Intraday Trading System to Trade Forex with RSI and Stochastic Divergence and Candlestick Patterns

Post on: 9 Август, 2015 No Comment

Preamble

This article has been written for people who are already familiar with Forex trading terminology and would like to become better traders. Its aim is to help you understand the principles behind our trading system so well that you will be able to use it with confidence. Our trading system is a fresh way of evaluating whether a potential new trade will be profitable or not.

We believe that a retail trader must use a trading system to have a chance. A trading system allows you to act decisively while you are on the market. It identifies all the signals that you need to open a position before you go onto the market. The amount of decision making that you need to do while you are on the market is minimal and this reduces the negative influence of your emotions .

Anybody who wants to develop a trading system needs two things: knowledge and experience. You need to know how the various technical indicators work, how to read them and how reliable they are. Experience tells you which indicators to pick, what pitfalls to look out for and, basically, what’s got a chance of working and what hasn’t.

This article will help fill any shortfall in knowledge or experience that the reader may have. It has been shaped by the experience and research of our teams of dealers and academics and brings a host of nuances and insights into play. The article is also an invaluable insight into how a trading system is constructed. This could help you in your trading career and will, we hope, be part of the foundation of your future success.

We chose to develop a system for intraday trading because although this time frame is attractive to both the novice and the more experienced trader,most trading systems seem to be designed for day trading .

We will break down the process of understanding the trading system into stages. First of all, chapter 1 deals with the groundwork necessary for any trade system and then chapter 2 examines each of the rules in our system in detail. Chapter 3 moves on to cover the practical application of the system.

Groundwork

When we are developing a trading system, we first need to identify its basic elements:

1. Time period: What is the time frame for the system? Is this a system ford ay trading or intraday trading?

2. Type of system: Will the system be one of the two main types i.e. a trend following system or a trading range system or will it have a particular focus within one of these two types?

3. Tools: What tools will the system use to generate signals? By tools I mean technical indicators (e.g. RSI or MACD ); chart patterns (e.g. lines and levels or the classic Western patterns like head and shoulders and double bottoms) and Japanese candlestick patterns (1 candle patterns; 2candle patterns or 3 candle patterns)?

4. Construction: How will the system combine the different tools? How will it prioritize signals? What will it do if the signals contradict each other?What confirmation is needed for each signal?5. Further considerations: What additional factors should the system take into account?

Now let’s deal with each element for our trading system.Elements 1 and 2 are easily addressed. This is a trading system for intraday trading. We would like to be active on the market for as much time as possible so our system is designed to work well on both trending and ranging markets.

Element 3 needed more careful consideration. Our collective experience of intraday Forex trading has convinced us that support and resistance levels play a much more significant role than the trend. This statement seems to contradict the bulk of trading literature. However, almost all these articles are written firstly with trading stocks and shares in mind and, secondly, for work on daily or weekly charts. Different markets and different time frames demand different strategy. Therefore support and resistance levels are our primary tool.

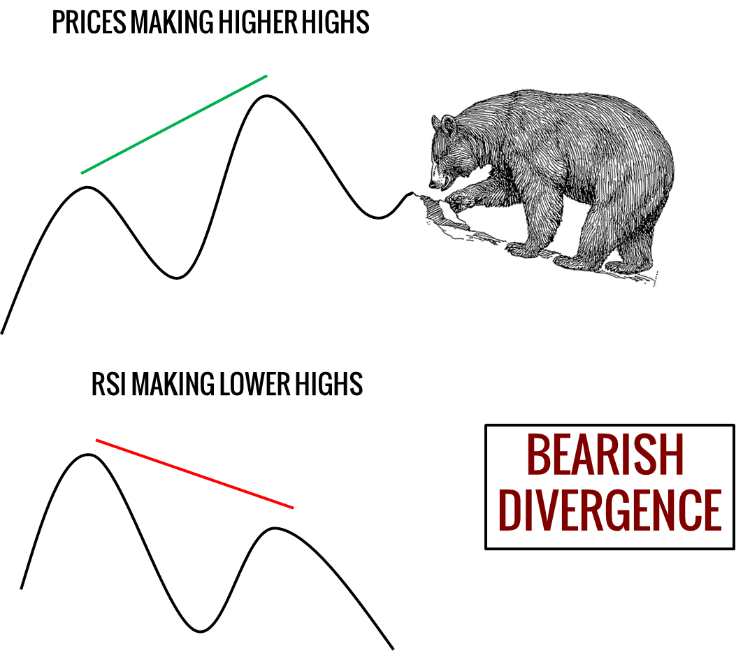

The signals that support and resistance levels give us are confirmed by the signals of a number of other tools. We use a number of one and two candlestick patterns because they signal quickly. We will also employ some technical indicators namely RSI and Stochastic.

Element 4 leads us to a major element of our system. We combine the signals by giving each a ‘weight’. The signal that each tool gives has a point rating. We add these points together and we only open a position if the total is above a certain amount.

This means that if the signals for the hour ending 11.00 add up to a tradable position then the opening price should be the opening price of the period ending 12.00. What tends to happen is that the opening price of your position will most likely be different from the opening price of the period because you will need some time to check the signals and rate the trade.

Element 5 includes time as an important consideration. Forex trading is a24-hour activity and certain times in the 24-hour period are far more active than others. This has a direct impact on when a move will begin so we give the time of day a points rating. Other considerations that the system factors in are the existence of a trend; the day of the week and the unexpected.These factors and their ratings will be dealt with in the rules of the trading system.

