Identifying market trends

Post on: 27 Май, 2015 No Comment

Knowing what to expect from trading currencies on the Forex market can go a long way to aiding a trader in succeeding. There are a myriad of factors that will change the prices of currencies, and some may seem, to beginners at least, a random combination. However, looking at the Forex market from a global, macroeconomic perspective will be beneficial and it highlights the difference between this form of investment and the microeconomics that are involved in trading shares.

Before approaching a broker, ActivTrades for instance, all traders should seek advice from an IFA. This cannot be understated as with leverage trading, and investment in general, there is a high degree of risk to capital involved. Even experienced traders could make a wrong move and suddenly be faced with a large loss. An IFA would be able to give traders an objective overview of how to operate an online trading account with Activ Trades. providing an invaluable insight in what can be a complicated process.

Analysis of trends within currency trading is an effective way to avoid making simple errors. Many brokers offer their own quantitative and objective statistics for the performance of the majority of traded pairs. Experienced traders will also be adept at working out what direction a currency will go in depending on extraneous economic factors and it is just a signifier of how long they have been in the industry.

Supply and demand is a major component of economics and its application to Forex trading is no less significant. Most currency trades are conducted by banks, large multinational companies and nations, which gives a good indicator as to what currencies are always in demand. US Dollars and Euros are the two most popular currencies that are traded globally because of the business conducted by the US and the Eurozone. This means that the prices of these two currencies changes slowly over the course of a trading period and they are referred to as being ‘stable’. A circular effect is then created as, more traders will trade in either of these currencies because of their stability, which will in turn increase the demand for Euros/USD and further maintain the values.

This is just a short example of how global economics will affect a trader’s position on the Forex market.

Leveraged products carry a high degree of risk to your capital. ActivTrades PLC is authorised and regulated by the Financial Conduct Authority, registration number 434413

What is a Market Trend?

A market trend is, basically, the overall direction where prices are moving within a market, and knowing about them and how to predict where they will go is the key to being successful in Forex trading. Trends can last for any amount of time, from hours to months or longer and traders can gauge their direction to help inform decisions and increase the likelihood of them having a successful trade.

What Are the Different Types of Market Trends?

There are three different types of trends: uptrends, downtrends and flat or sideways trends which are just as they sound: uptrends are when a market is appreciating in value; downtrends are when a market is depreciating; and flat or sideways trends are when a market is neither appreciating nor depreciating, but rather moving sideways within a narrow range.

How to Identify a Trend

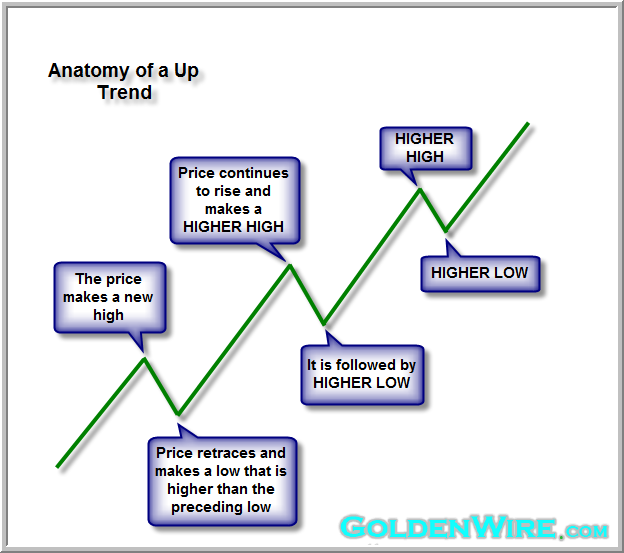

Knowing how to identify a trend is an important skill to have before a trading plan can be formulated and executed. We can see when an uptrend is occurring when a market is making a continuous series of both higher highs and higher lows. This means that each new set of highs and lows is higher than the last one. Conversely, we can identify a downtrend when a market is making lower highs and lower lows, causing its value to ultimately decrease. A sideways trend will generally have a mixture of higher and lower sets of highs and lows.

Trading a Trend

When you have successfully identified a trend and what type of trend it is, you can start implementing trend-based strategies depending on whether it’s an uptrend, a downtrend, or a sideways trend. Services like Activ Trades have very useful tools to help a trader work these trends without having to spend all day looking at charts.

When you are trading trends, there are a few things to look out for: false starts (or whipsaws), in which your position is positive before immediately reversing, causing a trader to potentially stop out of a trade prematurely; shake-outs, in which bad news or uncertainty cause traders to exit their positions before a movement in the market, often at their expense; and late exits, in which a trader holds their position for too long and misses out on gains.

Just like any other trading strategies, trading trends is not without its risks and needs effective strategies in place for the best chances of success.

Leveraged products carry a high degree of risk to your capital.

ActivTrades PLC is authorised and regulated by the Financial Conduct Authority, registration number 434413