Introduction to Ichimoku Trading Strategy Archives Ichimoku Trading Course

Post on: 30 Май, 2015 No Comment

Introduction Of the Ichimoku Trading Strategy

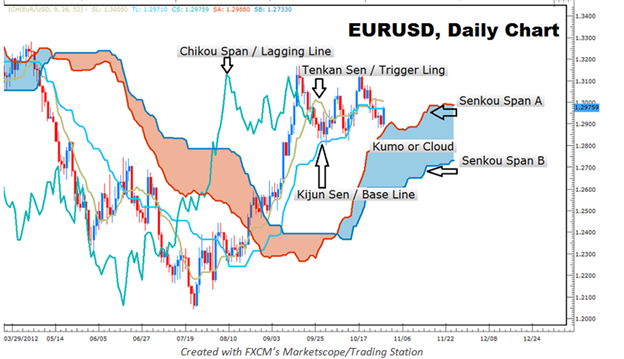

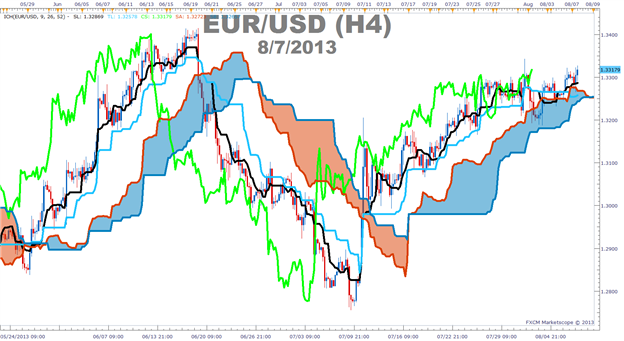

The Ichimoku Cloud is a popular indicator composed of several tools to gauge the price action of any instrument on any time frame. It can be used to recognize find with trend setups, reversals of current trends, support and resistance, along with time, wave and price cycles to determine when a move will likely reverse, who’s in control and where price will likely reach.

The full name of the indicator is the Ichimoku Kinko Hyo, which translates into equilibrium chart or ‘One Glance Balanced Cloud Chart’. The main idea is that with one look, you can recognize the trend, support and resistance levels, and who’s in control of the market.

Although the Ichimoku Cloud uses a lot of filters to find a trading signal, it helps to filter out false signals to give you higher probability setups.

[wp_ad_camp_1]

Components Of Ichimoku Trading Strategy

One of the most important and first lines you will want to understand is the Tenkan-sen. This is known as the ‘momentum’, ‘signal’ or ‘turning’ line. The main calculation for this line is to take the highest high + the lowest low over the last 9 periods, then divide them in half. There are many strategies built in using the tankan sen, such as the traditional tenkan – kijun cross. The main thing the tankan will measure is the underlying momentum of the price action for an instrument. As a general rule, a bullish move has strong momentum when price is above the tenkan while having strong bearish momentum when price is below the tenkan.

The Kiun-sen is generally referred to as a trend line – meaning it gauges the underlying trend in any instrument. It can also be used as a support and resistance line, or possibly a trailing stop in some trends.

Generally, if a strong trend has been in place, and then breaks above/below the kijun line, the short term status for the trend is neutral. A bullish trend needs to maintain the price action above the Kijun, while a bearish one below the kijun as a whole.

Senkou span A

Getting into the ‘Kumo’ or ‘Cloud’ in Ichimoku, the Senkou-span A is also known as leading span 1, which forms one edge of the kumo, or cloud. Depending on if the price is above the Senkou span, the top line serves as the first supporting level as a general rule.

The main calculation for the span-A is by taking the tenkan line + the kijun line, dividing that value by 2, and then plotting it 26 periods ahead.

Senkou span B

The Senkou-Span B forms the other edge of the Kumo, and the space in between the span A and B forms the entire cloud. The main calculation for the span-B is to take the highest high + the lowest low over the last 52 periods and dividing that by 2, then plotting it 26 periods ahead.

Taken together, they form as both present and future support and resistance levels for any instrument.

[wp_ad_camp_2]

As stated earlier, the Kumo is the combination of the spans A and B, with the area in between them being the kumo. There are many variations in manner of shape and thickness which are related to the price action for the instrument as to how the kumo forms.

When the cloud is thick, this is usually due to strong volatility in the price action which has led to a strong trend. A strong trend usually creates strong support/resistance levels to support the underlying trend along the way.

A thinner cloud or kumo generally means just the opposite. Since the kumo represents support and resistance, a smaller kumo means the support or resistance is also smaller.

Usually, trading markets are bullish when Senkou Span A is above Senkou Span B and vice versa when trading markets are bearish. Traders regularly search for Kumo Twists in forecast clouds, where Senkou Span An and B trade positions, a sign of potential trend inversions.

The chikou span is additionally called the lagging span and it is used in combination with the current swing in relationship to past price action. It is the current price action on a closing basis, plotted 26 periods back. If the chikou span during a bullish move has no prior price action above it, then the trend is considered generally strong. It is the opposite for a bearish move. Using the chart below, we can see the purple line (line 3) which is the chikou span. The current or last reading of the chart shows the chikou span has no price action above it. This means there is no resistance nearby in relationship with the current trend and the chikou span to past price action.

Ichimoku works great in all markets, not just forex or the Japanese markets. Although it is generally viewed as a trend trading strategy, it is also fantastic and picking up reversals along with future support and resistance levels.

There are other components of the Ichimoku Cloud, such as the ichimoku time theory (more here ), ichimoku wave theory (here ), and ichimoku price theory (here ) which are considered to be the main pillars of the ichimoku cloud, once you get past its basic construction.