Major Forex currency pairs that are most traded and best to trade

Post on: 19 Апрель, 2015 No Comment

Major currency pairs

AUDUSD currency pair is composed of the Australian dollar (AUD) and the American dollar (USD), and is rated among major currency pairs. This financial tool is characterized by high liquidity and considerable exchange volume. Australia is considered to be one of the worlds biggest suppliers of gold (AU). Gold is exported in the unprocessed state, and the gold export represents quite a significant part of the countrys GDP, thats why Australian dollar is often called a commodity currency.

Gold is a good means of protecting funds against inflation for many traders, and quotes of the Australian dollar are quite similar to the movements of gold, although not absolutely identical. Investing in Australian dollar can be a good solution for diversifying risks when trading on the Forex market. Since Australian dollar serves as a base currency in the above mentioned currency pair, the purchase of AUDUSD lot is equivalent to investing in Australian dollar, whereas the selling of this lot corresponds to investing in American dollars.

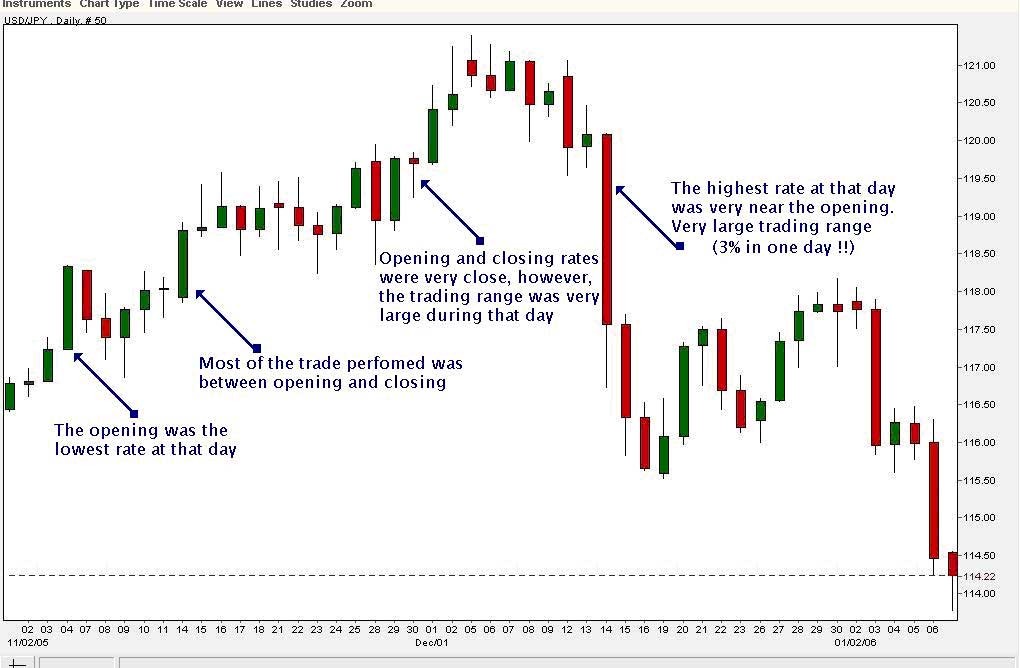

The pair consists of two currencies: US dollar and Japanese Yen and both of them has preconditions for changes in the rates. Primarily, the Yen is under the influence of the Bank of Japan, which actions are mainly aimed at decreasing the price of Yen, since the low rate enables to make Japanese products more competitive in the world markets. Declarations by the US politicians about new restrictions on import of Japanese goods and technology also have a significant role because introduction of restrictions and duties causes sharp decline in the Yen rate.

Meanwhile, the USD rate is affected by several factors: change of lending rate, economic situation in the country, US credit rating and some other events, which you can find in the economic calendar. The currency pair USD/JPY is the one, which is hard-to-predict. At the same time high market volatility allows to gain from several dozen up to a few hundred of points due to just a single market move.

From the moment of its free circulation, the EURUSD lot has become a number one financial tool for most of traders. Considered by many market participants as a real counterbalance to American dollar which could enter a competition as a universal currency, Euro attracted an impressive number of investments.

A large number of countries found it necessary to diversify their currency reserves, by converting huge amounts of funds into Euro.

The result was that Euro formed quite stable trends against American dollar during the first years. These days, the Euro evolution is becoming multidirectional, tending generally to consolidation, but its still popular with traders and accounts for a big percentage in total exchange volume worldwide.

The pound sterling quoted against American dollar represents another attractive investment instrument after EURUSD. This lot can be of interest to traders at least from 2 points of view. First, the pound sterling can be used for arbitrage and hedging, due to its higher volatility. Secondly, investors regard GBPUSD as a kind of indicator anticipating the movements of Euro. Finally, the highest liquidity of GBPUSD makes it applicable not only to position trading, but also to trading within shortest periods of time.

It should be also noted, that a considerable difference between the interest rates of the Bank of England and the Federal Reserve System of the USA makes it possible for traders to consider swaps when trading and to employ the tactics enabling them to profit from both investments and differences in interest rates.

The New Zeeland dollar is ranked among the so called commodity currencies, since the export of raw materials predominates in the GDP structure of New Zeeland. As opposed to Australia, where gold is evidently the main export element, New Zeeland exports various kinds of raw materials, which lets many traders find some correlations between the movements of the NZD and the Commodity Research Bureau Index representing at least 58%, according to many analysts. It provides both another advantage when forecasting the movements of NZDUSD and an opportunity for hedging and making profits through arbitrage operations.

At the same time, NZDUSD is included into the group of major currency pairs, which gives such an advantage in the eyes of investors as the highest liquidity and considerable potential for profit making expressed in the dynamics of this financial tool.

The economics of Canada is considered as one of the worlds most stable economics, and the export of raw materials predominates in the GDP structure. In particular, Canada is one of the worlds main suppliers of gold and has oil reserves eighth in size in the world. Thats why the Canadian dollar is called a commodity currency, and it would be wise to take into account the state of precious metals and oil markets when analyzing the price dynamics of USDCAD.

Another crucial factor for the price formation of Canadas national currency is the policy of the Governing Council of the Bank of Canada concerning the inflation control. The key inflation indicator is the Consumer Price Index whose variations influence the monetary police of the Bank that tries to retain inflation within the limits of 3%. USDCAD is highly liquid and is capable of significant movements, which can bring profits in both short-term and middle-term prospects, when sticking to investment, speculative or arbitrage strategies.

The Swiss franc is regarded as a shelter-currency, since its characterized by low volatility and is quite stable against sharp variations, unlike other financial instruments. The result is that USDCHF is perfectly suitable for position trading, owing to this stability. But, this currency pair doesnt account for large exchange volumes in the Forex market structure (less than 6%, as a rule).

The monetary policy conducted by the Swiss National Bank has a great influence on the dynamics of the national currency. Owing to the general fact, that the notion Swiss bank has become a common noun denoting stability and reliability, and considering that the role of the American dollar is on decrease, the Swiss franc can act as an attractive long-term investment instrument. At the same time, short-term operations with USDCHF can be used for diversifying current risks arising from particularly high market volatility.