Ichimoku trading Systems Basics Introduction

Post on: 3 Апрель, 2015 No Comment

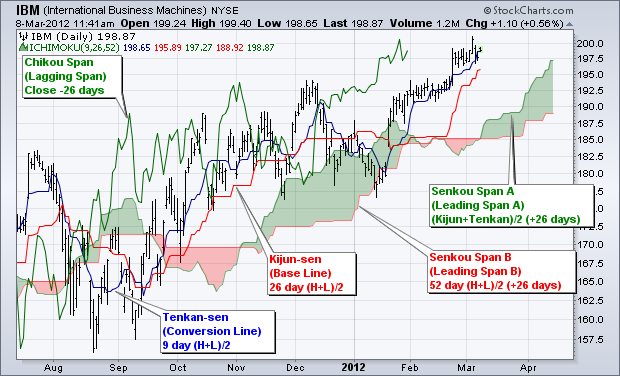

The Ichimoku trading system is one of the few default indicators available on most charting platforms that in itself makes up for a complete trading system. Derived from the Japanese, Ichimoku stands for equilibrium chart and is also refered to as the Cloud (or Kumo). As the name suggest, a view of the Ichimoku trading system gives the trader a clear idea on the trend and the general view of price.

Complicated as the system may look, Ichimoku is one of the most easiest trading systems and can be developed into a mechanical trading system as long as traders can follow the rules.

The trading system was developed in Japan by Goichi Hosoda around the period of World War II. The trading system was originally called Ichinoku Kinko Hyo and is used in forex, commodities and equity markets. The trading system was adopted by the West in the 1990s and the different components have also been renamed, ex: Turning Line, Standard, Close, Lead 1, 2. It does make sense however to keep the original terminology intact to avoid any confusion.

Components of Ichimoku

The Ichimoku Cloud is made up of 5 different indicators.

- Tenkan sen is the mid-point of price taken from the 9 periods high/low

- Kijun sen is the mid-point of price taken from the previous 26 periods high/low

- Chikou Span is a 26 period lagging indicator depicting the current closing price

- Senkou Span A is the mid point of the Tenkan Sen and Kijun Sen and shifted forward for 26 periods

- Senkou Span B is the mid point of the past 52 periods, shifted forward for 26 periods

The Senkou Span A and B together form the Ichimoku cloud that one sees ever so often.

Ichimoku Trading System Components

The default settings of Ichimoku trading system is 9, 26, 52 which has stood the test of time. Of course, different settings can also be used.

Trading with Ichimoku

The trading rules are quite simple. A long order is initiated when the following conditions are met:

- Current Price is above the cloud

- A bullish cross-over of Tenken and Kijun Sen (above the cloud)

- Finally, Chikou span should be above the Candles

Trade is entered after the cross-over and at the open of the next candle. Stop levels can be placed either trailing the Cloud or trailing the Kijun Sen.

Example: Ichimoku Long Trade

For going short, the following conditions should be met.

- Current Price is below the cloud

- A bearish cross-over of Tenken and Kijun Sen (below the Cloud)

- Chikou span should be below the Candles

Trades are not initiated when price is inside the cloud. Besides Kijun sen, the upper and lower levels of the cloud can also be used as stop levels. In effect, they behave as support/resistance levels. The thicker the cloud is, higher the strength of the support or resistance, whereas a flat kumo infers that the support or resistance level can be broken.

What happens when one of the conditions are not met?

Simply do not trade. It might mean that traders will have to sit on the sidelines while the trade continues to move in their direction, but discipline is something that most traders do not follow and thus result in losing most of their equity. The Ichimoku trading system if followed strictly can prove to be quite a profitable trading method in itself. Given that the Ichimoku trading system originated in Japan, traders can also make use of the Heiken Ashi Candles in order to improve their trade entrys along with the Ichimoku trading system.

To learn more about Ichimoku trading system. here are some great resources: