Marketing ROI Formula Return on Investment Calculator

Post on: 16 Март, 2015 No Comment

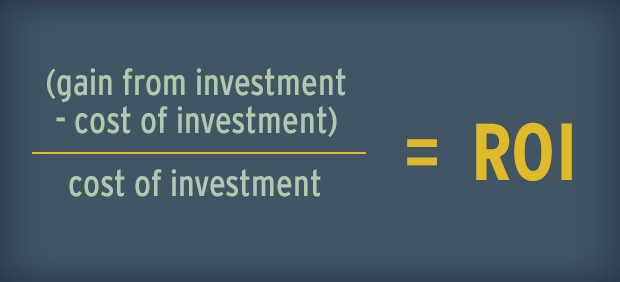

Return on investment (ROI) is a measure of the profit earned from each investment. Like the “return” (or profit) that you earn on your portfolio or bank account, it’s calculated as a percentage. In simple terms, the ROI formula is:

(Return – Investment)

Investment

Its typically expressed as a percentage, so multiple your result by 100.

ROI calculations for marketing campaigns can be complex you may have many variables on both the profit side and the investment (cost) side. But understanding the formula is essential if you need to produce the best possible results with your marketing investments.

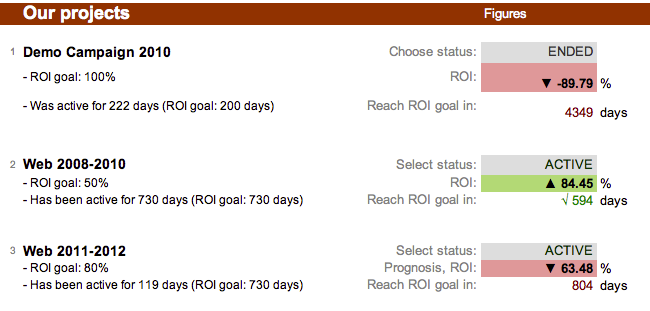

For step-by-step guidance on calculating ROI for a marketing campaign, check out our demo:

For marketing ROI. the tricky part is determining what constitutes your return, and what is your true investment. For example, different marketers might consider the following for return:

- Total revenue generated for a campaign (or gross receipts or turnover, depending on your organization type and location, which is simply the top line sales generated from the campaign)

- Gross profit. or a gross profit estimate, which is revenue minus the cost of goods to produce/deliver a product or service. Many marketers simply use the companys COG percentage (say 30%) and deduct it from the total revenue

- Net profit. which is gross profit minus expenses

On the investment side, its easy for marketers to input the media costs as the investment. But what other costs should you include? To execute your campaign, you might have:

- Creative costs

- Printing costs

- Technical costs (such as email platforms, website coding, etc)

- Management time

- Cost of sales

Marketing ROI Formula

One basic formula uses the gross profit for units sold in the campaign and the marketing investment for the campaign:

Gross Profit – Marketing Investment

Marketing Investment

You can also use the Customer Lifetime Value (CLV) instead of Gross Profit. CLV is a measure of the profit generated by a single customer or set of customers over their lifetime with your company.

Customer Lifetime Value – Marketing Investment

Marketing Investment

However, some companies deduct other expenses and use a formula like this:

Profit – Marketing Investment – *Overhead Allocation – *Incremental Expenses

Marketing Investment

*These expenses are typically tracked in Sales and General Expenses in overhead, but some companies deduct them in ROI calculations to provide a closer estimate of the true profit their marketing campaigns are generating for the company.

The components for calculating marketing ROI can be different for each organization, but with solid ROI calculations, you can focus on campaigns that deliver the greatest return. For example, if one campaign generates a 15% ROI and the other 50%, where will you invest your marketing budget next time? And if your entire marketing budget only returns 6% and the stock market returns 12%, your company can earn more profit by investing in the stock market.

Finally, ROI helps you justify marketing investments. In tough times, companies often slash their marketing budgets – a dangerous move since marketing is an investment to produce revenue. By focusing on ROI, you can help your company move away from the idea that marketing is a fluffy expense that can be cut when times get tough.

Best Case

Neutral Case

Worst Case

You measure and track the ROI of all of your marketing investments.

Your campaigns deliver the highest possible return and you’re able to improve them over time.

Your organization understands and agrees with the choices you make because there’s solid data to support your investments.