Learn The Basic Fibonacci Forex Trading Strategy Forex Blog

Post on: 27 Июнь, 2015 No Comment

A popular form of technical analysis that is widely used by a large number of foreign exchange (forex) market participants, known as Fibonacci, utilizes various measurements based on the ratio and formula behind calculating the famous Fibonacci sequence, and is normally available as a tool within most trading platforms provided by online brokerages.

Mr.Leonardo Pisano Bigollo (Also Known As, Leonardo Fibonacci)

This sequence is based on a ratio or relationship of numbers in a sequence that shares its formula from nature, as observed in many natural designs such in certain sea-shells, flowers, and even weather system patterns (with regards to spirals), and many other natural designs including man-made creations.

The Fibonacci sequence was made popular by an Italian mathematician named Leonardo Pisano Bigollo, known as Fibonacci. in the 12 th century (middle ages), as the sequence was noted as early as the 6 th century in India. Its not a coincidence that traders often ask how to use Fibonacci in forex trading. This article will aim to answer that in a basic way.

Relationship of Fibonacci Sequence to Finance

This ratio has made its way into financial markets, and used in modern times in architecture and other geometrically affected systems, and as a result is widely used to make sense of price action, and while observing historical price behavior in order to deduce future levels that may become relevant to traders.

This formula can be applied as a basic Fibonacci forex trading strategy, and can be effective despite its simplicity, because the combined effect of a large number of traders can cause the expectations of the market to result in a self-fulfilling prophecy, where traders either buy expecting support to be found, or sell when expecting resistance, such as is often predicted using Fibonacci retracements tools and other related calculators found within trading platforms based on this famous ancient formula.

Static and Dynamic Fibonacci Levels

While measuring Fibonacci (Fib) levels is normally done on a horizontal basis, where the specific level or percentage value is fixed to a price, some platforms also provide a dynamic Fibonacci tool, which can measure on a diagonal basis, similar to how a diagonal trend line whether ascending or descending is not fixed to a specific price, as it changes over time.

For the purpose of this article, and when applying a basic Fibonacci forex trading strategy. we will focus on the use of the static method, using horizontal levels, that are fixed to prices, over a given time period that is being measured. As will be revealed, using a Fibonacci retracement tool, we can measure retracements from highs to lows, as well as from lows to highs, over nearly almost any time frame that can be populated within a chart within the platform, and typically using candle stick style charts.

What is the purpose of Fibonacci in Forex?

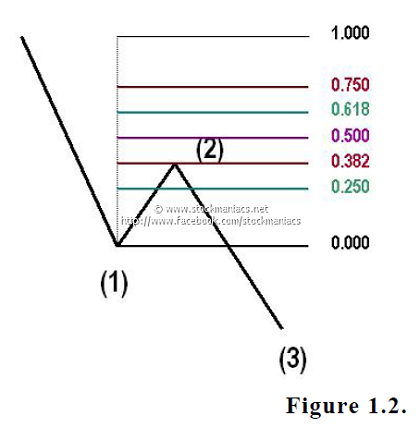

The Fibonacci retracement aims to predict levels where a retracement may find support or resistance after reaching a high or low, over the time period measured.

For example, if after reaching a high price, the underlying instrument reaches a low price, over say a 6 month period, a measurement from the high price (which occurred first and thus would be considered 100% level) would be initiated all the way to the low price (which occurred subsequently and considered 0% level), and therefore indicate that for the price to return back to the high would be a 100% retracement.

The Fibonacci tool, will then plot the levels in between and even beyond that correspond to the Fibonacci sequence of numbers, represented as a percentage, such as 1, 1,2, 3, 5,8, 13,21,34,55,89,144,etc These numbers in the sequence also share parallels with the Golden Ratio. another important mathematical formula that shares relationships with both nature, geometric structures, and the spirals depicted in the Fibonacci numbers.

In the above example measuring Fibonacci levels using historical and current forex prices, the levels plotted may reveal where support and resistance actually occurred throughout the down-trend that was measured (from the high to low).

These static levels, plotted as horizontal lines on the chart, and which corresponded to fixed market prices, may continue to act as either support and/or resistance, and as subsequent price action unfolds, and thus is how trades use such an approach when applying a basic Fibonacci forex trading strategy, as will be demonstrated below.

Measuring Fibonacci Retracement Levels From High/Low of Chart

Before going through an example trading situation, let us consider the opposite of the above scenario, rather than measuring from the high and subsequent low from a down-trend, if the instrument being analyzed had first reached a low on the chart history, and later hit a higher price, we would measure first from the low (which would be the 100% level) and end the measurement on the high price (which would be the 0% level), and thus if after that up-trend the prices returned to the 100% level, it would be considered a 100% retracement from the high of the chart (back to the low).

For this reason, it is always important to be aware of where on the chart you are starting the measurement from, and ideally it should be between the highest and lowest price visible on the chart, as this is the way that traders typically measure retracements, and thus could be the most relevant retracements to measure, or the levels that are most observed over a given time frame.

Forex Blog recommends WorldWideMarkets. a leading online brokerage that has developed the AlphaTrader platform. seen below, and which contains numerous Fibonacci related tools that can be applied within a chart. This includes, the Fibonacci Arcs, Fans, Retracements (seen below), and Time Zones, all of which incorporate the famous sequence from a different measurement context.

Example of Fibonacci Retracement Levels Drawn on AlphaTrader Platform

Understanding a Basic Fibonacci Forex Trading Strategy

Using a basic Fibonacci Forex trading strategy, a trader may draw static Fibonacci retracement levels, as described above, on the desired time-frames, such as 15-minute, 30 minute, hourly, daily, weekly, and other time frames for example, and across a number of currency pairs. Then the trader may scan and periodically look for when prices are approaching levels where a breakout or reversal could occur, around these fib levels.

This basic strategy for determining entry points and exit points, would be weighted by a multitude of factors such as recent and current market conditions, any market consensus or broad expectations related to fundamental news, and other technical levels that could be co-factors such as simple trend lines or even advanced technical indicators. Therefore, while Fibonacci itself isnt a panacea, it can complement a basic approach to trading, and can also work on its own, as part of a detailed trading methodology (see below).

Practical Application in a Demo or Live Forex Trading Account

Nonetheless, even using a basic Fibonacci Forex trading strategy as explained herein could provide a basis for a trader to find trading opportunities. and/or at least be aware of levels where other traders may be expecting price-action to increase or change, as such tools and measurements are commonly used to deduce support and resistance levels, and thus can have a collective effect when such levels are reached (multiplying effect).

Finally, applying a proper risk-management as part of an overall trading methodology or system will be needed for increasing chances for longer term success. and dependent on each traders unique goals and circumstances.

Forex Blog has a series of dedicated posts to this subject where traders can learn more, and contact WorldWideMarkets.com to test either a demo forex trading account, and/or live forex trading account. and try the above method using the Alpha Trader platform and/or MetaTrader4 platform available for free.