Learn Forex Chart Patterns

Post on: 12 Апрель, 2015 No Comment

Share this forex article:

Forex trend Continuation Patterns

This article discusses the most significant figures of market trends’ continuation (flags and pennants, triangles, rectangles and wedges) depicting the short term market trends.

Suggestion:

There is excellent mt4 plugin Autochartist pattern recognition mt4 plugin .Using this plugin you can get suggestion for trading.It is free for Alpari demo and live accounts.

Flags and Pennants

Flags and pennants can be singled out during actively growing trends, where both of the figures raise to the extent that they form straight lines in graphs. These figures essentially depict pauses in the growth of trends where the price takes a constant level. Pennant appears as a little triangle on the graph while flag depicts the short term price range. Once the trend curve is broken by these figures, the previous trend resumes till the figure’s distance.

The results of the two flags are only reliable if they are moving opposite to the flow of trend. Therefore signals are bullish if the flag is sloped downwards and bearing when facing upwards. The market undergoes high activity prior to appearance of flag and slows down after the pattern appears. During break activity alters again. In contrast to a rising market, flags appear faster for falling markets. And if pattern appears in a fast market then there is a probability of a puncture.

It should be kept in mind that the direction of flags and the pennants are not opposite rather in direction of the previous trend and more like for retracing trends.

In contrast to the rebound figures, trend continuation figures mostly denote a direction opposite to that of a trend. Situation is much complex in case of trend traversal figure, ‘triangle’.

Triangles may be taken as flags free from the flagpoles. There are four most distinguishing triangles;

1. Symmetric triangle is formed by a symmetric convergence of the support and the resistance lines that are drawn using minimally four points. This convergence depicts a demand and supply balance in the currency market. Although breakthrough can occur in any direction yet in case of bullish convergence, breakthrough takes the direction of prior trend.

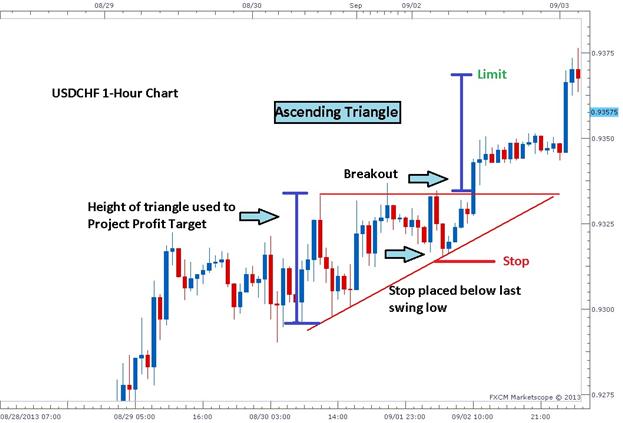

2. Uprising triangle is created an upward directed support line and the horizontal line of resistance. The figure depicts the supply exceeding the demand. Breakthrough is directed upwards towards the level of price whose distance from the breakpoint is equal to that of the triangle base.

3. Downfalling triangle is an exact mirror reflection of the uprising triangle and is created by a downward directed resistance line and the horizontal line of support. The figure depicts the supply being exceedingly higher than the demand. The breakthrough is directed downwards and the trade volume gradually decreases meeting the high. Once a break happens the volume comes back to normal.

4. Expanding triangle (megaphone) is an upside-down reflection of any of the above triangles where instead of base the corner of the triangle is aligned with the previous trend. The increase in trade volume is in proportion to size of expanding triangle. In case the closing price is set above or below the lines making the side of the triangle, then the break happens after which the curve generally rebounds in direction of punctured triangle side.

Wedges

Wedge is slightly similar to triangle as well as pennant in its creation time and form, however from analysis viewpoint it more similar to pennant void of flagpole. Mostly break happens opposite to its inclination direction but matches with the previous trend direction. Wedge can be bearish or bullish on basis of the trend.

See triangle forex patterns trading video:

Rectangles

Rectangle shows the consolidation time of a market where currency resumes the prior trend after breakthrough. But the break can change the trend from continuation to recoiling. The figure is prominent and is viewed as a sideways trend. In case it is created in direction an uptrend and the price break is also upwards then the rectangle is bullish.

See rectanlge pattern trading example video: