Key Uses For P2P Currency Exchange

Post on: 20 Июль, 2015 No Comment

Retail customers generally have to pay a stiff price for the privilege of exchanging one currency for another. By the time commissions. fees, and massive bid-ask spreads are factored in, a retail client could easily be looking at a total spread of 5% or more between the bid and ask price of a currency.

For example, if a US resident is looking to buy €5,000 and his financial institution is quoting a price of $1.17 / $1.23 (based on a spot price of EUR 1 = $1.20), it would cost him $6,150. This is a full 2.5% more than he would pay if the transaction were done at the spot rate of $1.20, in which case he would have paid $6,000 to buy his euros.

In the foreign currency exchange (forex ) world, the banks that dominate the $5-trillion per day currency trading business reserve the best rates for their biggest customers such as large corporations, governments, and institutions. The bid-ask spreads for such clients are wafer-thin because of the competitive nature of the forex business.

But retail clients, and to some extent small and medium-sized enterprises (SMEs ), have long had to contend with significantly higher prices because of the power of the entrenched middlemen (i.e. the banks) and the lack of alternatives for exchanging currencies. However, they now have a viable and much cheaper alternative in the form of peer-to-peer (P2P) currency exchange networks.

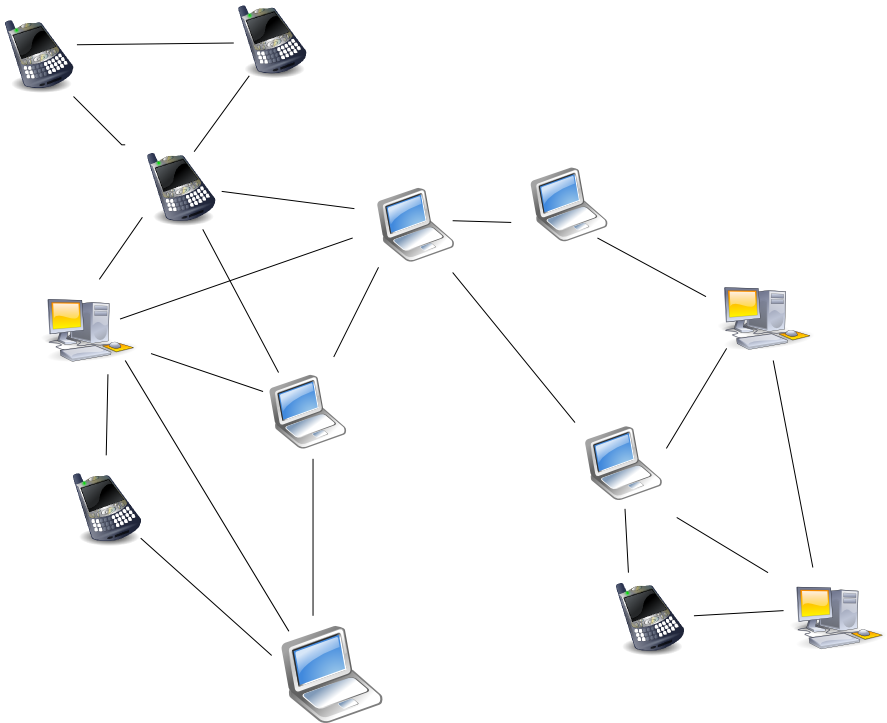

P2P networks have already proved to be disruptive technologies with the power to challenge the status quo and eliminate the middleman in many different business areas. Currency exchange is the next frontier for P2P, as evidenced by the increasing number of start-ups (most of them located in the United Kingdom) engaged in this business.

The premise for P2P currency exchange is very simple. A P2P platform simply brings together people with complementary currency exchange requirements. So if User A wants to exchange dollars for euros and User B is looking to exchange euros for dollars, they can do so over a P2P currency exchange. By harnessing the power of the crowd, users are thus able to obtain much better exchange rates than they would get through traditional currency exchange mechanisms.

CurrencyFair Ltd , for instance, claims that it can save up to 90% on international currency transfer fees. While £2,000 transferred through a typical bank could cost as much as £100 (£40 in international transfer fees and £60 in exchange rate margin), the same amount sent through CurrencyFair would only cost about £9 (a fixed £3 transfer fee plus £6 exchange rate margin). CurrencyFair charges an average of 0.35% of the amount exchanged as its margin, while TransferWise Ltd charges 0.5%.

The mechanism for P2P currency exchange is straightforward. A client opens an account with a P2P exchange and deposits money into the account. He or she then converts the money into the desired currency by “matching” with other clients on the P2P exchange. The foreign currency is then transferred to an overseas bank account nominated by the client.

Based on the foregoing discussion, it is apparent that P2P currency exchange can work well for the following applications:

- One-time payments: P2P currency exchange is ideal for smaller amounts, because the nominal, flat fee charged by these exchanges makes it much more cost-effective than traditional channels. For example, TransferWise charges £1 for a GBP to EUR transfer up to £200, and 0.5% above that threshold.

- Recurring remittances. Overseas workers often send money to their home country on a regular basis, typically monthly. The low fees charged by P2P exchanges can result in substantial savings over time. For example, a worker who remits $2,000 per month through a bank that charges her 2.5% would pay $600 annually in fees and commissions, whereas the same amount sent through a P2P exchange that charges 0.5% would cost her $120. This would result in savings of 2%, which equates to $40 per month of $480 annually.

- Rental and pension income. P2P currency exchange is also ideal for those with currency mismatches on a regular basis, such as investors with overseas rental property or retirees who live abroad. Investors with overseas assets may receive income in a foreign currency that they may desire to convert to their local currency. On the other hand, retirees abroad receive pension income in their home currency but would need foreign currency for their living expenses.

- Corporate transactions: The forex requirements of SMEs are cumulatively much larger than that of the retail market, since the volume of trade transactions (imports and exports) and capital flows are immense. UK-based Kantox Limited offers a P2P platform targeted at SMEs that enables companies to match their currency requirements in a secure environment. A feature of the Kantox platform is that it offers a P2P live mid-market rate that allows its clients to close trades without incurring a bid-ask spread. If the trade cannot be 100% P2P matched, Kantox makes up the difference through its wholesale forex market providers. Fees charged by Kantox range from 0.09%, if the forex amount traded annually exceeds €20 million, to 0.29% for amounts of less than €2 million annually.

The Bottom-Line

While P2P currency exchanges may catch on in a big way, you should conduct due diligence before you sign up with a P2P provider. At a minimum, ensure that the P2P exchange is a reputable one that is regulated by the relevant financial authority, and holds client accounts separate from its own.