Measure Volatility With Average True Range_1

Post on: 9 Июнь, 2015 No Comment

Volatility

Important: This page is part of archived content and may be outdated.

Volatility (variability) is a basic measure for risks associated with a financial market’s instrument. It represents an accidental constituent of an asset’s price fluctuation and is accounted as a range of the price alteration (difference between maximum and minimum prices) within trading session, trading day, month etc. Usually the wider range of fluctuations (higher volatility) means higher trading risks involved.

In this manner volatility is esteemed as a random value and its mathematical modeling provides basis for all risk assessment methods, used on Foreign Exchange market. For volatility measurement statistical standard deviation is calculated. It also determines exposure of financial investments. In intraday trading the most significant volatility indicator is average daily price range; in longer positions evaluation an average weekly, monthly or annual range may be used. Annual volatility is most common in long-term financial investments’ analysis.

There are two types of Volatility

Historical volatility equals to standard deviation of an asset values within specified timeframe, calculated from the historical prices.

Expected volatility is calculated from the current prices on the assumption that market price of an asset reflects expected risks.

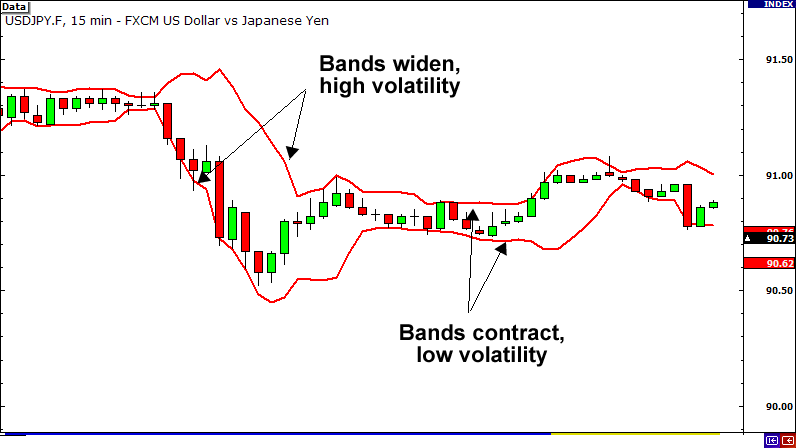

Volatility is regarded by Forex traders as one of the most important informational indicators for decisions on opening or closure of currency positions. It could be appraised through following financial indicators: Bollinger Bands, Commodity Channel Index, Average True Range. All of them are integrated in popular trading platforms. Additional important index is RVI (Relative Volatility Index). It reflects direction in which price volatility changes. RVI’s main characteristic is that it confirms Forex oscillators’ signals (RSI, MAСD, Stochastik and others) without duplicating them. Since Relative Volatility Index is determined by the dynamics of market data, which is not covered by other indices, it may serve as an excellent verification tool. It is RVI, used as a filter for independent indicators, which may define strength of a trend, measuring up the volatility instead of price, and this brings missing authentication element to trading system.

Forex traders traditionally chose currency pairs for their investments on the ground of classical risk/return analysis. Moreover both return and risk are assessed in each separate moment or, in the best case, for certain discrete time series. In reality actual price quotations change constantly at different pace: sometimes quickly, sometimes slowly. That’s why among all other market characteristics a lot of attention should be paid to volatility as a quantitative measure of past, current and future price range of a currency pair. Ultimately it gives possibility of estimating not only potential return on investments but also risks exposure. Special emphasis on volatility analysis should be made for futures and option market. Volatility value is critically important for call and put option assessment. It could be said that if on spot market traders are more concerned with return then on futures market they think further about volatility and risks.

When traders say that market is highly volatile this means that currency quotations change drastically during a trading session. High volatility of the market stands for higher risks for investors but generate more opportunities of high profits. Many novice traders tried to enter highly volatile market looking for bigger profits and quickly suffer serious losses. It’s better to start and test one’s trading strategies on calm market when weekly spot-rate fluctuations do not exceed 2-3% from previous week closing price. Experienced investors may like to utilize a volatile market opportunities up to direct volatility arbitrage.

Analytical information on currency pairs volatility is open to public and easy accessible. In most cases it is provided either by Forex brokers or through their trading platforms. Numerous statistical researches have spotted empirical rule that market volatility in terms of standard deviation is proportional to square root of observation period. But volatility is different on different market segments and may increase significantly faster than according to above mentioned rule.