Japanese Yen to Weaken Further Curbing Need for BoJ Intervention

Post on: 5 Июнь, 2015 No Comment

Japanese Yen to Weaken Further, Curbing Need for BoJ Intervention

Fundamental Forecast for the Japanese Yen: Bearish

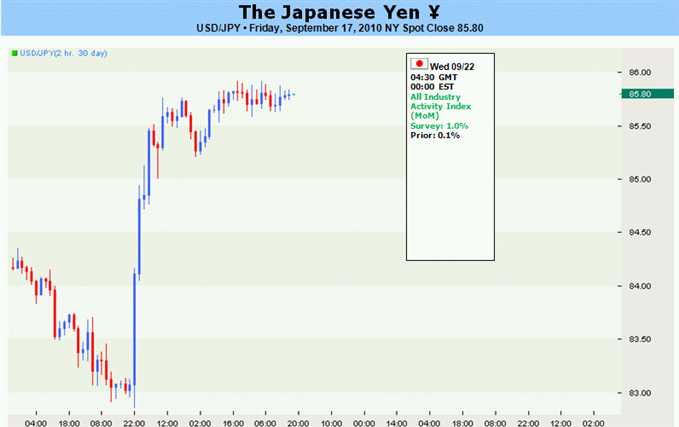

The Japanese yen pushed lower against the U.S. dollar this week, falling some 2.3 percent as developments in worlds largest economy begin to stabilize. Indeed, Fridays session marked the only day that the yen rallied against the greenback, but the advance may be short-lived as the market participants shift their focus to next weeks trade.

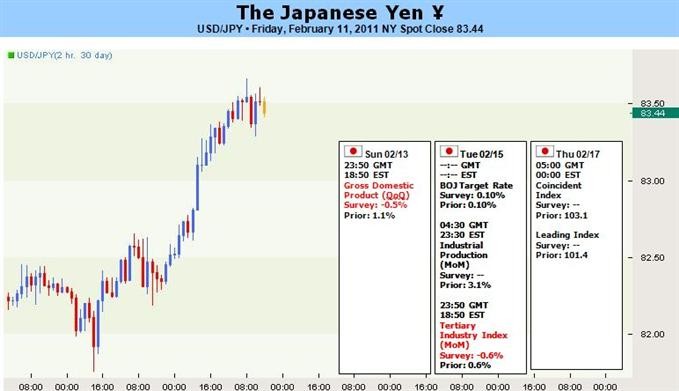

For most of 2010, the yen was benefiting from its safe save status amid uncertainty in the global economy, rather than developments in the region. The yen is considered a safe haven because the current account surplus reduces Japans dependence on borrowing from abroad. It is important to note and attribute the yens rally last year to its safe haven appeal because as the economy in the U.S. stabilizes, the yen will continue to lose ground. From a fundamental basis, consumer spending in the worlds third largest economy is expected to weaken as the fiscal stimulus comes to an end, while weak employment growth keeps a lid on household spending. In turn, growth is expected to slow in 2011 as the economy continues to battle these headwinds. Reports next week may shed light on some of the hurdles that Japan will battle. JPY traders will be faced with the leading index, machine tool orders, and the trade balance. In particular, market participants should monitor the leading index because the report tends to precede larger developments in the rest of the economy. At the same time, the machine tool orders release will provide investors with a sense of how strong or weak business confidence is.

Meanwhile, traders should not overlook developments in the worlds largest economy due to the fact that increased uncertainty in the U.S. may shift investors to the yen, while an improved outlook on the back of positive fundamentals in the U.S. will weigh on the yen. For the upcoming week, the U.S. calendar highlights the monthly budget statement, Feds Beige Book, and producer and consumer prices. As policy makers continue to express concerns surrounding the inflation, the CPI report is likely to paint a clearer picture for the direction of the USDJPY. Taking a look at price action, downside risks in the USDJPY remain capped by the 50-day SMA. So long as price action can hold above this moving average, a retest of 83.50 should not be ruled out. On an hourly chart, the pair is currently testing the rising trend line which has served as a line of support since January 3 rd. With technical and fundamental developments pointing to gains in the near term, bears should caution entering into a short trade. -MW

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.