Introduction—Spot Futures Forwards Options Spread Betting

Post on: 29 Май, 2015 No Comment

Related Five FOREX Markets articles

Introduction—Spot, Futures, Forwards, Options, Spread Betting

The overwhelming majority of currency trading volume is in the spot market. FOREX inevitably means spot trading to most participants. But it is possible to trade FOREX as a futures vehicle, as forwards or with options.

Forwards are traded on the Interbank market and are transactions for a fixed time such as 30, 60, or 90 days. While useful for hedgers and some long-term position traders, they are effectively unknown at the retail trading level.

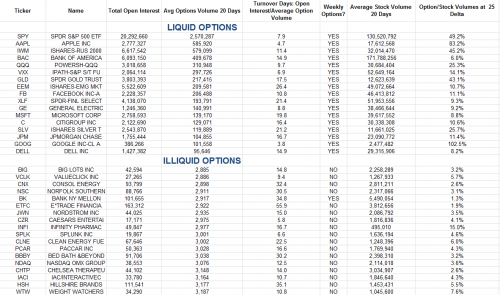

The primary advantage of FOREX futures lies in the setup of futures markets being centralized, and as such, are more heavily regulated. Traders leery of market maker practices in retail spot FOREX may find comfort and a better sleep by trading currencies on a centralized, heavily regulated futures exchange. Indeed, an increase in futures FOREX has been identified in the past two years although volume continues to be dwarfed by the spot market. But the selection of traded currency pairs with reasonable liquidity is also smaller in the futures arena. A secondary advantage is that many popular technical trading methods use volume of trading and open interest. While aggregate volume is known in FOREX, daily figures are unobtainable because of the decentralized nature of the business. Attempts are under way, including those by the author, to synthesize spot FOREX volume and open interest statistics from other data using statistical methods. The correlation of spot FOREX volume and open interest data to futures FOREX data has not been promising.

A futures contract is an agreement, or contract, between two parties: a short position, the party who agrees to deliver a commodity, and a long position , the party who agrees to receive a commodity. For example, a grain farmer would be the holder of the short position (agreeing to sell the grain) while the bakery would be the holder of the long (agreeing to buy the grain).

In a futures contract, everything is precisely specified: the quantity and quality of the underlying commodity, the specific price per unit, and the date and method of delivery. The price of a futures contract is represented by the agreed-on price of the underlying commodity or financial instrument that will be delivered in the future. For example, in the grain scenario, the price of the contract might be 5,000 bushels of grain at a price of $4 per bushel and the delivery date may be the third Wednesday in September of the current year.

Options (here meaning delivery months) are staggered throughout the calendar year. The most current option month typically generates the most trading activity, as it is most easily identified with the spot market. If you wish to stay beyond the March USDCAD, you must sell your contract and simultaneously buy the May USDCAD. In spot trading, this is not necessary as positions are automatically rolled over from trading day to trading day.

Currency options, always popular at the institutional level, have just since 2009 gained an audience at the retail FOREX level. A currency option is effectively also a contract to purchase buy (a call) or sell (a put) a currency pair at a specified price for a specified period of time. The party who takes the other side of the contract is the writer, collecting a premium from the purchase for the rights of the option. The advantage of purchasing an option is that your risk is limited to the price of the option. The disadvantage is that you pay a price, or premium, for off-loading that risk to someone else. You may think of an options purchase as similar to an insurance policy in that regard.

Strategies using spot FOREX and options or just using options can become enormously complex. The mathematics of options pricing is not for the squeamish! Currency options may be used as either a trading vehicle or as a tool for managing the risk of a spot transaction. I discuss options in more detail in Options and Exotics .

Spread betting is an alternative way to participate in the spot currency markets. One literally makes a bet on the direction of prices. Although popular in Europe, it is not available to U.S traders. Selecting a FOREX Broker discusses spread betting in more detail as an alternative to using a retail FOREX broker-dealer for those whom it is a legal option.

Adapted from Getting Started in Currency Trading.

Content provided here under exclusive license