Money Management_1

Post on: 29 Апрель, 2015 No Comment

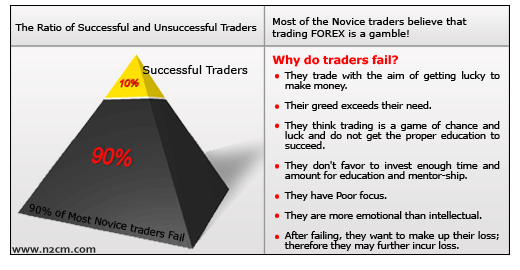

Money Management (hereinafter MM) is the most important factor separating the seasoned traders from the amateurs and the most important ingredient to successful Forex trading. If you fail to fully understand the implications of MM as well as how to actually implement MM techniques, your risk of loss while trading on Forex market is going to increase considerably.

Below, we will take a closer look on two major questions in MM and explain them one by one.

1) What is the optimal volume of the trade to be used in first and following transactions?

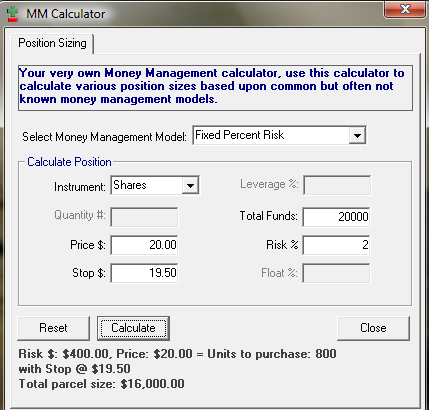

The first of the two most important subjects in MM is choosing appropriate size of the trading account risk level or in other words, a percentage of an account balance which the trader is willing to lose. Choosing risk level depends on traders risk tolerance. It is customarily believed that essentially, for a beginner on Forex market, the appropriate risk level should not exceed 2% of the trading account balance on any given trade. For example, given a deposit of $2,000 on a trading account, a risk of loss should be limited to $40. Risking with 5% is generally considered an aggressive approach and the uppermost limit of prudent money management. Looking at it in perspective, placing orders takes mere seconds, and therefore, 10 consecutive trades resulting in loss would draw down the account by 50%, leaving $1000 out of initial $2000.

Surely, the best thing to do is to never risk more money than you are OK with losing.

Make sure you understand position sizing

Choosing the volume of each trade directly affects the amount of resulting loss or profit, hence, limiting trade volume to a certain percentage protects you from losses exceeding your subjective risk tolerance level.

How to calculate the volume of position?

For example, GBPUSD 1 standard lot (that is, a trade unit used in trading platform) equals to 100 000 units of base currency and minimum fluctuation in the price is 0.0001 point (pip) which equals $10. Please click here for more information on trading conditions specific to each instrument. In a nutshell, the trader may adjust a lot size since it directly influences pip value — for example on a $2,000 account risking with $40 (2% of balance), the possible loss could be up to 4 points on a standard lot of GBPUSD.

Therefore, it is critical that the trader uses smaller portion lots to properly limit his or her risk in one trade, with regard to chosen trading strategy.

In the Trading examples section you can find more in-depth description of trade size calculations and respective MM approach for each particular trading scenario provided. You could also make use of our Traders Calculator — this way easily adjusting a number of lots per trade to meet your desired amount per pip.

Why is it so important to define proper trade size?

The following example helps underline the significance of trade size: two traders, both opening same positions on the same conditions and start trading with the same amount as initial deposit. The only difference is that Trader #1 risks 70% of his capital in each trade, and Trader #2 risks only 5%.

Take a look at the table below describing 5 of their deals in simplified form: