Market Timing V and Hold Which Is Better

Post on: 16 Март, 2015 No Comment

Does Market Timing Pay Off?

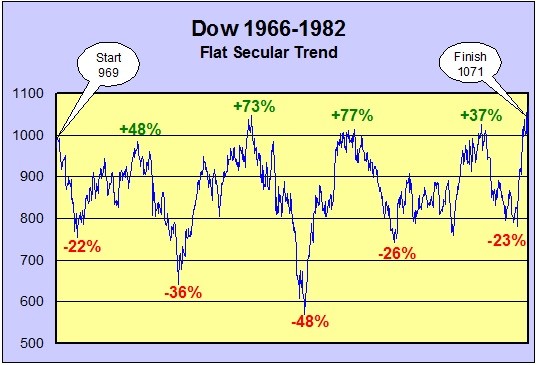

Let’s assume you’ve set out to defy the plethora of academic research out there that concludes that market timing is ultimately ineffective in generating superior returns compared to a traditional buy-and-hold approach over the long-haul.

Before you place your next limit order, consider the following chart, which showcases the cumulative returns of the five best days in every year. In other words, the blue horizontal bars represent the percent return you would have earned if you had been fully invested only during the five best days that year (let’s assume the power of hindsight for this example).

Consider that the S&P 500′s average annual return is 9.10% over the last decade. In the 63-year sample above, the “best five days” strategy outperforms the market’s average annual return in 42 instances. Put another way, the 10 best single session performances for the Dow Jones Industrial Average have added almost 10,000 points to the benchmark. If you’d missed those days, your investing experience would be quite a bit different than a buy-and-hold strategy.

Another important takeaway from the above chart is that the bulk of the S&P 500′s gains in a particular year are often generated over the course of just a few trading days. This notion in turn raises the question, are investors better off trying to time the market versus buying-and-holding the entire year?

When Timing the Market Goes Wrong

If you have conviction on what the five best trading days are going to be every year, then you are most certainly better off timing the market and not wasting opportunities by sitting in an index fund the rest of the year. However, if you’re like most people and without a crystal ball (or time machine), then the chances of you getting burned in an effort to time the market are dangerously high; if you make one wrong move and miss just one or two of the best days in a particular year, your return may turn up flat or even negative that year depending on your luck with timing the other sessions.

The point here is that missing even just one of the five best days in a given year can rob you of meaningful returns, which again emphasizes the risks associated with moving in and out of the market rather than maintaining some degree of exposure at all times.

Now consider the same market timing strategy, but with a bearish perspective. The chart below showcases the cumulative returns of the five worst trading days every year:

Similar to the “five best days,” the above chart showcases the notion that during down years, the bulk of the losses are accumulated in just a few trading sessions.

The Bottom Line

The topic of “market timing” has enticed and inspired academics and professional traders for years; at the center of this conversation lies the age-old debate between pursuing active management or a buy-and-hold strategy. For some seasoned professionals, successful market timing may not be as elusive as many academics might contest. But for most investors, market timing is a costly endeavor that is likely to produce unsatisfactory results that ultimately pale in comparison to those generated by a simple buy-and-hold strategy over a long-term horizon.