Part 2

Rules of the system

Rule #1: Bouncing off a level

When price hits a level of support or resistance it can do one of two things.It can either ‘bounce off’ from the level or break out through it. We believe that it would be a pretty tall order to design a trading system which could generate signals for both a bounce off (reversal) and a breakout. We reckon that you would need two trading systems for this. We are only designing one system here and we have decided to design one that identifies reversals from a level. This is because reversal happens much more often than break out.

First we need to define what we mean by a reversal:

- If price reaches a support level and then starts rising; or if it breaks through this level only to rise back above it and keeps rising after that.

- Likewise: If price reaches a resistance level and then falls back or if it breaks through the level only to fall back below it and keeps falling after that.

We want to stress that support and resistance are in fact zones with a width of a number of points rather than one-point wide levels. On intra-day charts we take these zones to be 10 points wide. This means +/-5 points from the precise level we chart. So, if price reverses within 5 points of a level, then we take this as a reversal from that level.

Different levels have different strengths and the stronger the level is the more likely that price will reverse from it. Here are the ratings for the different levels:

- A level confirmed on the daily or weekly chart: 5 points.

- A level confirmed on 6-hrly charts: 4 points.

- A level confirmed on hourly charts: 3 points.

- A level confirmed on 30-minute charts: 2 points.

The first rule of our system is that we are only looking at reversals that occur in our zones of support and resistance. These zones surround a level which can have a maximum strength of5 points. We will only be considering levels that have been retested in the last four full weeks.

Now we’re going to hand over to Peter Eriksson, one of our top analysts and a man who likes to tell it as it is. This is his take on those mystery men:the market makers.

Who are the market makers? They are the fat cats who employ analysts and academics as consultants. I really don’t believe that any of the ‘market makers’ in question ask these nerds what Stochastic is doing right now or whether the MACD histogram is signaling a good time to buy.

Who knows how they decide when and what to buy. It’s down to guess-work. If you’re asking me, the only important factor is the bottom line: the prices. What is the high and what is the low? Where can he buy and sell and when? The price is the market maker’s only reference point. Indicators and what-not are for the birds, using them takes graft and skill: qualities of the poor and needy. The highs and lows on the market are the only benchmarks. They are all you need.

But which highs and lows should we be looking at? Forget about intraday charts: the market-makers don’t check them; their lives are full of other distractions. Day charts are perhaps more telling, but big players don’t place orders everyday and I use the highs and lows of the week, at the very shortest, as my guide. A further refinement of my system is that these weekly highs and lows are what Tomas Demark called base points. Demark described a base point as being made up of three candles with the centre candle higher (in the case of a High base point) or lower (in the case of a Low base point) than the two flanking candles. Take a look at the EURUSD chart:

- The May 27th candle is both a base point and the week high: it’s a significant high and we can chart a level from it.

- The May 13th candle is a base point because the lows of both the12th and the 14th of May are higher than it. Unfortunately, it is not the minimum for week 12th 16th May and so no level is charted. However, the May 16th candle is both the weekly low and a base point and we can chart a level.

- The May 5th candle is the weekly low, but it is not a base point, so no level.

What Andrei is telling us here is that the highs and lows of the week that are also base points give us significant levels of support and resistance.

We also use shorter-period candles for less emphatic (but more numerous) signals. We monitor support and resistance on six-hourly candles for intra- day work.

Plotting support and resistance levels on a 6-hour chart

Take a look at the EUR (6-hourly) chart. The chart also features the Price Channel indicator. with the time period set at 4 (4 x 6hr = 24hr) giving us the high and low for the previous day.

We plot support and resistance levels when Price Channel is horizontal.The arrows mark some of the horizontal sections we have used to generate levels of support and resistance. We only chart the levels we feel price can reach today. We should be flexible and ready to bring in other levels as and when the situation changes and we limit the price history that we use to the last six weeks.

When a number of lines are close together, we have a ready-made support and resistance ‘zone’, with its midpoint running at the average of the levels. In the chart we have a level at 1.1651 (1), another at 1.1654 (2)and a third at 1.1657 (3). We treat these levels as part of the same support zone that has a ‘spine’ at 1.1654.

Notice how often the chart confirms certain levels as support/resistance.

One final point is that although this system may not identify support and resistance exactly, our 10-point wide zone rule for intraday charts means that any inaccuracies will be filtered out.

You may like to experiment with Rumus2 using hourly charts with your Price Channel time period set at 24 (24 x 1hr). This will give you the same levels of support and resistance but we think that you’ll agree that the chart does not display the key info as emphatically and that there is far less interaction between the candles and the channel borders. Try it and see for yourself.

With a little practice you will soon be easily able to identify important levels of support and resistance on a six-hour chart without the assistance of Price Channel or any other indicator.

Rule #2: Candlestick patterns

This section identifies the candlestick patterns that our trading system uses. You’ll notice that our patterns include some of the classics (like the Dragonfly and Harami ) and some of our own (the Ice and the Umbrella). Each pattern is given a rating. You can incorporate other candlestick patterns into your system if you want. However, in our opinion the ones on our list will be sufficient. In intra-day work speed is the important thing and many classic patterns like Three Black Crows or Three White Soldiers can only be positively identified once the third candle has closed when it maybe way too late to open a profitable position based on the initial signal of two hours before.

One tip for anticipating significant patterns on hourly candles is to monitor30-minute candlesticks. If you get a clear pattern on these candles, the chances are you will get a similar strength pattern on your hourly sticks.

Our second rule is that candles confirm price bounce-off. If you flick through 2.2.1, you’ll see that the maximum confirmation rating is 4 points.When two patterns appear at the same time (e.g. tweezers and the ice) you should only rate the stronger pattern.

Bearish signals (confirmation to sell):