MACD Divergence Strategy

Post on: 15 Август, 2015 No Comment

January 22, 2014 By Mayfair Options

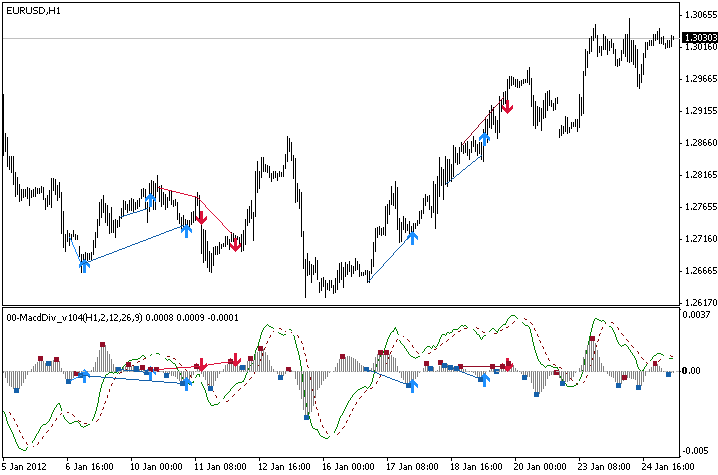

MACD is a popular tool used in many binary options strategies. It can be used with various time frames, and along with any asset. The MACD Divergence strategy uses of one of the conventional divergence alerts offered by the MACD for trading using the 30 minute chart. This strategy makes excellent use of classic MACD signals and for that reason is simple to use.

MACD points out market traction. It measures convergence and divergence for two moving averages. MACD acts as an oscillator and can be displayed in two different ways standard or histogram. Standard is similar to oscillators like stochastic or RSI. It shows you a pair of lines which can move over and under, and also in-between. The histogram portrays convergence and divergence for the lines. Both views offer insight into momentum.

This strategy centers around MACD divergences and tries to capture the quick movements that are part of corrections and reversals. The strategy is based on just one indicator and one signal, a point that not all binary options traders are going to appreciate. Even so, blending MACD divergence with other indicators like Fibonacci or EMA should make it more reliable.

MACD divergence can represent an upcoming market adjustment or rally. Divergence often indicates that momentum is beginning to deteriorate and that a pullback is likely to occur. Divergence can occur within different time frames, and can be bullish or bearish. It also blends well with supplemental techniques and can pair with various assets and price charts. The standard 12-26-9 setting within a Forex chart is recommended, along with periods up to 4 hours.

There are a few drawbacks to consider. For one, signals will not show up on a consistent basis. When they do, they could offer hazy entry points. With single indicators and signals, this comes as no shock. This does not mean that this binary options strategy is useless, but instead that it should be used together with supplemental techniques and tools. Doing so will provide you with much needed extra verification.

Divergence can be complicated and may entice you to accept higher levels of risk. The best plan is to use multiple time frames method and search for convergence of divergence. Another way to optimize this strategy is to boost the number of indicators. Stochastic, Fibonacci, and more can be blended with MACD. Only when a number of indicators show that divergence is likely to yield profit should you enter into a trade.