Moving Average Convergence Divergence (MACD) in Forex Trading

Post on: 3 Май, 2015 No Comment

- 14 September, 2009 GMT

The Moving average convergence divergence (MACD) indicator was created by Gerald Appel in 1960. MACD is a momentum indicator and considered a valuable tool for any forex trader. MACD essentially indicates the correlation between the prices of two different moving averages of say two different forex contracts. It therefore shows the relationship between moving averages of two different prices.

MACD is calculated by subtracting the 26 day exponential moving average (EMA) from the 12 day exponential moving average (EMA). In addition, a 9 day exponential moving average is referred to as the signal line. The most commonly used EMAs for the MACD indicator are 12, 26 and 9 (suggesting the number of days for which the moving average is calculated). MACD can be applied to daily, weekly or monthly forex charts.

The following are the three ways to interpret MACD:

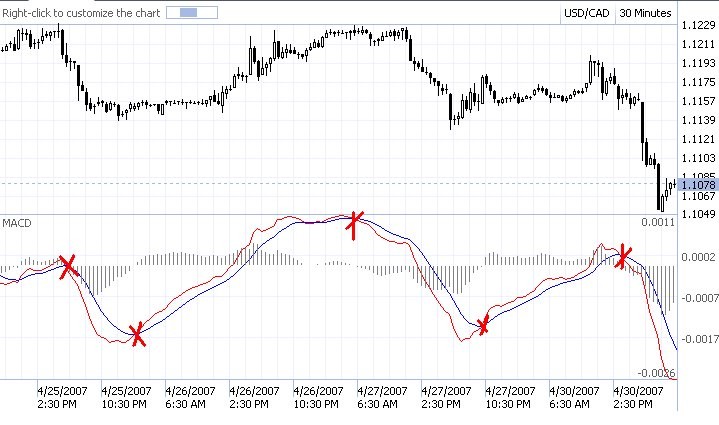

Crossovers

When the MACD falls below the signal line, it represents a bearish signal for a forex contract. It gives an indication for traders to sell the currency pair or short it, as the case may be. On the other hand, if the MACD moves above the signal line (breaking it from below), then the market is supposed to be in an upward movement, representing a bullish trend as a result of which, many traders may either long a currency or hold position(s).

Centre Line Crossover

This is another way to interpret MACD. When the MACD crosses over the central or zero line and moves from negative to positive, it suggests a sell signal for forex traders. On the other hand, when the MACD moves from positive to negative, it suggests a buying signal.

Divergence

When the price of a currency pair deviates from the MACD, we can interpret it as the end of the current trend. Such a thing mainly occurs when the price of a share moves in one direction and MACD in another direction.

Overbought/Oversold Conditions

When the shorter term EMA moves above the longer term EMA, it suggests that the specific currency in question is in an overbought state- this implies that traders are likely to short the currency or square off their holdings.

MACD Benefits

- One of the main benefits of this indicator is that it can be used both as a trend and as a momentum indicator.