Interest Rates and Volatility correlation between interest rate gaps and volatility

Post on: 16 Март, 2015 No Comment

Updated: March 08, 2013 at 4:49 AM

Volatility in the currency markets is influenced by a number of factors foremost among which is the risk perception of financial actors. Risk, of course, can be defined in terms of many different variables including politics, natural disasters, in addition to the usual economic factors that always go into the calculation (read more about risks ). But among those factors, arguably nothing is as important as interest rates in determining the level of long–term volatility in the forex market. Of course, this is not a one way relationship. Interest rates are themselves influenced by volatility, since the fluctuations caused by ongoing and long-term volatility strongly influence the decisions of central banks. Here we will take a look at the causes of the relationship between interest rates and volatility, and will attempt to determine its role in our choice of leverage and margin.

Volatility is a reflection of uncertainty. In a market where there’s no new information, volatility itself would be low or non-existent, but it is clear that the mere existence of a large number of market participants by itself creates volatility. Thus, there probably exists a state of minimal volatility below which no market activity would be possible. In other words, ordinary transactions necessary for the conduct of business and minimal economic activity would itself necessitate a minimal level of volatility in even the calmest markets. The question that we want to discuss here is about the impact of interest rates on the trade decisions of speculative actors and the bearing of their decisions on market volatility. Learn how volatility can be used to estimate forex trading risk.

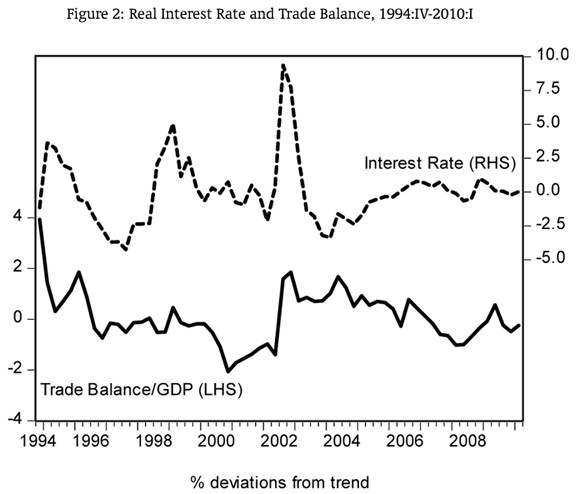

A brief look at recent history

At first sight, it is clear that interest rate differentials increase the number of transactions in the market. Clearly, gaps between the interest rates of different central banks create opportunities which are exploited vigorously by speculative actors of all kinds. But at the same time, we know from experience that the widening gap between emerging market and developed market interest rates was coupled with a decrease in forex volatility, as part of the so-called and by now disproven Great Moderation discussed by some economists. This is partly due to the fact that rising liquidity causes lower volatility. But the relationship between increasing liquidity, and a widening gap between interest rates is not that well understood. First of all, since interest rates and risk perception are closely related to each other, it is counter-intuitive that a rising interest rate gap between nations would result in lower volatility, and lower risk perception among market participants. We can illustrate this better by making an analogy with the interest rate gap between bonds of investment grade firms and speculative grade junk bonds. When this spread widens, it is coupled to increasing volatility in the bond market. During the same period when the widening gaps in interest rates among nations led to reduced forex volatility, reduced volatility in the corporate bond market was coupled with a contracting gap between the bonds of speculative and investment grade firms. Clearly, there is some discrepancy here.

A way of explaining this is by separating the period between 2000 and 2007 into two phases. The first phase was dominated by falling interest rates around the world, initiated by Alan Greenspan’s choice to bring the rates down to 1 percent and keeping them there until they were raised by Ben Bernanke four years later. During this period, volatility came down from higher levels as dormant money found its way to stock markets and other kinds of investments around the world. During the second part of this era, again initiated by the US Fed, interest rate gaps actually widened, but there was no corresponding rise in longer term forex volatility, apart from a few blips that occurred, for example, in February 2007. Was it then a sign of the coming turmoil in 2008 that these widening gaps between emerging markets and developed economies were not reflected in the forex market? We would argue that it was. For one, the rise of inflation has almost always been coupled to a subsequent cooldown period, or even recessions in all economies. No economy can afford to run at full speed in an inflationary environment. And since many emerging markets were raising rates to fight inflation in this period, historical experience strongly suggested that a period of slowdown was likely which would have necessitated a rise in volatility, as it often happens. But market participants refused to adjust themselves in accordance with this fact, driving the currencies of emerging markets higher, being content with lower risk premiums, until volatility returned with a vengeance in a series of events that all of us are familiar today culminating with the Lehman bankruptcy, and its aftermath.

What are the lessons that can be drawn?

