If your technical indicator lets you down try doubling down

Post on: 21 Июль, 2015 No Comment

#1 Forex Education Mentoring Program

In Part 1 of this three-part series, we discussed the favorite habit of all forex traders – to become disenchanted with your technical indicators. as if they were responsible for your poor performance in the trading realm. The basic point to remember is “confluence”, the coming together of many different pieces of information to increase the odds that your interpretation of the situation at hand is the right one. Even under these circumstances, your strategy may not work 100%, but trading is a game of odds – over time, a “60/40” winning ratio will deliver the goods, but patience and discipline are required.

Confluence also tells us that a single indicator should never be the entire basis for a decision. Too often, we tend to abandon one tool and search for a better one, but common sense suggests that we stick with a few favorites, learn the idiosyncrasies of their individual personalities, and supplement them with other information related to support, resistance, and typical pattern formations.

But let’s assume that you have done all of these things, but you keep exiting a strong trend well before its final reversal. This problem is common among beginners and even the well-heeled veteran traders among us. The typical source of the early exit is an overbought or sold condition, emanating from a popular indicator designed for that purpose. These tools fall into a class of indicators known as “oscillators” that were the result of studies that were conducted to gauge the health of a trend.

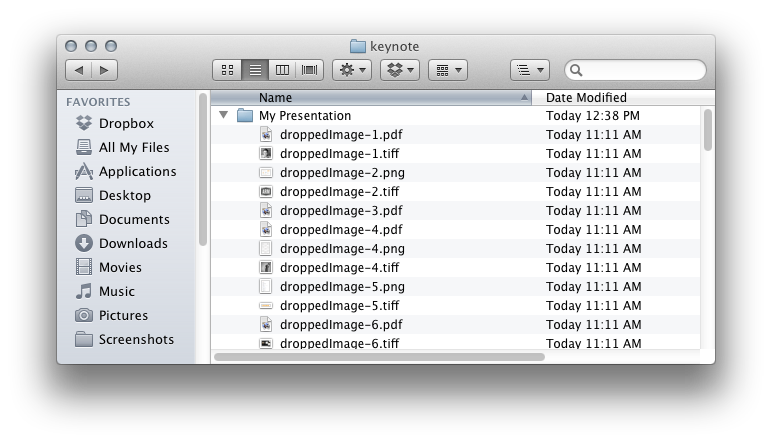

Let’s take a look at a healthy trending example for the Aussie Dollar:

The Aussie made a fine upward thrust of 130 pips over a four-day trading period, but the Slow Stochastic, the favored oscillator for most currency traders, gave no less than five overbought signals during the run. It is common for profit taking to occur every 25-30 pips for any trend. The weak hands leave early, while the more aggressive traders stick with it, letting the trend be their friend.

Should you abandon your Slow Stochastic indicator for not telling you to stick with it? One trick that some traders have learned is to “double down” on the same indicator. In this case, the first one has the standard settings of (9, 3, 3), but if you add another with longer settings of (21, 9, 9), then you can supplement your knowledge base with one more cogent factor. In this case the slower indicator stayed in the overbought region until the fourth “blue” circle of the standard setting’s signals.

Once again, however, let’s not forget about confluence. Asian analysts pay close attention to the Kumo Cloud, one aspect of the Ichimoku trading system. When the AUD burst through the cloud and the 100-Hour EMA, the “red” curving line, then one could expect more momentum. The candlesticks also stayed well above the lower Bollinger Band, a two standard deviation event from the mean average. One out of ten candlesticks would have touched this border in a normal distribution, but the Aussie refused to drop. (To learn more about Forex Technical Analysis, click here ).

Will this “trick” work every time? Of course not, but it might have been the extra bit of knowledge that helped you stay with the above four-day trend in the “AUD/USD” pair. Once again, remember not to rely on a single indicator, but look for additional insights that help solidify tour interpretation. No one said that trading is easy, but the more experience you have, the more these approaches will become second nature.

Will this work for a “ranging” market? Stay tuned for Part 3 of this series brought to you by www.forextraders.com