Long Term Forex Trading Strategies

Post on: 19 Июль, 2015 No Comment

Forex trading strategies usually vary from trader to trader, with most traders customizing their strategies to their own particular trading style and personality. While many novice traders tend to prefer trading in the short term since it gives instant gratification and can reduce overnight risk, long term forex traders usually consist of more experienced and seasoned traders.

Long term traders also generally approach their forex trading more as a form of investment than trading or speculation, and this is especially true of carry traders. Long term trading styles also tend to be more trend oriented, and so they may require larger amounts of capital to hold margined positions that go against the trader, depending on how well they have timed their entry into the market.

Trend Trading

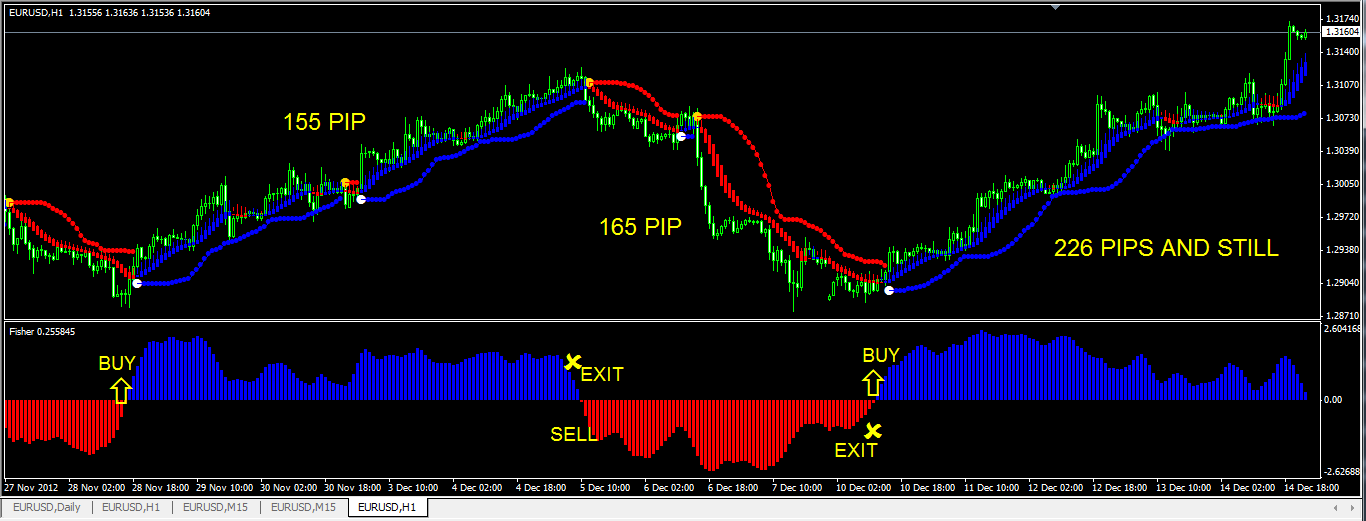

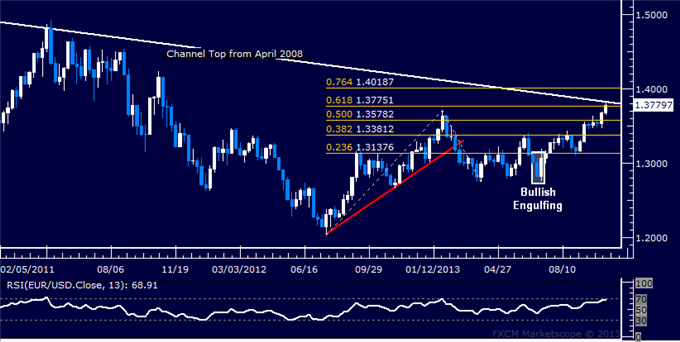

Trend trading is by far the most potentially profitable forex trading technique, when correctly executed. A trend trader will usually start by identifying the major market trend. They will then wait for optimum market entry conditions, such as a correction, before initiating a position in the direction of the trend.

While this may sound relatively simple, most inexperienced forex traders cannot distance themselves sufficiently from the market to establish and maintain a long term position. Also, many inexperienced traders lack the funds needed to weather adverse market conditions sufficiently to stay in the market while following a trend.

Some long term trend traders establish their positions in several parts, getting in on a certain percentage of the desired position first and then averaging the position over time. This allows them to scale into their positions gradually at different stages of the overall market move. Furthermore, some long term trend traders will wait for a corrective move against the direction of the trend before taking on a significant trading position or adding to one.

Many long term forex trend traders prefer to trade well established trends in the major cross rates, rather than in currency pairs involving the U.S. Dollar since liquidity and dealing spreads are less significant to their trend trading style than substantial directional movements based on interest rate differentials.

The Carry Trade

Another popular long term trading strategy that is often implemented by major financial institutions, hedge funds and large individual traders, is known as the carry trade.

The carry trader exploits the differential in interest rates paid out and charged on two different currencies, with the trader going long the high interest yielding currency and shorting the low interest yielding currency. This nets the trader the difference between the two interest rates and pays the trader interest on a daily basis.

As a result of the increasing popularity of the carry trade among financial institutions, large flows of liquid investment capital have moved into the Australian Dollar, which currently carries a relatively high interest rate that investors tend to find attractive in low risk market environments. On the high end along with the Australian Dollar, is the New Zealand Dollar.

Conversely, investment capital has flowed out of currencies more suitable for borrowing in, such as the Japanese Yen and the U.S. Dollar, which has a short term benchmark interest rate of only.

For more information on Forex trading, click here .

Guest post by Sara Mackey

For more forex and economy related articles, check out our forex education section .