Liquidity of the Forex futures trading

Post on: 10 Июнь, 2015 No Comment

Forex exchange market is no doubt, one of the most dynamic and ever changing financial markets of today. It’s quite amazing to know that more than 1.5 trillion hands are changed every passing day. At the same time, millions of different currencies are included in the forex exchange. Due to this reason, the participation and level of currency trading has increased in the past number of years.

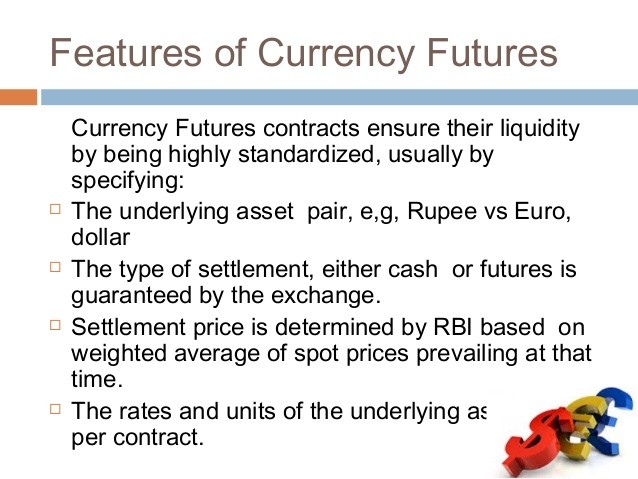

On the other hand, the concept of futures is which the selling and purchasing of any particular currency is specified right from any particular date and the respective price at which the currency is sold is dependent on the particular price. Thus, the entire functioning of the forex trading and the futures trading is complementary yet different at the core level.

Concept of forward exchange deals

One can also get to know the exact functioning of the futures by the concept of the forward exchange deals. These deals have been tailor made to suit the requirements of the customers and also to meet the need of funds amount which are in accordance with the respective deal dates. When forex and futures trading are compared, the comparison itself shows about the various features and benefits which are conferred by the forex in terms of the liquidity, transaction fees and the target audience.

The entire market of the currency is controlled throughout 24 hours. Due to its ever changing dynamism, the forex traders are much more updated regarding the various developments and news so that they can automatically reveal their reflex regarding it. This kind of facility which is available at the forex cannot be made available at the futures market, as they donot function for the entire 24 hours but only for few limited hours.

Liquidity of the forex futures trading

The liquidity of the forex market is unmatched compared to the respective currency futures. Thus, with so many hands bustling the forex market, it becomes quite clear that forex is one of the most liquid markets of the financial sector.

Transaction volumes

One of the various reasons why futures market is considered to be of great value is because of the huge volume of transactions that can be included in it and at the same time, the enhanced trading volumes.

Thus, on the other hand, the futures market is all about the lesser trading volume and the transaction amount of only thirty million dollars. Due to this reason the liquidity of the futures market is very limited and the trading volume is also lesser.

At the same time, the utilisation of the forex is done through the implementation of the price quotes and the futures currency trading. At the same time, when the futures market is taken into consideration, they have the entire need of calculation adjustment, which makes the entire process very much froth with dynamism. Coming to the other side, the futures side is also related to the clearance fees, the exchange rates and the increase in the trading costs. This eventually decreases the paramount profit which the trader might have surfaced. One the other hand, when it comes to forex, the trader has the entire feature to having the retained profit to him as forex trading is all about online exchange at present.

Conclusion

But at the same time, this fact cannot be ignored that no matter, which kind of currency trading it is, whether its futures, equities of forex, there is a certain kind and level of investment which is necessary to be invested in the entire deal. Forex trading confers every trader with the chance of experiencing the high execution quality and acceleration because of the ratio of higher trading.