Learn The Lingo Of Private Equity Investing

Post on: 16 Март, 2015 No Comment

The media frenzy surrounding the credit bubble has helped make private equity. which was once only recognized by the most sophisticated investors, a commonplace word. Many mainstream investors have become interested in learning more about the private equity industry. Because of the non-public nature of private equity, it can be difficult to gain access to the lingo used by industry insiders. Read on if you are interested in learning more about the different private equity terms and ratios that have been raising the eyebrows of even the most sophisticated institutional investors .

Private Equity-Speak 101

Before we can discuss the important ratios used in private equity, you must first be familiar with some of the basic terms that are important to private equity investors. Some of these terms are strictly used in private equity. Others may not seem so new depending on your exposure to alternative asset classes, like hedge funds .

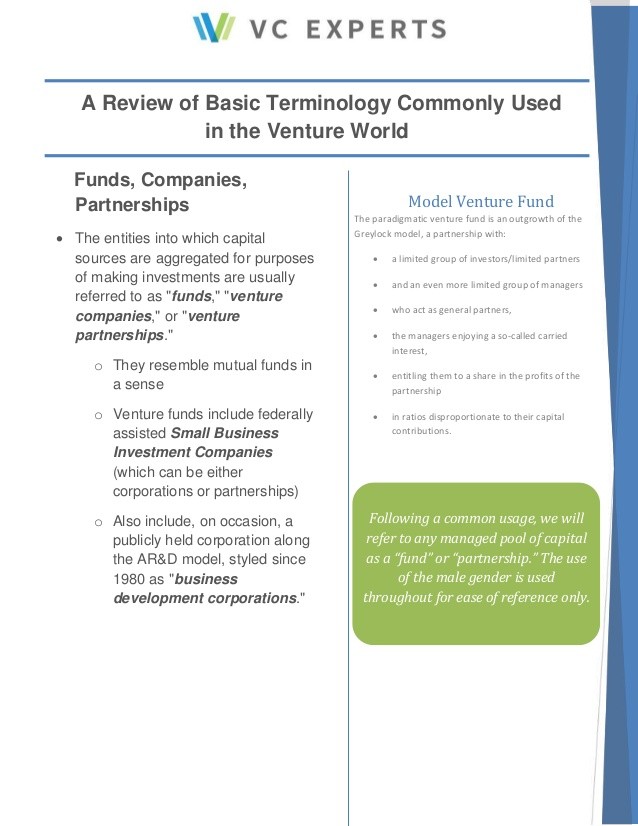

Limited partners are usually institutional or high net worth investors interested in receiving the income and capital gains associated with investing in the private equity fund. Limited partners do not take part in the fund’s active management. They are protected from losses beyond their original investment as well as any legal actions taken against the fund.

The general partners are responsible for managing the investments within the private equity fund. For their services, they earn a management fee and a percentage of the fund’s profits, called carried interest. The general partners can be legally liable for the actions of the fund.

Preferred Return, Carried Interest and Clawback Provision

Like most other alternative investments. private equity compensation structures can be complicated. The general partner’s compensation usually comes from two different sources: carried interest and management fees. Carried interest is the general partner’s share of the profits of the investments made within a private equity fund. It can range from 5-30% of the profits.

In addition to carried interest, the general partners earn a management fee, which is typically 2% of commitments paid annually, although there are exceptions when the rate is less.

Private equity funds usually have clauses in their compensation agreements. Two of the main types of clauses are the preferred return provision and the clawback provision. The preferred return, or hurdle rate , is basically a minimum annual return that the limited partners are entitled to before the general partners may begin receiving carried interest. If there is a hurdle, the rate is typically around 8%. The clawback provision gives the limited partners the right to reclaim a portion of the general partner’s carried interest in the event that losses from later investments cause the general partner to withhold too much carried interest.

Committed Capital, Drawdown, Vintage Year and Paid-In Capital

In the private equity world, money that is committed by limited partners to a private equity fund, also called committed capital. is usually not invested immediately. It is drawn down and invested over time as investments are identified.

Drawdowns. or capital calls, are issued to limited partners when the general partner has identified a new investment and a portion of the limited partner’s committed capital is required to pay for that investment.

The first year that the private equity fund draws down or calls committed capital is known as the fund’s vintage year. Paid-in capital is the cumulative amount of capital that has been drawn down. The amount of paid-in capital that has actually been invested into the fund’s portfolio companies is simply referred to as invested capital.