Learn Forex Three Simple Strategies for Trading MACD

Post on: 14 Август, 2015 No Comment

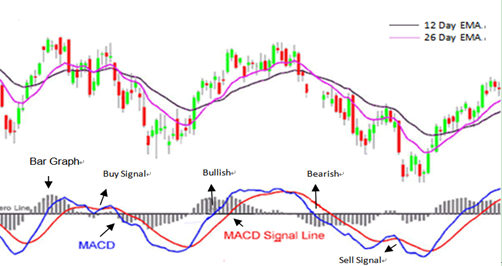

In our previous article, Trading with MACD. we saw that this utilitarian indicator can help a trader see quite a bit of information — including the possibility of noticing trend changes at a very early stage of a currency pairs move.

Unfortunately, one of the drawbacks of the indicator using default input settings is that many of the signals that are generated may not work out the way the trader wants.

So while this can be a valuable indicator, it is necessary to enhance the strategy or approach with additional means of determining which signals to take and which to avoid.

In this article, we are going to look at 3 different ways that traders can look to utilize the MACD indicator based on the market condition they are looking to trade.

Trend Strategy

Traders looking to trade trends with MACD may feel very at-home with the indicator, as MACD is generally utilized as a mechanism to enter into trending situations.

Traders can look to filter trends with the 200 period moving average, and taking trades only in the direction of the trend.

So — when price is above the 200 period Moving Average — traders are only looking to buy on bullish MACD crossovers of the Signal Line. The chart below will illustrate further:

Created with Marketscope/Trading Station II

This strategy can be utilized on any timeframe longer than the hourly chart. Charts of shorter time periods may prove too lagging for many short-term traders tastes. Both indicators are built and traded from the same time frame, so no additional work outside of adding the indicators is required of the trader.

Strategy Tools: 200 Day Moving Average, MACD with (12, 26, and 9 inputs)

Entry Criteria: Take MACD Signals ONLY in the direction of the general trend, as graded by the 200 period Moving Average.

Exit Criteria: Contra-cross of MACD OR price Crossing the 200 period Moving Average. (So if trader had taken a long entry with a MACD Buy signal — they would exit the position on either a MACD Sell signal OR price crossing below the 200 period Moving Average.)

The Ranging Swing Trader

The next strategy isnt as flexible as the first in the fact that it is specifically built for the 1 hour charts, with some assistance from the 4 hour chart (although the 4 hour chart specifically will not be used.)

But just because multiple time frames are utilized by the trader, it doesnt mean that the entirety of the traders analysis cannot be done on the same chart time frame. In this strategy, the trader wants to first grade for ranging market conditions, and this can be done with the ADX indicator.

Traders can use an hourly chart, and build the ADX indicator based on the 4 hour chart simply by clicking the Data Source tab in the indicators properties boxes on Trading Station II (shown below).

Created with Marketscope/Trading Station II

After applying ADX built on values from the 4 hour chart, traders can add a line to the indicator with the horizontal line tool at the value of 30.

This is the filter for the strategy. If ADX is greater than 30 — then traders do not look to trade this range-based strategy as prevailing trends may be too strong for cogent entries. If, however, ADX is below 30 — then traders can look to take each and every MACD signal that generates from the indicator.

Created with Marketscope/Trading Station II

Strategy Tools: Hourly chart with MACD applied, ADX based on the 4 hour chart

Entry Criteria: Take MACD Signals ONLY when 4 hour ADX reads below 30.

Exit Criteria: Stops and Limits with Limits being set at 2 times the stop amount. Stops and Limits can be obtained by using the 4 hour Average True Range amount.

Reversal Strategy

While being one of the most difficult market conditions to trade (since it is nearly impossible to predict when a reversal of price may actually take place), trading Reversals is also one of the most attractive to retail traders.

With one look at the SSI, and noticing the penchant that many retail traders have for attempting to call tops or bottoms helps illustrate this.

Reversals can bring big moves to the trader. They can also bring big losses. Which is precisely why it is so important to use strict risk management when trading in these conditions; and traders should be ready to cut their losses quickly the reversal proves unlikely.

In the article, How to Trade MACD Divergence. Walker England shows exactly how this can be done.

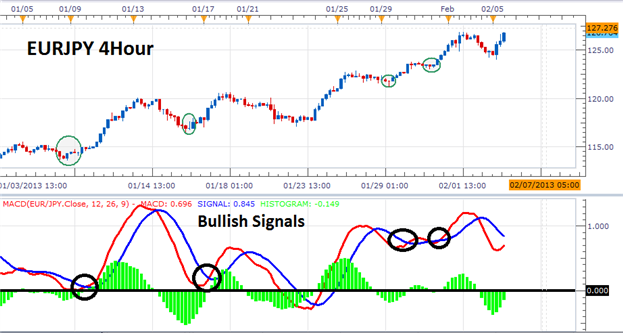

The picture below will illustrate a classic case of Bullish Divergence. In this instance, notice that price has went on to make a lower-low, while MACD has printed a higher-low.

Notice that while prices were in the process of printing a new low, the higher low established by RSI illustrates divergence. This, in-and-of-itself is often used by traders to trigger entries in reversal markets.

Traders will wait for the crossover of the MACD and Signal line, and look to enter the trade with the higher-crossover. The illustration below will show the exact point with which traders would look to enter, using the same chart we investigated previously.

Created with Marketscope/Trading Station II

Strategy Tools: Any time frame chart with MACD applied (default inputs of 12,26, and 9)

Entry Criteria: Take MACD Signals when Divergence is present.

Exit Criteria: Stops and Limits with Limits being set AT LEAST 2 times the amount of the stop. Stop should be set to the low of the move (with Bullish Divergence) or the high of the move (with Bearish Divergence). Traders may also incorporate a trailing stop, as shown in Trading Trends by Trailing Stops with Price Swings. by incorporating price action into the trade management.

— Written by James B. Stanley

To contact James Stanley, please email Instructor@DailyFX.Com. You can follow James on Twitter @JStanleyFX.

To join James Stanleys distribution list, please click here .

Would you like a customized curriculum to walk you through Trading Education? Take our Trader IQ quiz and receive a full lesson plan with numerous free resources to expand your information arsenal.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.