Medicare Tax on Investments First Look

Post on: 16 Март, 2015 No Comment

June 16, 2010

Taxation of investments will undergo one of its most significant changes ever in 2013, when the Medicare tax is set to begin applying to investment earnings of higher-income individuals. Although this tax is years away, investors and their advisors need to be planning for it now as it will affect strategic decisions they make this year, including Roth conversions and capital gain realizations. Heres a first look at the new tax.

Background on Medicare tax

The Medicare tax currently applies at the rate of 2.9% to wages and net earnings from self-employment. Employers shoulder half the burden of this tax on wages of their employees; self-employed individuals get to pay the full amount. Unlike social security tax, which applies only up to a limitation known as the wage base (currently $106,800), the Medicare tax applies to an unlimited amount of income within these categories. It has not previously applied to income other than wages and net earnings from self-employment.

Boosting the rate on wages

Beginning in 2013, individuals will pay an additional 0.9% in Medicare tax on wages (or net earnings from self-employment) above $200,000 on a single return, $250,000 on a joint return, or $125,000 if married filing separately. Above those levels, therefore, the overall rate of tax will be 3.8%. In the case of employees, this added tax falls only on the employee, even though the employer continues to pay half the base rate of 2.9%.

Applying the tax to investment income

Heres the kicker: the new law will also impose a 3.8% Medicare tax on investment income to the extent adjusted gross income (modified to add back excluded foreign income) exceeds the levels just mentioned. Here are some examples of how this would affect different individuals.

- Youre single, with $170,000 of investment income and no other income. You wont pay the new Medicare tax on investments because your overall income doesnt exceed the $200,000 threshold for single taxpayers.

- Youre single, with $170,000 of investment income and $180,000 of other income. Now your income is $150,000 above the threshold, so youll pay this tax on $150,000 of your investment income.

- Youre married filing jointly with $200,000 of investment income and $280,000 of other income. Your overall income is $230,000 above the $250,000 threshold for married couples, so youll pay this tax on all your $200,000 of investment income.

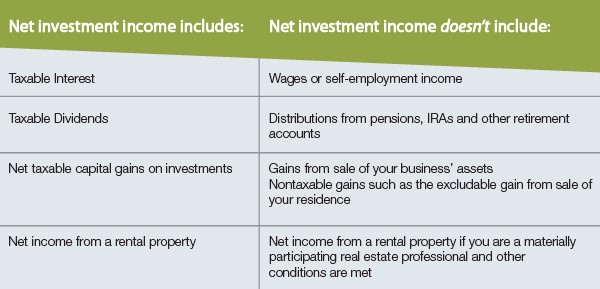

Categories of investment income

Heres a look at how different categories of investment income will fare under this new tax.

Taxable interest. Taxable interest, currently subject to income tax at rates up to 35%, is likely to be taxed at rates up to 39.6% beginning 2011 when the Bush tax cuts expire. Beginning in 2013, the Medicare tax would take another 3.8%, for a maximum rate of 43.4%.

Capital gains. The top rate on long-term capital gains is currently 15%. This rate is scheduled to revert to 20% in 2011. (It is possible the 15% rate will be retained for taxpayers with income below the levels mentioned earlier.) With the added Medicare tax beginning in 2013, the overall hit would be 23.8%.

Dividends. Qualifying dividends are currently taxed at the same rates that apply to long-term capital gains. Without action by Congress this favorable treatment expires as of the end of 2010, causing the top rate on dividends to leap all the way from 15% now to 39.6% next year and 43.4% two years later. Our crystal ball is cloudy as to whether Congress will step in to prevent this result.

Annuities. The taxable portion of an annuity payout is currently taxed at rates up to 35%. The top rate would change as indicated above for interest income: 39.6% in 2011, and 43.4% when the new Medicare tax applies beginning in 2013. Income from annuities that are provided as part of a qualified retirement plan isnt treated as investment income for this purpose, though, so it escapes the added 3.8% tax.

Retirement plans. Income from pensions, 401k plans, IRAs and other qualified retirement plans is excluded from the definition of investment income for purposes of this tax. As we saw earlier, however, an increase in your other income can cause you to pay this tax on investment income that would otherwise fall below the threshold amount that applies for your filing status.

In later articles well see how an expectation of paying this tax beginning in 2013 might affect decisions you make this year about strategies such as Roth conversions and capital gains realization.

See more news and features in these categories:

Or with these tags: feature

Sign up for our FREE NEWSLETTER