The common paradigm suggests that widening gaps in interest rates should be coupled to rising volatility. However, as with all fundamental changes, it may take a long time before market participants recognize the changing risk profile, adjust their positioning in accordance, reconsider their leverage ratios and margin arrangements, which all lead to a contraction in liquidity and the consequent rise in volatility. Sometimes there’s no gradual arrangement at all. Instead, market shocks and related events create dynamics which force traders to reconsider everything in panic, creating massive volatility in a very short term, followed by periods of calm. Eventually, the pattern of rising and falling volatility creates the familiar zigzagging pattern we’re used to seeing in shallow markets where swings are sharp and deep.

The relationship between the interest rate gap and volatility is not very difficult to explain. Of course, the gap that we here speak about is a general measure of the gap between the weighted average of developed nations’ central bank interest rates, and that of developing nations. Low interest rates in a single group of nations is not enough to draw down volatility, for the simple reason that low risk in developed countries, that is, low risk in financing, does not translate into low volatility in forex unless it is coupled to low investment risk, as measured by developing nation rates. To illustrate this further, we can consider the example of the investor who borrows at very cheap rates in Japan, and invests the funds in a commodity project in Russia, where interest rates are high due to many possible reasons. Although the risk perception in Japan is low due to the (past) fundamental strength of the economy, and consequently, the risk on the financing side is small, the high rates in Russia would suggest that the investment in Russia has an unfavorable risk profile. Since these relationships are bilateral, the gap among interest rates, rather than the rates one nation, or a group of them is what determines risk perception and volatility.

Another aspect of wide interest gaps that causes volatility to rise in the long term is the carry trade. While carry trades are most active towards the end of a low volatility environment where the gaps are widening, by definition, the highest amount of activity in this field is coupled to the greatest risk. In other words, the low volatility environment under which the carry trade thrives is irreconcilable with the widening of the interest rates, which also means that the higher the profitability of this trade, the higher its risk, and the greater the imbalances created by it. Indeed, the carry trade itself is perhaps the greatest driver of all economic activity in a low interest rate gap, low volatility environment wher money flows easily. When it is considered as the sum of all investments that are made in search of high yield (and not just high yield in the form of interest rates, but including FDI, cross-border acquisitions, and everything that is driven by a low perception of investment risk), the carry trade is clearly the major driver of activity in a low volatility environment. The paradox created by the irrationality of those taking part in it is one of the most important causes of the eventual spike in currency market volatility and similar sharp changes in market trends and dynamics that announce the end of interest rate rises.

Interest rates and traders: how to anticipate volatility

All of the above discussion would lead its logical consequence that ties volatility to gaps in interest rates. It is rare to have high volatility in a situation where interest rate gaps are closing. Conversely, it is infrequent that a widening interest gap among nations results in a low volatility environment. But it must be born in mind that markets can remain irrational, and refuse to recognize facts for periods longer than what would be required by analysis. Thus, although volatility and interest rates are closely related, the momentum of trading and economic activity can distort this picture greatly, creating periods where the relationship seems to break down. This was clearly the case, for instance, during most of the 2005-2007 period. As of the writing of this text, it seems that we’re going through a similar phase where decreasing interest rate gaps are coupled to higher volatility. It is unlikely that this situation will be long-lasting.

How should traders use this information for trading choices? First, for long term traders, here lies another indicator that can be utilized to identify imbalances in the market which can then be used for profit. Small positions opened against the market as soon as the disparity between the actual rise or fall in volatility and what would be demanded by theory can be maintained until the eventual realignment occurs, and the market moves in the direction anticipated. After that, increased leverage, and greater positions may allow the exploitation of the new situation. For short term traders, the alignment between fundamental analysis(theory) and market conditions can be used as a gauge for determining the best trade. In short, the trader would open a position that would be suitable to a low volatility environment (such as the carry trade) when interest rate gaps are closing (which often happens in an environment of falling rates), and vice versa.

Conclusion

Of course, in this discussion we are neglecting the impact of velocity of money on the dynamics created by interest rates. The impact of the interest rate gap is greatly influenced by the velocity of money, but the factor is even more important when interest rates are falling. The impact of the falling gap can be negated if falling velocity of money results in reduced liquidity finding its way into the markets. In that case, volatility may not fall much, as the availability of credit doesn’t become reflected in an increasing number of transactions which could fuel increased activity in the forex market. Our discussion in this text presupposes only a moderate fall in the velocity of money, that is, banks reduce lending, but only moderately during the period that leads to the lowering of gaps between central bank interest rates. If the reduction in velocity were severe, the outcome would be serious enough to invalidate our scenario.

The relationship between higher volatility and money management is evident. High leverage and high volatility is an explosive cocktail that can easily wipe out a large number of accounts in a short time, but increasing leverage in an environment of lower volatility is not an extreme decision. Understanding the relationship between interest rates and currency market volatility can be helpful in adjusting our portfolio accordingly.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.