential moving average.

Interpreting buy and sell signal using moving averages. Moving average provides buy or sell signal. A trader can choose whether to buy or sell depending on the crossover of moving average and the current price lines on a chart.

Long term investor looks for long term moving average and short term trader looks for short term moving average. A buy signal is generated when the security’s price rises above its moving average and a sell signal is generated when the security’s price falls below its moving average.

What are commonly used moving averages period?

Their are many moving averages right from short moving average to high moving average but most common of them are 15 days, 50 days, 100 days and 200 days.

How to choose a Moving Average period ?

There is no magical Moving average period. Use of any moving average period will provide similar result. For example both 60 day moving average and 70 day moving average will provide similar results but will give buy/sell signal at slightly different time. The key is to stick to one MA otherwise your trade can get messed up. One of the common way to choose a MA is to divide the period of interest by 2(two).

For Example, A trader looking at a stock movement for 40 days then he will choose 20 day moving average is suitable. If you are looking at a stock movement for 20 days then a 10 day moving average is suitable and so on. Generally it is preferable to stick to 15, 50, 100 and 200 days moving averages as they are used by lots of big investors and market reaction to these averages is more likely.

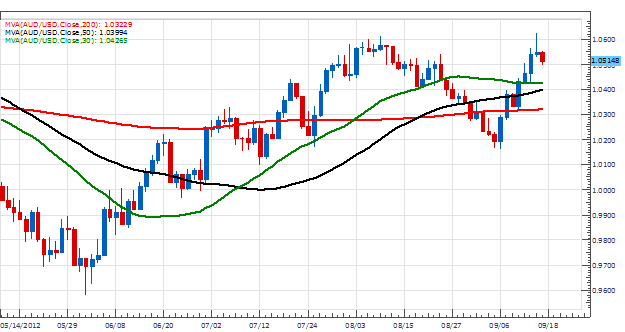

a) Red line represents 15 day Moving Average. b) Blue line represents 50 day Moving Average.

c) Green line represents 100 day Moving Average. d) Yellow line represents 200 day Moving Average.

Example Showing Price verses Different Moving Averages: SAIL

Disadvantages of Moving Average

Although they are highly simple to use and plot in our system.But like everything, Moving Average do have certain drawbacks to deal with.Some of the disadvantages of Moving Averages are:

- Moving averages lags the current price since they are the data from the past.

- It’s ineffective in sideways market.

- Since it’s slow it misses turning points and trends.

Due to above shortcoming analysts have designed more complicated yet effective way to deal with price and moving average.One of them is Exponential Moving Average.

Exponential Moving Average: Another kind of moving average is exponential moving average (EMA). There are certain advantages of EMA like it considers the the importance on the most recent stock prices than the earlier stock prices.