Importance of Leverage and Margin in Forex Trading

Post on: 8 Июль, 2015 No Comment

Leverage and margin are two of the most basic and simple terms that every forex trader needs to know about. In fact most traders tend to lose their money due to mismanagement of their capital and this can be largely attributed to forex and leverage. I can also stress on this point further that forex trading can be basically categorized into two aspects.

- Good money management

- Good trading skills

As you might start to understand by now, Leverage and margin are two terms that fall into the money management aspect of things.

Why is Leverage and Margin so important?

In order to answer that question, we need to first understand what these two terms mean. Before we go any further, the biggest aspect to bear in mind is that leverage and margin go hand in hand.

Explanation and definition of Leverage: Leverage is defined as the ability to trade larger positions in forex using small or minimal amounts. You might have come across various forex brokers who would advertise their leverages starting from 1:1 and up to 1:1000. So what does this mean?

The number 1:1 or 1:50 basically infers that for every $1 that you invest, using leverage, your positions can be multiplied. So a 1:1 leverage means that you are not trading on any leverage, while a 1:100 leverage means that for every $1 that you invest in trading, the broker opens a position of $100. Likewise, 1:500 leverage infers to a $500 in position being opened by the broker for every $1 that you invest.

Explanation and definition of Margin: Margin is nothing but the amount you deposit in order to maintain an open position. In the previous paragraph, I spoke about 1:100 leverage, which means that for $1 invested, the broker opens $100 position. The $1 that you invest is what is referred to as the margin.

Margin is basically the amount set aside to keep a trading position open. Margin is nothing but the deosit or the collateral for a trade. It should not be misunderstood for commissions or any other charges levied by your forex broker.

There are many terms for leverage and margin, and one of the most commonly used phrases is referred to as Trading on margin, which is nothing but leveraged trading.

Leverage and Margin Why is it so important?

Before we go into why it is important to understand leverage and margin, we need to discuss about the most basic building block in forex, which is Pips.

Currency pairs, commodities and so on move in pips. Each pip (one pip) is a measure of change of the exchange rate in 4th decimal or 0.0001.

So if for example EURUSD was at 1.2950 and after a while moves to 1.305, the total pips was 100 pips, which is the equivalent of $0.01.

Now if you were to trade with just $100 with a 1:1 leverage, the maximum profit you would have made would be only $0.10 which is really insignificant.

Imagine if you used a leverage of 1:100, which now means that you are trading with $10,000; then for the same trade, your profit would have been $10 for a 100 pip movement.

The downside to this would be that if the pips moved against you or rather -100 pips, this would mean a -$10 in your account, which would bring your actual investment to $90. As you can see, the higher the leverage you lose, the great the potential to make profits and also losses in just a few pips movement.

Margin as percentages

Margin levels is the percentage of the full amount of the position that you open. You might notice that forex brokers usually specify margin as percentages. Ex: 2%, 0.5% and so on.

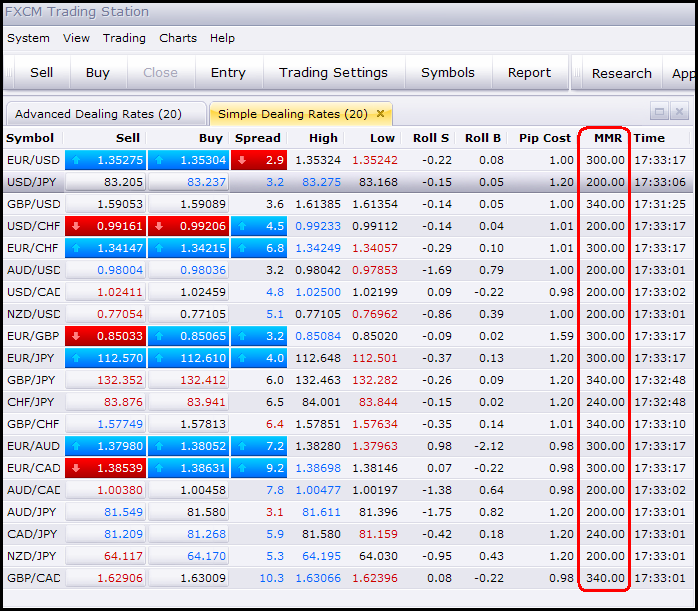

Lets take a look at what these percentage levels mean from the below table which shows the margin percentage and also the leverage that each of them refer to.