Long Term Forex Trading Strategy Knowing The Best

Post on: 26 Август, 2015 No Comment

Hey guys, this is Nathan Tucci with some insight on how to trade a long term strategy in the Forex Market.

If you have been following me for any amount of time, you may know that I am a big supporter of longer term trading strategies when it comes to Forex.

There are a lot of reasons why I believe that longer term trading sets you up for success more so than using smaller time frames to trade, and I will get into several of those reasons within this article.

I also lay out a few of those reasons in a more light-hearted tone in my Scalp vs Swing Article which has gotten a lot of attention.

The first thing I want to do is clarify that when I say “Long Term” I am meaning at least looking on the daily charts. I believe that one of the big issues with Forex traders today is that they are so caught up in short-term trading and scalping (which again, I really do have a hard time believing traders can be profitable with), that they dont even recognize what long term trading is.

I have had many traders say something like this to me: “I want to begin looking at long term trading because scalping has not worked for me. I am now using a long term strategy, trading the hourly charts.”

See, I think the above statement is one of the issues with Forex Traders today and why so many have a lot of trouble being profitable.

For some reason, the majority of traders—especially beginners—are so bent on scalping that they dont even have a realistic idea of what long term trading really is (I know my friend, Zaheer . will agree with me on this one).

So again, when I am talking about “Long Term Trading,” I am talking about using the Weekly charts (and even the Monthly) as your guide for set-up potential and targets, and then, perhaps, using a lower time frame to actually execute the trade for more precision.

Before I get into the actual strategy I want to share with you, I want dig a little more into why the right perspective is so important when it comes to trading long term strategies—I know that many of you only care about the actual strategy guidelines, but I believe that the following information about perspective and a holistic approach is actually more important than the strategy guidelines (comment below if you agree/disagree with me on that).

As an example of how this “Short Term Mindset” can get you into trouble, lets take a look at the EUR/USD.

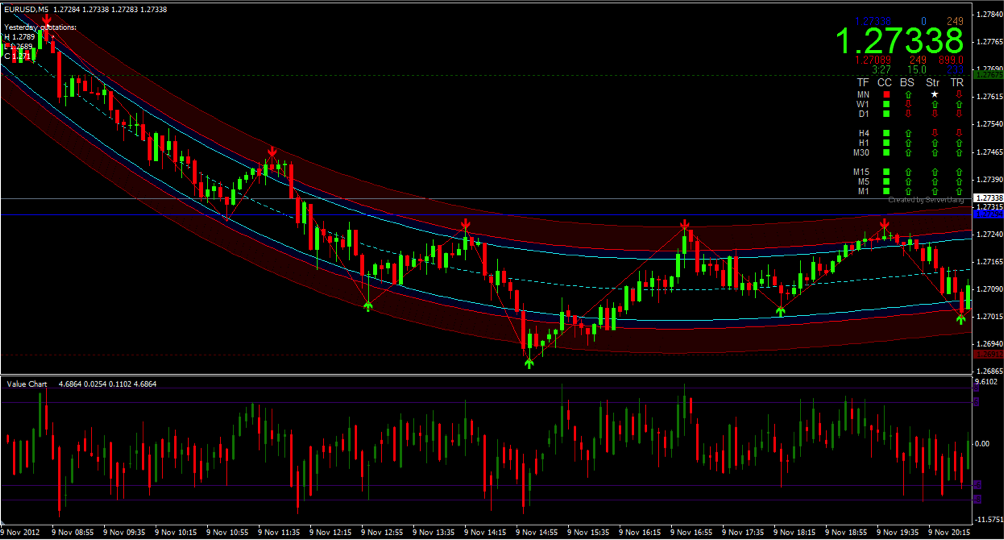

Someone looking at the EUR/USD on a 4HR chart would see something like this:

EUR USD 4 HOUR CHART

In the above chart, you see that there is a lot of bullish momentum moving toward higher highs. From this perspective, it looks as though all bullish continuation set-ups will be great entries; however, a longer term view of the EUR/USD at the same exact time tells a different story:

WEEKLY EUR USD CHART

You can see by looking at the Weekly chart, that the EUR/USD is in a long term down trend, and that the bullish rally on the 4HR chart is just a pull-back rather than a raging trend as it appeared before.

Not only is it only a pullback, but it is a pullback heading into unsuspected resistance (unsuspected if you only look at the 4HR and dont realize what is going on long term).

If we move a little bit ahead in time, you can see a bearish bounce off the resistance level. To the trader viewing only the 4HR chart, this may look like a great time to buy again in anticipation of Bullish trend continuation

buy set up on eur usd

What the 4HR trader may not realize is that this is not a pullback of the 4HR trend, but rather a continuation of the Weekly trend. So, where the long term trader sees obvious Bearish continuation potential, the short term trader thinks this is “just a pullback.”

So to the 4HR trader, this looks like an unexpected major reversal in the market, but to a long term trader, it is an obvious and expected continuation of market flow, looking like this on the Weekly view:

WEEKLY CONTINUATION

This is why it is so important to have a long term view of the market ESPECIALLY if you are going to call yourself a long term trader. Again, so many people looking at 4HR charts think they are long term traders, but they are ignoring the real long term time frames—and that can get you into big trouble just like in this real life example Those two bearish weekly bars you see would crush someone trying to take long positions on the 4 Hour chart, yet they are just part of the flow on the Weekly view.

Now, I am not saying that you cannot trade profitably on the 4HR charts; I am saying that it is very difficult to make consistently profitable trades when you do not have a good perspective of the markets longer term movement—especially when trying to trade an intermediate time frame like the 1 or 4 hour time frames.

With that said, lets talk about my long term strategy for traders who want to be profitable and consistent!

One major note about this strategy is that you must be disciplined if you want to succeed. Yes, you need to be disciplined with all strategies to expect success, but in particular, if you want to trade a long term strategy effectively, you must control your emotions and desire to “get into the market.”

One of the biggest mistakes that unprofitable traders make is over-trading and over-managing their trades. As human beings, we have the desire for action and involvement which tends to cause us to always want to have a trade open or always want to manipulate the trades we do have open, and I can promise you that this will only lead to less and less profitability.

If you want to be successful using the long term strategy that I am presenting to you, you must accept that there will not be a ton of entries (which is a good thing, in my opinion) and that there will not be a need to “jump in” to the open trade and manage it.

Here is how the strategy works:

1 T ake a look at the Monthly and Weekly charts.

Looks for trends on these longer term charts that have good momentum in the respected direction. Something like this:

WEEKLY CHART OF TREND

Identify the direction of the trend (bear or bull) and make a note to only look for entries in the direction of that trend (for instance, if it is a bullish trend, look for buys).

2 Zoom into the Daily Chart and draw a Fibonacci Retracement from the current high to current low (or the other way around).

Here is how to draw a Fib Level for those that dont know:

3 Look for pullbacks on the Daily time frame that are approaching the 38.2, 50.0, or 61.8 Fib Levels.

usd cad daily forex chart

If price is getting close to one of those 3 key fib levels, be prepared to make an entry.

4 Look for Candlestick Entry after Fib Level is Tested (touched by Price)

As soon as price touches a weekly Fib level, you are now in the “waiting for signal” mode. In other words, the criteria has lined up for you to make a trade, now all you need is the signal to confirm your forecast.