Market Sentiment and the COT (Commitment of Traders) Report

Post on: 22 Апрель, 2015 No Comment

Every trader will have their own explanation on why the market is moving a certain way. Traders express this view when they make their day trading strategies. But sometimes, no matter how convinced a trader is that the markets will move in a particular direction, and no matter how pretty all the trend lines line up, the trader may still end up losing.

A trader must realize that the overall market is a combination of all the views, ideas and opinions of all the participants in the market. This combined feeling that market participants have is what we call market sentiment.It is the dominant emotion or idea that the majority of the market feels is the best explanation for why the market is moving in a particular direction.

How to Develop a Sentiment-Based Approach

As a trader your job is to determine what the market is feeling. Are the indicators pointing towards bullish conditions? Are traders bearish on the economy? We can’t tell the market what we think it should do. But what we can do is react in response to what is happening in the markets.

Note that using the market sentiment approach doesn’t give a precise entry and exit for each trade. But even without this kind of information a sentiment-based approach can still help you decide whether you should go with what others think is the direction of the market or not. Of course, a better option for any trader is to use both market sentiment analysis with technical and fundamental analysis to come up with better forex trading strategies .

In stocks and options, traders can look at volume traded as an indicator of sentiment. If a stock price has been rising, but volume is declining, it could be a signal that the market is overbought. On the other hand, if a declining stock suddenly reversed on high volume, it means the market sentiment may have changed from bearish to bullish.

Unfortunately, since the foreign exchange market is traded over-the-counter, it doesn’t have a centralized market. This means that the volume of each currency traded cannot be easily measured.

Commitment of Traders Report

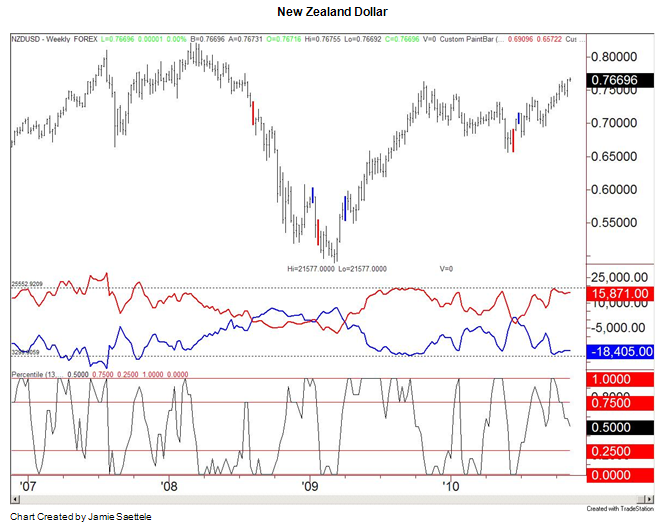

One good way to help determine market sentiment is to use the Commitment of Traders (COT) report.

The Commodity Futures Trading Commission, or CFTC, publishes the Commitment of Traders report every Friday, around 2:30 pm EST.

Because the COT measures the net long and short positions taken by speculative traders and commercial traders, it is a great resource to gauge how heavily these market players are positioned in the market.

Remember, since spot FX is traded over-the-counter, transactions do not pass through a centralized exchange like the Chicago Mercantile Exchange.

How to Access the COT Report

2. Scroll down to the “Current Legacy Report” and click on “Short Format” under “Futures Only” on the “Chicago Mercantile Exchange” row to access the most recent COT report.

3. what you’ll see may be intimidating (it’s a whole bunch of text) but with a little bit of patience, you can find exactly what you’re looking for. Just press CTRL+F (or whatever the find function is of your browser) and type in the currency you want to find.

To find the British Pound Sterling, or GBP, for example, just search up “Pound Sterling” and you’ll be taken directly to a section that looks like this –

Here’s a breakdown of each category:

Commercial: These are the big businesses that use currency futures to hedge and protect themselves from too much exchange rate fluctuation.

Non-Commercial: This is a mixture of individual traders, hedge funds, and financial institutions. For the most part, these are traders who looking to trade for speculative gains. These are the traders that are like you.

Long: The number of long contracts reported to the CFTC.

Short: The number of short contracts reported to the CFTC.

Open interest: This column represents the number of contracts out there that have not been exercised or delivered.

Number of traders: This is the total number of traders who are required to report positions to the CFTC.

Reportable positions: the number of options and futures positions that are required to be reported according to CFTC regulations.

Non-reportable positions: open interest positions of traders that do not meet the reportable requirements of the CFTC like retail traders.